Could the Black Sea export pace slow? Grain market daily

Tuesday, 24 September 2024

Market commentary

- Global wheat and maize futures rose yesterday as speculative traders covered short positions after concerns about global wheat supplies. There are ongoing concerns about the Russian wheat crop size after harvest delays due to adverse weather in eastern areas and EU crops. There’s also debate over if the pace of exports from the Black Sea could slow (more below).

- UK feed wheat futures (Nov-24) gained £1.25/t to settle at £181.05/t.

- Short covering by speculative traders was also a driver for oilseed prices, as dry conditions continue to hamper soyabean planting in Brazil. Paris rapeseed futures Nov-24 contract gained €12.50/t to close at €475.25/t.

- After the markets closed, the USDA reported that the US maize harvest had reached 14% complete. While ahead of the five-year average (11%), this fell short of market expectations (17%, LSEG). The soyabean harvest was 13% complete (in line with expectations). Winter wheat planting was 25% complete, slightly behind expectations (27%).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could the Black Sea export pace slow?

Despite an expected smaller crop, there’s been a strong start to the Russian wheat export campaign. Throughout August the highly competitive offers weighed on markets. Reduced EU crop estimates, plus concern about the size of the Russian crop and access to Black Sea grain supported prices in the first half of September. As the concerns about access to Black Sea grain have eased this week, attention has returned to the export availability.

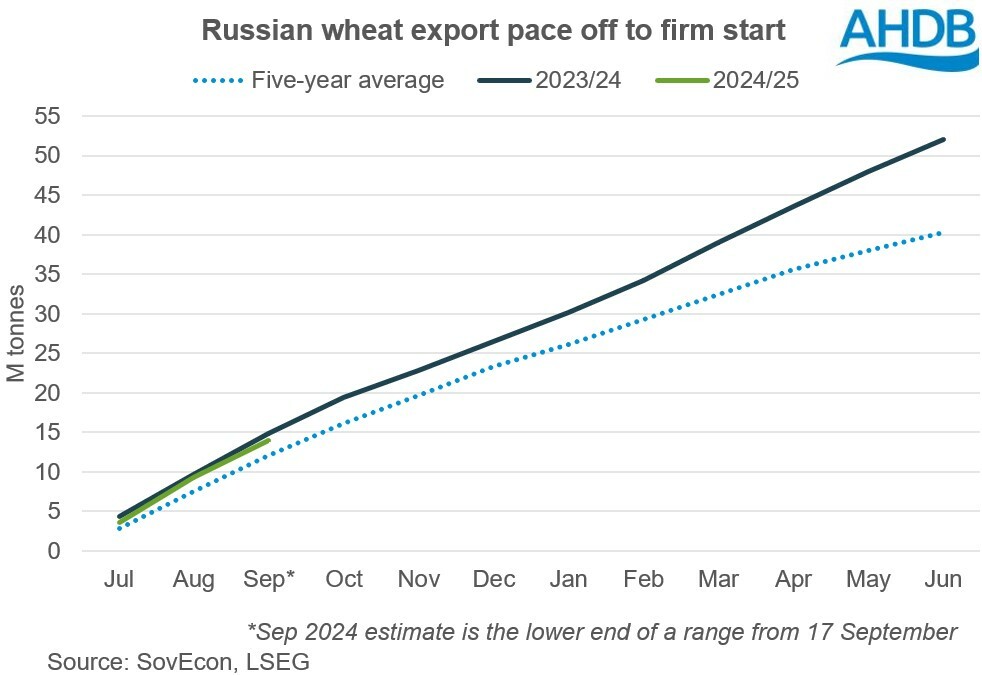

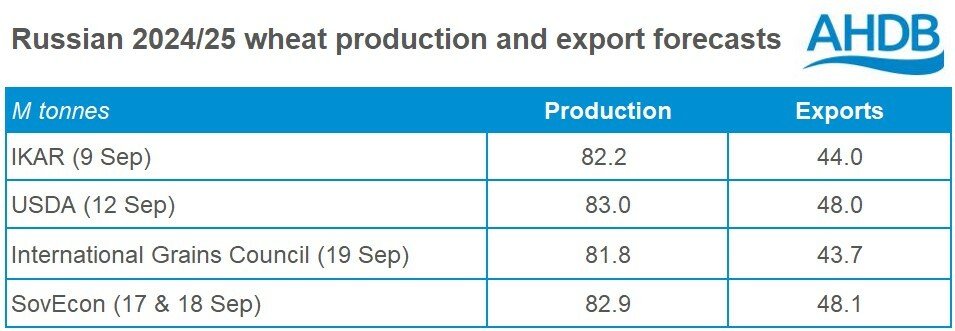

Recent projections from SovEcon suggest that Russia could export 4.7 – 5.0 Mt in September. Even the lower end of this range could mean July – September exports would only be 5% below last year’s record pace. This is despite several global and local forecasters pegging the 2024 crop around 9-10% smaller than last year.

Comparing exports to date to the predicted crop size suggests the 2024/25 export pace is stronger than might be expected. Using the lower export figure from SovEcon and the USDA crop estimate suggests 17% of the Russian crop will be shipped by the end of September, above last year’s 16% and the quickest pace since 2018/19. This suggests that the export pace needs to slow down. There also remains uncertainty over the Russian crop size, with harvest delays in the Urals, Siberia and Volga regions. Any cuts to crop estimates could increase the need for the export pace to slow.

Ukraine’s exports off to a strong start too

Meanwhile, Ukraine also reports a faster pace of exports than in the early months of the 2023/24 season. Ukraine’s Ministry of Agriculture reports wheat exports by 23 September at 5.4 Mt, which is a third of the agreed total maximum exports for the season (16.2 Mt).

In 2023/24, Ukraine exported 18.3 Mt, with 3.3 Mt in the first three months (UkrAgroConsult) as the end of the UN-backed Black Sea Initiative hampered exports. Exports picked up later in the autumn after Ukraine started to operate its humanitarian corridor.

Where now?

Given the smaller crop than last year and the relatively strong start to the export campaign, the Russian export pace will need to slow when compared to last season. As the flow of exports from the world’s largest exporter of wheat slows, this is likely to offer some support to prices. Some sources suggest this could already be happening, with IKAR reporting that export prices edged up last week. There’s now said to be lower availability close to the port in Russia and the need to transport grain larger distances would add cost. However, we’ll need to monitor the export pace to confirm the shift.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.