Coronavirus impacts – a global perspective

Monday, 20 July 2020

By Patty Clayton

A roundup of how key dairy markets have been impacted by the coronavirus pandemic, including a summary of government support.

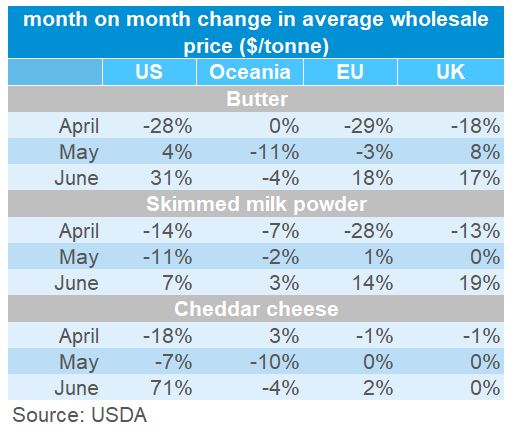

Wholesale prices

- Dairy product prices fell significantly in April, with similar trends seen in the three northern hemisphere regions (UK, EU and US)

- Prices in Oceania were less impacted despite its reliance on global trade. As the pandemic took hold at the end of its production season, the majority of product was already contracted.

- US saw a more significant downturn in cheddar cheese prices, linked to the proportionally higher reliance on foodservice markets than in the EU or UK. According to GIRA, this is estimated to be as high as 60% in the US in comparison to 30-35% in the EU

- Cheddar prices in the UK were insulated by strong retail demand.

- Prices began to recover in May and June as governments eased lockdown conditions.

- In the US, the surge in Cheddar prices was the result of supply concerns after strong export sales, high government purchases and the resumption of foodservice demand.

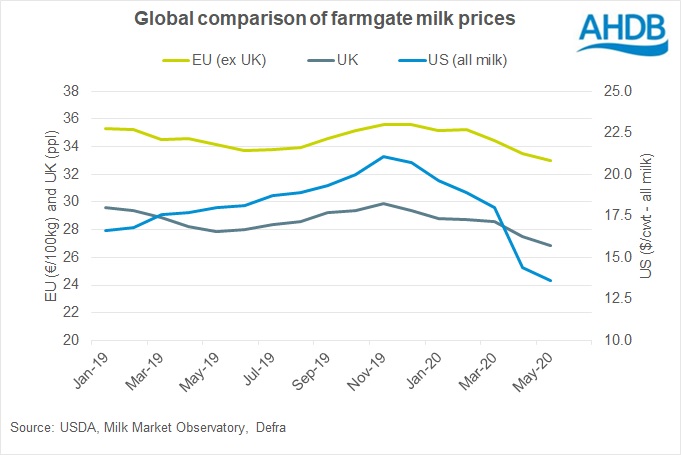

Farmgate prices

- Average farmgate prices (in local currencies) were trending down prior to the lockdown. However, the rate of decline accelerated in the US and Europe from March as export and consumer demand began to be affected by lockdowns.

- The US saw the sharpest drop as measured by the ‘All milk’ announced prices. Class III prices (cheese) have seen huge volatility due to the reopening of restaurants in some states and strong export orders.

- Price adjustments varied across EU member states. In the main producing regions, the average May price is between 2% and 12% lower than the average in February.

- In the UK, the average price across all milk fell by 6.5% between February and May. However, prices paid by some milk buyers saw larger decreases, particularly by those reliant on foodservice markets.

Government support

European Union

- Private storage aid scheme opened for butter, skimmed milk powder and cheese

- Intervention buying opened, although not utilised

- increased advance payments for both Pillar 1 and Pillar 2

- increased flexibility in use of Rural Development funds

- temporary derogation of competition rules

- national campaign to support cheese demand in France

- €10m fund established in France to compensate farmers for production reductions (industry funded)

United States

- $3bn for food purchase and distribution ($100m/month for dairy)

- $19bn direct support to farmers for losses (across all agricultural sectors)

- $1.5bn for additional support to food banks

United Kingdom

- direct support for dairy farmers (max £10k per qualifying farmer)

- temporary derogation of competition rules

- consumer campaign to support dairy consumption

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.