Do wheat prices matter for bread? Grain Market Daily

Wednesday, 26 August 2020

Market Commentary

- Nov-20 feed wheat futures closed yesterday at £167.50/t, £1.35/t higher, as CBOT maize prices saw a 4th consecutive day of gains on the back of downgraded crop conditions for US maize.

- As a result of the sharply higher CBOT maize prices, the EU import tariff which uses CBOT futures in its calculation, has been reduced from €.48/t to €0.26/t, effective immediately.

- Eastern and Southern parts of the US Corn Belt are forecast some rainfall over the coming days which may alleviate late-drought stress, but crop damage from storms persists.

- Whilst US crops suffer, exports to China are improving with another 408kt of maize and 204kt of soyabeans booked for shipment yesterday. This overall tone of uncertain supply and strong demand keeps US and world futures underpinned. This may prevent a drastically bearish sentiment returning until the US harvest starts in anger later in September and US maize yields are known.

Do wheat prices matter for bread?

In 2020 we’ve seen the impact of panic-buying on agricultural supply chains, and the need to ensure transparency in how our agricultural products affect food supply and prices in order for consumers to better understand the market place.

So it’s slightly surprising, and against logical thought, that the price of wheat does not translate directly and proportionately to the price of bread.

Wheat prices have a much more direct and pronounced impact on flour, but the subsequent bakery production processes, ingredients, packaging, marketing and transportation mean that wheat isn’t directly related to the price of bread. We estimate that the value of wheat in an 800 gram loaf of bread stands at only 11%.

With a small harvest and increased imports, our domestic milling wheat prices have been moved higher. However, the price of a loaf on the shelf will be far more influenced by the need for supermarkets to keep consistent prices for consumers amid the record-breaking recession we face (and possible deflation).

Bread prices have moved lower in 2020

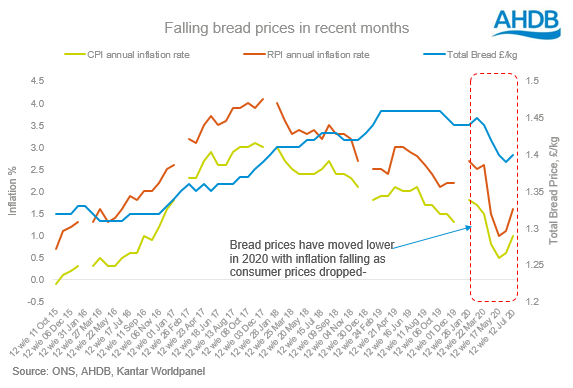

In 2020, falling bread prices have actually been a part of the reason that inflation has been reducing.

In the 12 weeks ending (w/e) 26 Jan 2020, the average bread price across GB stood at £1.44/kg. In January, CPI and RPI inflation rates were at 1.8% and 2.7%, respectively. Since then, in the 12 w/e 12 July 2020, inflation has reduced to 1.0% (CPI) and 1.6% (RPI), as bread prices lowered to £1.40/kg.

Volatility in wheat, but not in bread

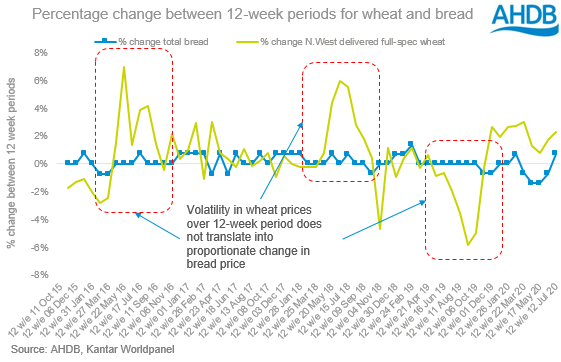

In the 12 w/e 03 January 2016 the average bread price across GB stood at £1.33/kg, with full spec bread wheat delivered into the North-West at £133.88/t.

Over the next 4 years the price of bread wheat into the North-West reached highs of £203.92/t in the 12 w/e 07 October 2018, a 52.3% increase. At this point, bread prices stood at £1.42/kg a 6.7% increase.

As the chart below shows, the percentage change between the 12 weeks periods for full-spec bread wheat is far more volatile and does not translate into proportionate percentage changes in the price of bread.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.