Dairy summary of the FAO & OECD Agricultural Outlook 2022-2031

Tuesday, 12 July 2022

The latest FAO & OECD Agricultural Outlook 2022-2031 has been released and we have summarised the key points for the dairy sector.

Supply

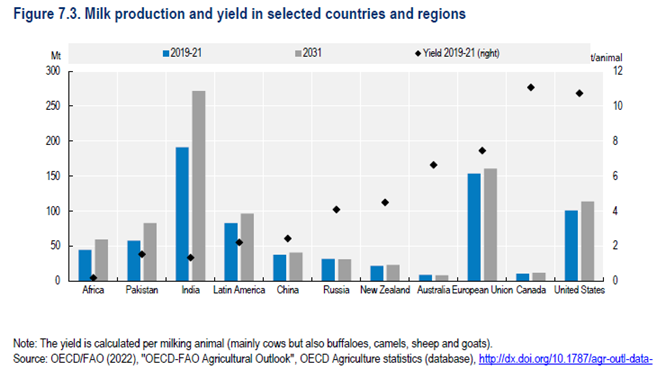

World milk production[1] is projected to grow at 1.8% p.a. over the next decade to 1,060 Mt by 2031, faster than most other main agricultural commodities. Over half of the increase in total milk production is anticipated to come from India and Pakistan, which will jointly account for over 30% of world production in 2031. In the main exporting countries, growth is only expected in the EU and US.

In almost all regions of the world, yield growth is expected to contribute more to production increases than herd growth, the drivers of which include optimising milk production systems, improved genetics, improved animal health and feed efficiencies.

Production in the EU is projected to grow more slowly than the world average, as a result of EU policies targeting sustainable production. At present, more than 10% of dairy cows are within, but not limited to, organic systems. In general, domestic demand is expected to grow only slightly, meaning most additional production will be destined for export.

North America has some of the highest average yields per cow, as the share of grass-based production is low, and feeding is focused on high yields from specialised dairy herds. Herds sizes are expected to remain largely unchanged and production growth to originate from further yield increases. As domestic demand is projected to remain stronger for milk fats, the US will mostly export SMP and a sizable amount of cheese, whey, and lactose.

New Zealand is the most export orientated country although growth in milk production has been very modest in recent years and expected growth is minimal. The main constraining factors for growth are land availability and increasing environmental restrictions, but a shift to a more feed-based production is not forecast.

Demand

Although milk is a highly perishable product, most milk is consumed in the form of fresh dairy products, including those fermented and pasteurised. As incomes and population increase, more dairy products are expected to be consumed over the medium term. In low and middle-income countries, fresh dairy products make up over two-thirds of the average per capita dairy consumption, while consumers in high income countries tend toward processed products.

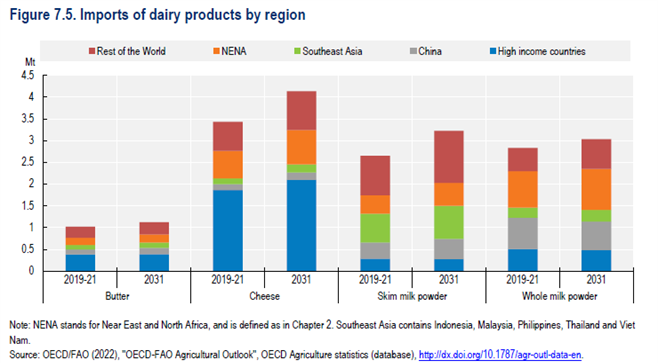

While some regions are self-sufficient, such as India and Pakistan, total dairy consumption in Africa, Southeast Asian countries, and the NENA is expected to grow faster than production, leading to an increase in dairy imports. As liquid milk is expensive to trade, this additional demand is expected to be met with milk powders, where water is added for final consumption or further processing. In Europe and North America, overall per capita demand for fresh dairy products is stable to declining but the composition of demand has been shifting over recent years towards dairy fat such as full-fat drinking milk and cream.

There is substantial regional variation in the consumption of processed dairy products. Consumption of cheese primarily occurs in Europe and North America, exhibiting a growing trend in both regions. In Asia, butter has the strongest projected growth in consumption. In Africa, cheese and WMP account for the majority of processed dairy. However, over the coming decade, SMP is expected to record the highest growth, although from a lower base.

Trade

China is expected to remain the most important importer of milk products despite a slight increase in domestic milk production. Over the medium term, the EU, New Zealand and the US will remain the key exporters of processed dairy product and are projected to jointly account for around 65% cheese, 71% WMP, 74% butter, and 80% SMP exports by 2031.

Changes in trade policy could alter dairy trade flows as international trade agreements (e.g., CPTPP and CETA) create opportunities for further trade growth. Argentina has the potential to become a competitor in the global WMP market due to rising milk production and below-average growth in domestic demand, though it currently accounts for a relatively small share of trade. To date, the big milk consuming countries, India and Pakistan, are largely self-sufficient with production growing in parallel with domestic consumption. However, a potential increase in the consumption of processed dairy products like cheese and milk powders may drive an expansion of processed dairy imports during the coming decade.

[1] World milk production is roughly 81% cow milk, 15% buffalo milk, and 4% for goat, sheep and camel milk combined

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.