German live pig imports falling even before ASF outbreak

Wednesday, 30 September 2020

By Bethan Wilkins

Germany is a significant importer of live pigs for both fattening and slaughter. About 13.8 million pigs were imported in 2019. Slaughter totalled around 55 million head over the same period, indicating that about 25% of Germany’s production originates from piglets born elsewhere.

With the outbreak of ASF in German wild boar reducing the market for German pig meat, there may be some desire to reduce these live imports and so cut production originating in Germany. If the pigs could be finished and slaughtered outside of Germany, the market for them would be larger. However, this may be logistically challenging, as finishing and slaughter capacity in the origin countries (mainly Denmark and the Netherlands) is likely to be insufficient.

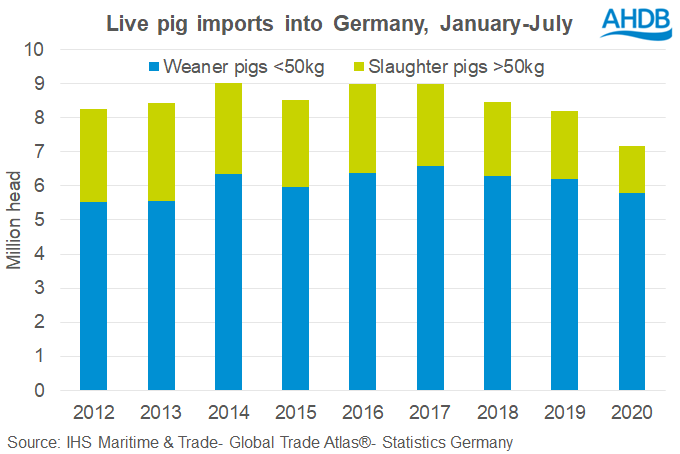

Nonetheless, live pig imports into Germany had already been falling so far this year, according to Statistics Germany. Between January and July, 5.8 million piglets were imported, 7% down on the same period in 2019. Slaughter pig imports were down to 1.4 million head, having stood at 2 million head last year. Coronavirus-related disruption has probably influenced this trend to some extent.

It also seems that Denmark is now finishing more pigs domestically again. Sow numbers have been increasing and slaughter is up a little so far this year, while live pig exports remain relatively stable. Previously, there had been a trend towards exporting more live pigs for finishing elsewhere.

The second largest importer of live pigs in Europe is Poland, with numbers totalling 6.8 million in 2019. Most of these pigs come from Denmark, and Poland may be seen as an alternative outlet for pigs that might have been sent to Germany. However, imports here have been down by 2% for January-June. Slaughter is also down by 8% so far this year. Poland continues to struggle with its own ASF outbreak, which also affects some commercial farms, and so reports indicate that confidence in this market is not particularly high. This may limit the demand for fattening pigs in Poland.

Assuming Germany’s ASF outbreak remains localised and within the wild boar herd, the limited alternative options mean it is likely that similar numbers of live pig imports will continue in the short-medium term. However, we would expect the price paid for these pigs to fall.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.