European pig meat demand still increasing

Tuesday, 26 April 2022

The trend of growing European consumption of EU pig meat seen in the second half of 2021, has continued into 2022.

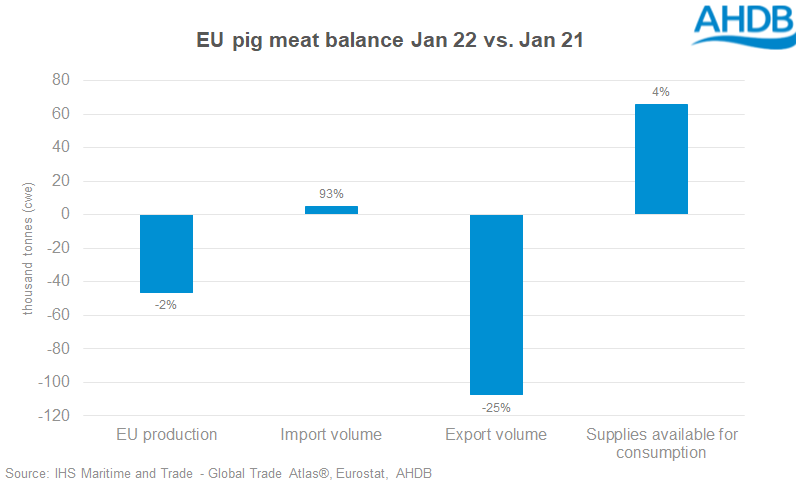

January production data from Eurostat shows a year-on-year decline of 2% (-45kt), to 1.97 million tonnes. Pig slaughter in the bloc was 20.7 million head, less than 1% lower than in January 2021, showing that lighter weights also contributed to the lower monthly production figure.

Looking at the performance in some of the main production countries: production fell in Germany year-on-year (-12%, -50kt), and also in Poland (-11%, -19kt). Production was stable in France and the Netherlands, but it grew in Denmark (+4%, +7kt) and in Spain (+8%, +38kt).

EU pig meat exports fell in January to 325kt (cwe), a decline of 25% compared with the same month year before. They fell again in February by 36% year-on-year. Continued falling exports to both China (-70% in January and February combined) and the UK (-35%) were the main reason. Increases in export volumes to Japan, South Korea and the Philippines were not enough to offset these falls.

So, with a fall in production, but an even greater fall in exports, this pig meat would have been consumed with in the EU, especially if stocks were not building. This is likely to have been true in February as well as January, although February production data is not yet available.

Industry market reports suggest that although the amount of pork in store was at high levels in January and February compared to previous years, it was being drawn down. If this is indeed the case, then that supplies available for consumption* figure in the chart above, could even be an underestimate; pork coming out of store would boost supplies offsetting some of the production decline.

More recently, pig prices in the EU have been strengthening, as the supply of live pigs has not kept pace with demand. It will be some time before March production and trade data from the EU are available.

* a proxy for demand. “Supplies available for consumption”, is calculated from production plus imports minus exports and includes stock changes.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.