EU wheat exports appear to slow, key data missing: Grain market daily

Wednesday, 20 October 2021

Market commentary

- Nov-21 and Nov-22 feed wheat futures slipped back a further £0.50/t yesterday to close at £206.50/t and £191.50/t respectively.

- Paris rapeseed futures (Nov-21) continue to climb, closing yesterday at €689.25/t, up €15.50/t from Monday. This follows strength in oil markets as discussed yesterday by Helen.

- According to Chinese officials, wheat planting was 27% behind the usual pace with just 26% of the expected crop planted by 19 October due to constant rain. Rain is also causing delays to the Chinese maize harvest.

EU wheat exports appear to slow, key data missing

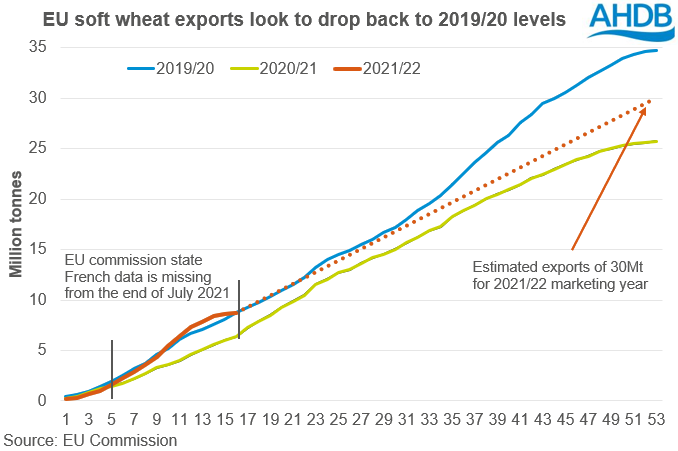

The EU has exported 8.67Mt of soft wheat by 17 October 2021, according to the EU Commissions weekly trade data report. Exports have been led by Romania, Bulgaria, and Germany. Although EU soft wheat exports are still 36% ahead of 2020/21, they are back in line with 2019/20. This comes as weekly exports drop to just 80Kt in the week ending 19 October after continually shrinking week-on-week since the week ending 5 September.

However, the EU commission have stated that some French data is missing from the report and has been since the end of July 2021. The report shows French soft wheat exports total 719Kt which differs significantly from Refinitiv’s loading estimates of 2.26Mt. According to French ports loading data from Refinitiv, China and Algeria are the biggest non-EU buyers of French wheat so far this season.

EU soft wheat exports have generally been strong this season. A weakening euro has aided price competitiveness into export markets, as have tight supplies amongst other major exporters. Russian wheat prices have also helped elevate the export market. Russian FOB prices, for 12.5% protein wheat, have been reaching highs in recent weeks aiding EU competitiveness.

The EU will need to remain competitive on the global market to maintain export levels. In the second half of the marketing year pressure could come from southern hemisphere crops.

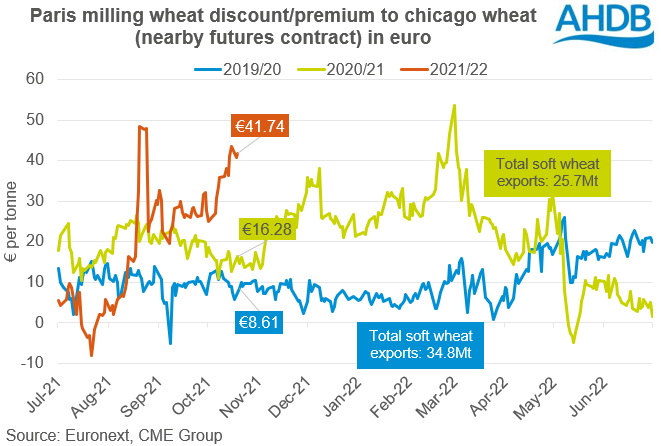

Yesterday, the nearby Paris milling wheat futures contract closed at €273.75/t. This is a €41.74/t premium over the nearby Chicago wheat futures contract, €25.46/t greater than the same time last year.

This discount may need to squeeze to maintain export pace. And in turn this could add pressure to UK markets due to the close relationship UK futures have with Paris futures. However, it is key to note that this discount may not need to squeeze as much as usual, due to the tight outlook for wheat on a global scale.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.