Could a weak sterling vs US dollar support domestic prices? Grain market daily

Friday, 10 January 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday’s session at £189.10/t, down £0.70/t from Wednesday’s close. The Nov-25 contract fell £0.10/t over the same period, to close at £193.40/t.

- Domestic wheat futures followed global grain markets yesterday. May-25 Chicago wheat and Paris milling wheat futures were down 0.5% and 0.3% respectively. The grain market is moving in a narrow range, and the main drivers now are currency fluctuations, winter crop weather risks and export demand. Today, the USDA is due to publish a number of reports, so we'll be looking out for increased volatility in grain and oilseed prices.

- May-25 Paris rapeseed futures closed at €528.50/t yesterday, up €3.50/t from Wednesday’s close.

- Winnipeg canola futures (May-25) fell 0.6% as the Canadian market remained under pressure with uncertainty over demand for canola oil and meal from Canada to the US weighing on the market.

- Chicago soyabean futures (May-25) have now remained above the strong psychological support level of $10/bshl since 26 December 2024.

Could a weak sterling vs US dollar support domestic prices?

Recently, currency fluctuations have impacted commodity markets. The US Dollar Index (Mar-25) has gained more than 9% from September 2024 to 9 January 2025. The US Dollar index measures the relative value of the US dollar against a basket of foreign currencies. Traditionally, when other fundamental influences are minimal, a strengthening US dollar has been a bearish factor for Chicago wheat, maize and soyabean futures, and a weakening US dollar has been bullish. This is due to US exports becoming less or more competitive on the global market.

Yesterday, sterling reached a one-year low level of £1 = $1.2304. While this could potentially support domestic grains and oilseeds prices, we should consider that the main agricultural commodity trading partner for the UK is the EU. As such, that’s why the relationship of sterling against the euro also has weight for UK grain and oilseeds prices. In December 2024, sterling hit an eight-year high against the euro, though recently we have seen some correction.

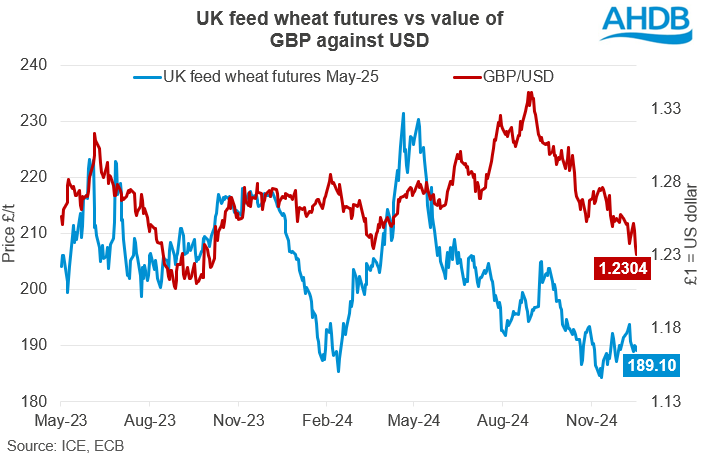

When comparing data on UK feed wheat futures (May-25) and the value of sterling against the US dollar, there are certain periods where currency impact is evident. The most obvious example is from May to August 2024, where we see a strengthening sterling and a decrease in UK feed wheat price.

However, with many other drivers in the market, it can be difficult to measure the direct impact of currency fluctuations. From September 2024 onwards, the value of sterling and UK feed wheat futures both moved in the same direction. During this period, UK feed wheat futures fell due to fundamental factors in the grain market and strengthening sterling against the euro.

Looking ahead

In a situation where grain prices are trying to find further direction, currency volatility can have greater influence on the market. Therefore, with current market conditions, it is something to consider. However, with a closer trading relationship to the EU, the strong sterling against the euro could limit any upside potential.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.