Contrasting crop fortunes continue: Grain market daily

Tuesday, 23 May 2023

Market commentary

- UK feed wheat futures slipped lower again yesterday. The Nov-23 contract declined £1.90/t from Friday’s close to £187.50/t. The May-24 contract fell £3.30/t to its lowest closing price to date of £195.45/t.

- Paris rapeseed futures also fell. The Nov-23 contract lost €2.75/t to close at €402.75/t. The Nov-24 contract set a new contract low of €410.00/t, down €3.25/t from Friday’s close.

- Markets are still assured of global supplies, due to the extension of the Black Sea Initiative and expectations of good crops in key exporting nations. US markets rallied a little after the European markets closed, reportedly due to technical trading factors and bargain buying.

Contrasting crop fortunes continue

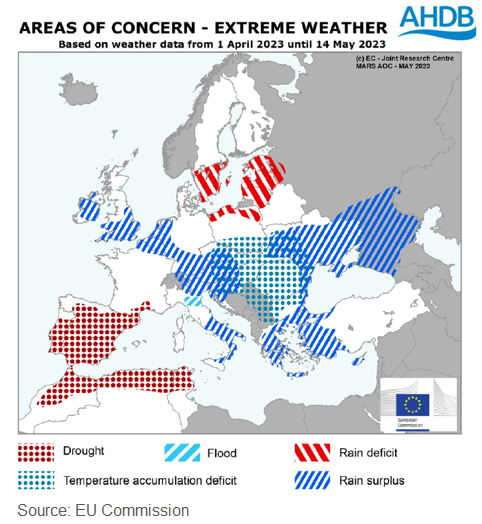

Newly released crop reports show continuing good crop conditions in much of Europe. But this contrasts with poor prospects in Spain, Portugal, and parts of North Africa. Crop fortunes also continue to contrast within the US.

Harvest is underway or imminent in Spain, Portugal, Algeria, Morocco, and Tunisia. We’ll soon have full confirmation of the yields, but expectations are low (EU Commission) and will mean high import needs in the 2023/24 season.

Yet, there is still good crop potential in most other areas of Europe, including the main exporting countries. High rainfall in big swathes of Europe slowed spring planting but means good moisture for growing crops. Meanwhile, good soil moisture has offset below normal rainfall in the Baltic countries.

The EU Commission’s MARS bulletin increased yield forecasts for soft wheat, winter barley and rapeseed. The forecasts were above average in April and now are further above.

Maize and sunflower yield forecasts were reduced, partly due to planting delays from cold / wet weather. But these forecasts remain above their respective five-year averages. The spring barley yield is down 0.14t/ha to 3.90t/ha, moving further below the 5-year average of 4.19t/ha.

In the US, there are signs that winter winter wheat crops are stabilising. The proportion rated good/excellent was up slightly (2 percentage points) week on week to 31% as of 21 May (USDA), but still very low. Meanwhile, maize and soyabean planting are going well and more good weather is generally expected this week. 81% of maize is now planted, still ahead of the five-year average (75%). Two-thirds (66%) of soyabeans are also in the ground, versus 52% on the five-year average for this point in May.

The impact?

Yesterday’s reports from the EU Commission and USDA only really confirm, or tweak information the market already had. They don’t substantially change the story so, arguably this isn’t enough to disrupt the current bearish tone in markets.

It would need big crop issues to shift market sentiment, given how entrenched the current bearish outlook is. Things to watch include the Brazilian Safrinha maize crop (forming its yield now), plus US maize and soyabean crops. These are expected to be very large crops, but the critical window for US yield formation is still ahead in July and August.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.