Rapeseed prices lifted by palm oil, but 2022 recovery threat: Grain market daily

Tuesday, 19 October 2021

Market commentary

- The UK feed wheat Nov-21 and Nov-22 futures contracts eased back yesterday after recording their highest prices to date on Friday. The Nov-21 contract fell £1.50/t from Friday to £207.00/t, while Nov-22 closed at £192.00/t, down £1.75/t.

- European wheat prices eased back slightly yesterday after strong gains last week. However, losses were limited by a rise in US maize prices due to concerns that high fertiliser prices could cut the maize area in 2022.

- Nov-21 Paris rapeseed futures gained another €1.25/t yesterday to €673.75/t. The price rose due to stronger vegetable oil prices after the Malaysian Palm Oil Council cut its forecast of 2021 palm oil output yesterday.

- After the market closed, the USDA also reported slower than expected US harvest progress last week. The maize harvest was 52% complete by 17 October, 2% behind expectations, while the soyabean harvest was 60% complete vs an expected 62% (Refinitiv).

Rapeseed prices lifted by palm oil, but 2022 recovery threat

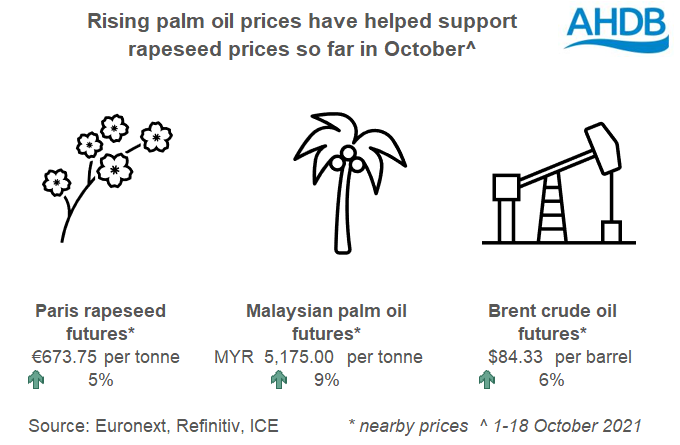

The recent surge in rapeseed prices was driven by tight supplies of the oilseed and palm oil, plus a rise in crude oil prices. Paris Nov-21 rapeseed futures prices have risen €29.50/t (5%) since the start of the month. Over the same time frame, Malaysian palm oil futures have risen 9% and Brent crude oil has risen 6%.

The tightness in palm oil stems from strong global demand for vegetable oils, but lower production in Malaysia. Malaysian palm oil output was cut by labour shortages as restrictions of overseas workers due to the COVID-19 pandemic hit, plus some challenging weather. The latest estimate from the Malaysian Palm Oil Council (MPOC) is 18.4Mt in 2021, a fall of 0.7Mt from 2020.

The most recent price rises follow official data pointing to a drop in stocks in Malaysia. This, along with higher crude oil prices, means Malaysian palm oil futures are near record highs. Because some vegetable oils can be used for the same purposes (to a limited extent), this also pushed up rapeseed oil prices, and so rapeseed prices.

Although the market is supported in the short term, higher palm oil production could be on the horizon. Oil World (www.OilWorld.biz) forecasts that global palm oil production will rise 3.5-4.0Mt in 2021/22, driven by increases in Indonesia and Malaysia.

Supporting this outlook is that Malaysia, the second largest producer, has approved 32,000 work permits for overseas workers. While this might only be part of the expected shortfall, more labour would increase harvesting and so production.

A rebound in production would remove some support from palm oil prices. But, it would also potentially pressure rapeseed oil, and so rapeseed prices too. The timing of the recovery is important – will it impact prices for the end of the 2021/22 rapeseed season? Or primarily impact the 2022 crop?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.