February dairy market review

Wednesday, 9 March 2022

By Patty Clayton

Milk production

GB milk deliveries remained muted through February, with volumes estimated to be down 3.0% on year earlier levels. Seasonal growth is in line with last year, although the rise towards the spring flush is slightly slower than what we would normally see, based on the past 5 years.

In February, average GB daily deliveries were running 2.9% below previous year levels, and 1.6% below forecasted figures. Yields are said to be affected by poor silage quality, and possibly some reduction in milk frequency due to labour shortages.

Global milk delivieries saw a year on year drop in December of 1.3%, equivalent to a drop of 10.5m litres of milk per day. The drop in milk deliveries occurred primarily in the EU-27 and New Zealand, although US deliveries were also marginally down on the year. Little change was seen in January to this situation, and there are no signs it will improve before the northern hemisphere flush. Bad weather has been hampering production in Oceania and high input costs suppressing production growth in the EU-27, UK and US.

Wholesale markets

Prices on dairy wholesale markets have moved up steadily so far in 2022 in all key markets, and the expectation is this will continue, at least until later in the spring. The outlook for global milk supply is for minimal growth, despite higher farmgate prices as input costs pressure farmer margins.

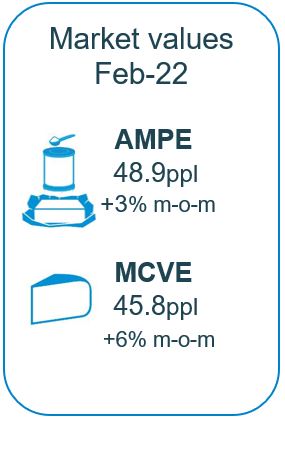

In the UK, wholesale prices are at or near 5-year highs, pulling up both AMPE and MCVE closer to the 50ppl mark. Our Milk Market Value (MMV) indicator reached 46.4ppl in February, up 14.3ppl from last year, and 2.4ppl up on the month. The milk price equivalents do not yet reflect the full increase in processing costs, but their movement is accurately reflecting the rising market value of dairy products.

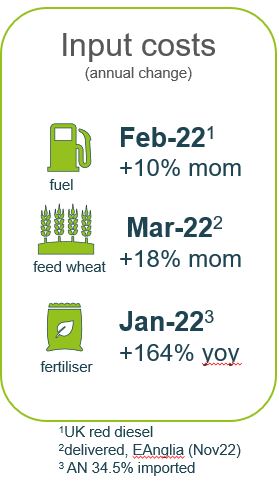

Farmgate prices and input costs

Market-related farmgate prices in GB continue to move up in response to the higher market returns, with processors announcing more increases for March and April. Since the beginning of the year, average prices paid on market related contracts (excluding aligned liquid) have increased by just under 5ppl based on announced prices to date[1]. Over the same period, prices paid on retailer aligned contracts did not move up at the same rate, shrinking the typical premium paid on these contracts. Due to the use of lagged cost trackers in setting prices on these contracts, it is expected further increases will be implemented later in the year.

While milk prices are helping to offset rising input costs, it is not yet clear how this will affect milk production through 2022. At the latest AHDB Milk Forecasting Forum, the general consensus was the uncertainty surrounding the impact of the war in Ukraine on input prices, along with changes to agricultural policy and labour shortages, will make farmers cautious. It remains to be seen if the higher milk prices will prompt higher milk production or whether the cost increases will make this unprofitable.

[1] Announced price changes to 09 Mar. 22 applied to the AHDB standard litre, excluding retailer aligned prices

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.