Chinese maize support to feature for a consecutive season? Grain Market Daily

Wednesday, 21 July 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £180.40/t gaining £2.00/t on the day. The contract has gained £14.40/t from last Tuesday (13 July) owing in part to detrimental hot weather affecting parts of the US. The May-22 contract gained £2.05/t, to close at £185.50/t, yesterday.

- The recent deadly floods in Germany is estimated to have resulted in wheat production losses of between 150Kt – 200Kt, for reference Germany is expected to harvest 22.8 – 23.0Mt in 2021/22. Questions remain for winter wheat quality with, concerns for hagberg and protein levels.

- The Argentinian government has made efforts to limit water usage to alleviate pressure on the Parana River, where water levels are at a 77-year. The Parana River is the route for an estimated 80% of Argentina’s agricultural exports. A continued lack of rainfall at both its source in Brazil and the river in Argentina will continue to hamper exports.

Chinese maize support to feature a consecutive season?

In the last twelve months, maize markets (Chicago - nearby) have undergone quite a change. From August Chicago maize futures (nearby) climbed 151% to briefly peak at the $7.70/bsl mark ($304.2/t) in May 2021. As we know Chinese purchases have supported the gains. But, if we look forward a couple months, are Chinese fundamentals different to a year ago?

As we approach global crop harvests, US maize futures (nearby) have fallen 28% from the May peak to yesterday. Ending stocks for the 2021/22 global maize crop is forecast to increase 4% year on year by the USDA owing to increased production.

China too is expecting a rise in maize production, namely a 12.0Mt increase according to Refinitiv, to 272.7Mt from USDA figures last season. Despite Chinese maize futures (Jan-22) easing back 10% from the May peak to yesterday, the contract is $167.13/t above CBOT Dec-21 maize futures.

High internal Chinese prices are the likely source of a 2.7% increase in planted area figures. The province of Jilin is forecast to produce 34.9Mt of maize this season with spot prices (Ex Works incoterm) currently at 2600 CNY ($401.7X/t). This is somewhat elevated against a theoretical spot import price of $350.87/t (US Gulf FOB $276.00/t + $74.87/t Freight from US Gulf to China).

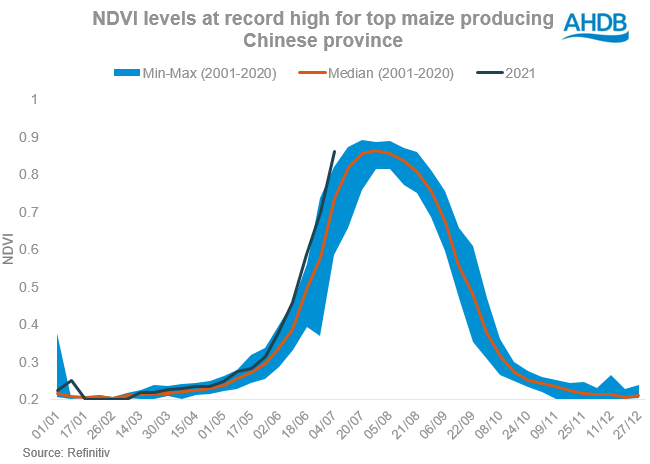

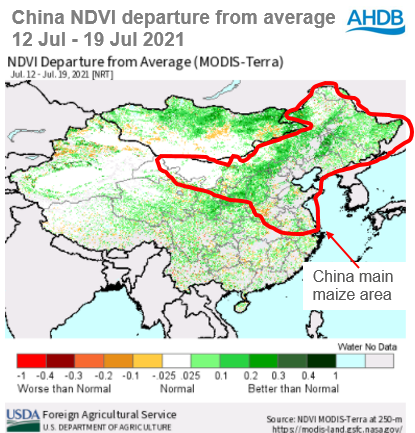

The Chinese maize crop looks to be doing well. Vegetation densities (NDVI), derived from satellite imagery, in Heilongjiang and Jilin provinces are at record levels since monitoring began in 2001. These two provinces alone are forecast to produce 76.39Mt of maize.

Forecast high production could pressure Chinese internal spot prices if strong yields are seen. We also need to watch the main demand arm, the 439 million head pork herd (end June). If we see further detrimental effect from fresh outbreaks of African Swine Fever (ASF) price would also likely see pressure.

China has a hefty forward book of maize purchases penned in, at 10.74Mt of US origin maize for the next marketing year, beginning in September. However, bear in mind that these can be cancelled.

To put this into perspective, so far this marketing year (Sept 2020 – Aug 2021), US maize exports to China have totalled 18.14Mt, with a further 5.1Mt of outstanding trade to sail. As such, with a large forward export sales book already, it is perhaps unlikely that new, large forward sales will occur before the Chinese crop has been harvested. New export sales are a supporting factor for markets. The global export demand for maize markets will depend heavily on this Chinese maize crop, and as such so will price direction going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.