EU weaner prices falling

Thursday, 8 October 2020

By Bethan Wilkins

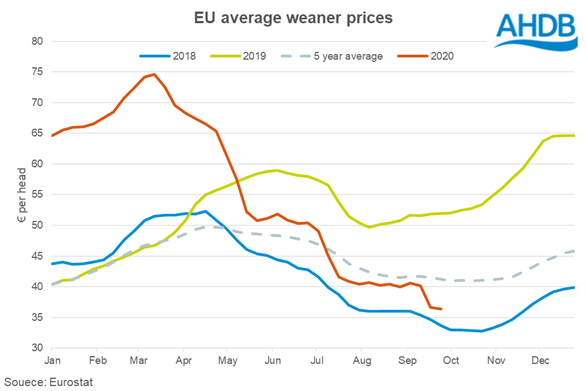

Weaner prices have fallen further in the past few months, losing significant ground in July before declining again in late September. The EU average for the latest week ended 27 September was about €36/head, the lowest price since November 2018. This is less than half of the price recorded at the peak in March, representing a significant drop in income for breeders. This price is also nearly €5 below the 5-year average for the time of year.

A significant weakening of the finished pig market has discouraged the demand for weaners at a time of year when prices are already often falling. The coronavirus pandemic has disrupted pork demand across the EU. More recently, Germany’s ASF outbreak has brought a new wave of downward price pressure, with the pork that would have been exported to China now trading on the EU market. Reports also indicate some countries, particularly Germany, have developed a backlog of market ready pigs due to constrained processing capacity. This may also dampen the weaner market, if space on fattening farms is limited.

Weaner prices followed a similar pattern in the majority of EU countries, though in some nations prices have remained stable so far in more recent weeks. Prices had been picking up in Denmark in early September, but this small increase has since been lost and prices are now around €56/head, the lowest level since May 2019. Denmark supplies significant number of weaners to Germany for finishing and demand for these pigs would be expected to fall now pork from Germany faces limited export prospects. Weaner prices in Germany itself have fallen to just €31/head in the latest week, the lowest price since 2007.

Prices in southern Europe have been noticeably more stable, with Spanish prices similar to late July while Italian prices have actually increased by €4 over the same period. Strong trade with China is supporting the Spanish market, though the outlook for Italian prices, as a significant pig meat importer from Germany, looks more uncertain.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.