Energy prices could squeeze margins for 2023: Grain market daily

Friday, 2 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £267.45/t, down £2.20/t on Wednesday’s close. The Nov-23 contract gained £0.50/t over the same period, closing at £256.00/t.

- The Nov-22 Paris rapeseed contract dropped €11.50/t yesterday, closing at €605.00/t. This follows the bearish sentiment of the wider oilseed complex.

- Palm oil has been pressured, lowering the vegetable oil pricing floor due to demand concerns, related to lockdown restrictions in China and expectations of higher outputs from Malaysia.

Energy prices could squeeze margins for 2023

With overheads accounting for two-thirds of the total cost of production, these costs are key drivers of profitability on farm, alongside yields.

One key parameter of these overheads is energy prices. The impact of increased energy prices could have the potential to squeeze margins for 2023.

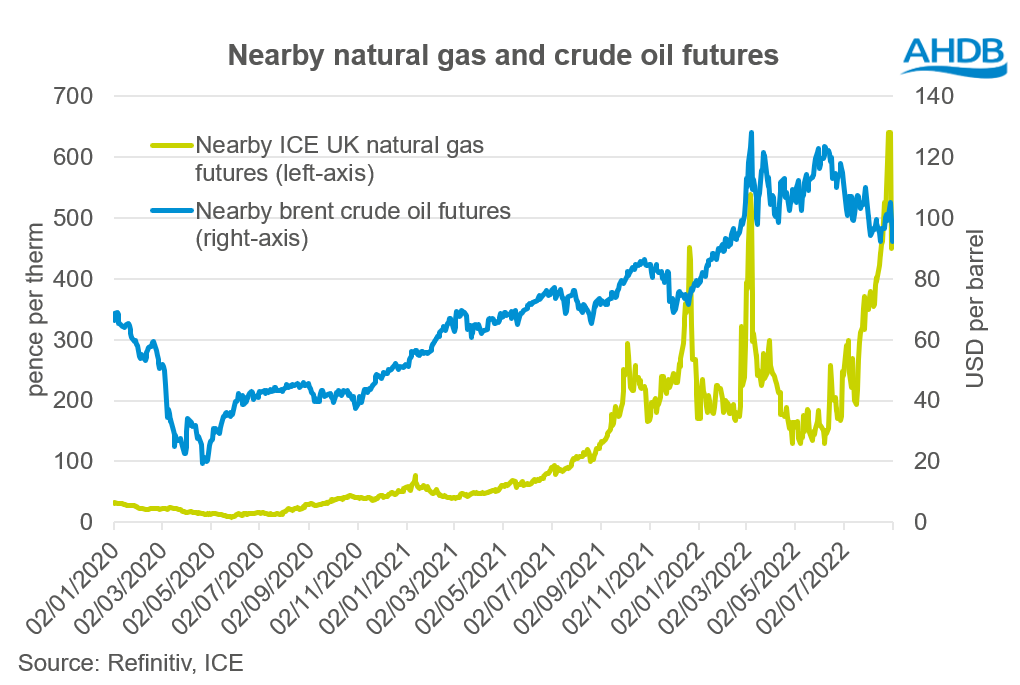

As recent analysis shows UK natural gas prices remain high compared to levels prior to Russia’s invasion of Ukraine.

However, crude oil prices have fallen slightly, but still remain historically high. Due to this, red diesel prices are currently over 80% higher than the same point last year (BoilerJuice).

With energy prices high and 2022 harvest near complete, focus now turns towards 2023 harvest, but what could happen to energy over the coming months?

Crude oil

With crude oil markets remaining volatile, prices have been gradually coming down from the peak at the start of March, when Brent crude oil futures (nearby) peaked at $127.98/barrel. Since then, based on yesterdays close Brent crude oil closed at $92.36/barrel. This has filtered into red-diesel prices as over this same period prices peaked at £1.51/litre (10 Mar) but have since come down to £1.09/litre (30 Aug) (BoilerJuice).

There is currently a bearish element towards crude oil as August has seen OPEC’s oil production at its highest levels since 2020’s early pandemic days, upwards of producing 29 million barrels per day. Further to that, there is also pressure from a weakening Chinese economy and reduced factory output due to COVID-19 restrictions, and western recessionary worries. Recession causes inflation and rising interest rates which leads to reduced disposable incomes. Less spending reduces oil demand, this could put further pressure on crude oil. This is providing OPEC outputs are not constrained in excess in the near future.

Natural gas

Natural gas prices have been volatile and increasing since Q3 in 2021 which has fed into higher fertiliser prices. In recent weeks prices have reached all-time highs and on 26 August nearby ICE natural gas prices were £640.36/therm, but since then they have come down to close at £483.74/therm yesterday.

The recent pressure has been due to increased wind power generation in the UK and a larger Norwegian supply to both the UK and EU.

However, currently the energy market is facing increasing setbacks with recent 3-day (31 Aug to 03 Sep) maintenance to the Nord Stream 1 pipeline reducing supply from 20% to 0% (Reuters).

Looking forward prices could possibly remain high throughout the season, meaning that fertiliser inputs, especially for 2023, will remain high adding to variable cost inputs. Recent news such as CF industries temporarily halting production of ammonia at their Billingham site will likely keep prices high too.

A view to the season ahead

Whilst margins for 2022 are strong, it is expected that energy prices will remain historically high. However, there could possibly be some relief to crude oil prices due to recession. Energy prices ultimately affect profit margins, and rising input costs mean profits could reduce for 2023.

However, there are options to help reduced squeezed margins such as adjusting your fertiliser usage and considering forward selling a proportion of your crop whilst prices are supported.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.