EU weaner prices rise… tighter supplies?

Thursday, 18 March 2021

By Bethan Wilkins

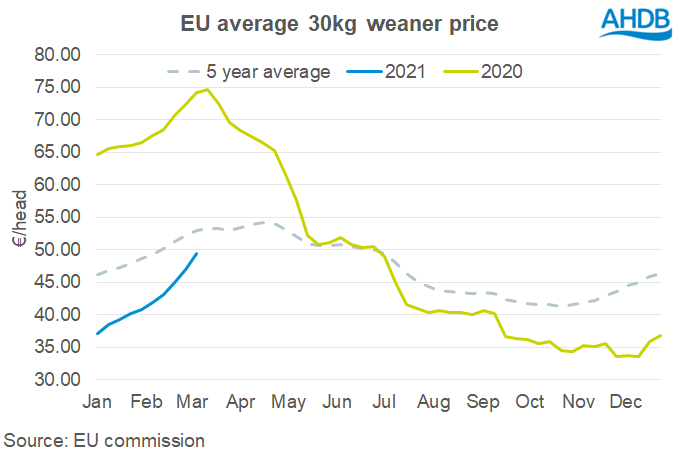

Weaner prices across the EU have firmed noticeably since mid-December, with the EU average reference price rising from below €34/head to nearly €50/head over this time. This increase will ease the pressure on breeders, many of whom will have experienced increased financial difficulty over past months.

Over the past five years, it has been quite normal for weaner prices to rise at this time of year. However, prices are currently increasing relatively rapidly, bringing quotes closer in line with the 5-year average for the time of year. Recent progress in moving finished pigs off farms to slaughter has boosted demand for weaners to fill rearing/finishing places. It may also be that weaner supplies are now a little tighter. In the latest EU census results for the end of 2020, fattening pig numbers were still up on the year overall, although a couple of key producers (Germany and the Netherlands) are heading into a contraction. The Netherlands in particular is a key exporter of weaners and decline here may be supporting market prices.

Despite this, weaner prices are still well below year earlier levels. While there is clearly a level of optimism for some recovery in finished pig prices, the likelihood of a marked improvement remains unclear. That is, at least until we see how Chinese import demand develops and the coronavirus pandemic plays out this summer.

Looking at individual member states, price trends have been quite similar. Most of the leading producers recorded strongly rising prices, particularly in Italy, Belgium, Spain and the Netherlands. The Spanish herd has undergone strong growth in recent years, although in the December census weaner pig numbers were similar to a year earlier and the breeding herd was stable. Rising prices might indicate that demand from finishers is still increasing, driving competition for the available weaners.

The only key producing member state with a much lower degree of price growth was Denmark. Denmark has an expanding herd but also faces lower demand in Germany for its weaner exports. So, it is perhaps not surprising prices have not seen the same buoyancy here.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.