Chinese demand continues to beef up South American exports.

Thursday, 29 October 2020

By Charlie Reeve

Both Brazilian and Argentinian beef exports remain strong for the year to date.

During the first nine months of 2020, Brazil exported 1.4 million tonnes of beef globally (fresh/frozen, offal and processed), an increase of 11% year-on-year.

The major driver behind this trade continues to be demand from China. During this period, China has accounted for 42% of total Brazilian beef exports. During the first nine months of 2019, Brazil exported 260,000 tonnes of beef to China, but 600,000 tonnes in the same time this year, a substantial increase of 130%.

China has recently lifted restrictions on several meat processing sites in Brazil that had previously been prevented from exporting to the region due to COVID-19 concerns, although there are some other sites which still have restrictions in place.

The demand for proteins in China still remains elevated, on the back of African Swine Fever (ASF) decimating the Chinese pig herd last year. China is working to rebuild its domestic pig herd, however in the short-term demand remains strong for all imported proteins.

Argentinian exports have also grown in volume, with an increase of 13% year-on-year, to 525,000 tonnes globally during the first nine months of 2020. Chinese demand has also been the driving factor behind this increase.

By comparison, Brazilian exports of beef to the UK have actually declined marginally year-on-year, during the first three quarters of 2020 around 18,000 tonnes of Brazilian beef has been exported to the UK, a decrease of 2% on 2019 levels.

Production

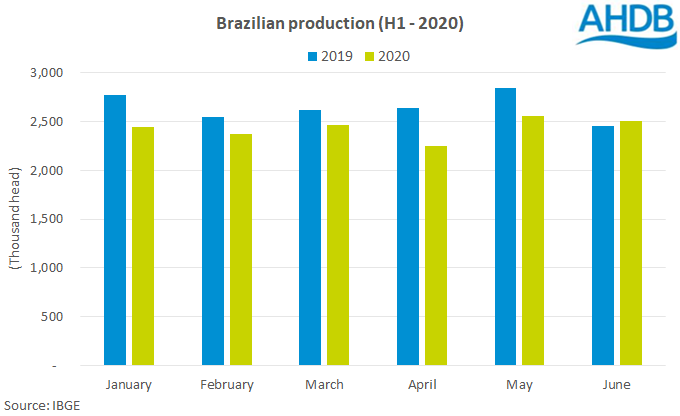

Brazilian production was down 8.1% on 2019 levels, based on the first half of the year. An estimated 1.29 million fewer cattle were slaughtered during the first half of 2020 in Brazil. June was the first month of 2020 to see any increase on the same month of 2019.

The USDA’s latest Gain report suggests Argentina’s production is also likely to be lower year-on-year, one of the reasons behind this may be longer finishing times due to the growing export market demanding heavier carcases.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.