European weather in focus as spring plantings continue: Grain market daily

Friday, 28 April 2023

Market commentary

- UK feed wheat futures (May-23) closed at £187.65/t yesterday, down £2.30/t from Wednesday’s close. New crop futures (Nov-23) closed at £199.65/t, down £6.30/t over the same period.

- Global wheat markets were under pressure yesterday as competitive Russian supplies continue to weigh on the market. Rainfall in the southern US plains has also relieved some concerns over the ongoing drought in key wheat producing regions.

- Old crop Chicago maize futures (May-23) closed at $246.85/t yesterday, down $5.71/t over the session.

- While US maize shippers should be in their peak season, China has cancelled cargoes this week, causing concern over export potential, especially with the record Brazilian crop expected to come on the market.

European weather in focus as spring plantings continue

Over the last few weeks, focus in global grain markets has very much turned to new crop conditions in the northern hemisphere, so it’s important to look at European crop prospects for next season. According to the latest MARS report published by the European Commission on Monday, while in general, crops across the continent are faring well, there are some areas of concern. So, what are these areas? And why is this important for UK growers?

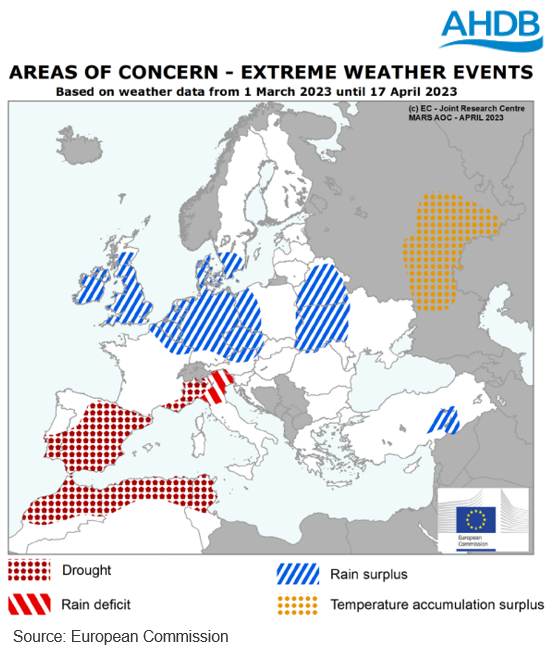

Rain surplus in the north but drought in the south

Large areas in northern Europe have experienced a substantial amount of rainfall over the past few weeks. This has benefitted soil moisture, ground water and surface water levels, but in some areas has resulted in delays to spring plantings and other fieldwork. The planting of spring barley in particular has seen significant delays in certain regions, and it’s unclear whether intended area will be accomplished in Ireland, parts of western Europe, and here in the UK.

On the other hand, in southern regions in Europe, there are ongoing concerns over drought conditions. In Spain and Portugal, there has been no significant rainfall since January, with temperatures also abnormally high. In winter crops, as well as spring barley, soil moisture is now critically low, impacting the growth and development of crops. In Spain, the drought, combined with low water reserves for irrigation, will also impact planted area of spring crops, where some maize will be replaced by sunflowers or other water stress resistant crops. Monday’s report also suggests that some land may not be drilled at all in this region.

What could this mean for UK exports?

Looking ahead to next season, most of Europe is faring well, with total cereals output for harvest 23 estimated at 283.1Mt (up 1.4% on the five-year average). However, with some crops in southern regions struggling, much like this season, there could be increased export opportunities for the UK, especially for barley.

Spain’s barley crop for harvest 23 is currently estimated at 6.0Mt by the European Commission, down 28.6% on the five-year average. If realised, this would also be down 8.7% on the year. According to HMRC trade data, UK barley exports to the EU so far this season (Jul-Feb) have totalled 769.3Kt, up 58.5% from the same period in the 2021/22 season. With Spain taking the largest proportion of EU barley imports this season, another yearly decrease in production will likely lead to even more imports.

However, strong UK barley exports will of course depend on our own ability to plant spring barley over the next few weeks, though we are forecast some dryer days at the end of next week. It’s also important to remember that the UK will need to remain competitive on the global market in order to see a greater export pace next season. This will be something to watch as we move into the next marketing year.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.