China beef update: Domestic production continues to grow as wholesale prices stabilise

Thursday, 19 October 2023

Key points:

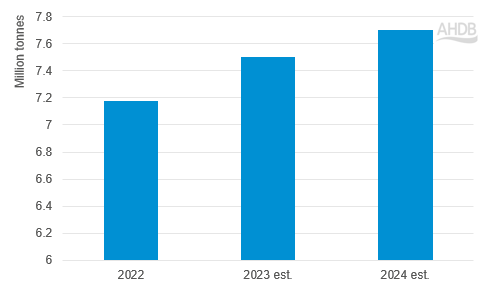

- USDA predict China’s beef production will increase to 7.7 million tonnes in 2024

- The average beef wholesale price stabilised at 72.5 yuan/kg at the end of September

- Chinese beef consumption is predicted to remain flat in 2024, however some downtrading to cheaper products is expected

- Chinese beef imports continue to be dominated by Brazil, with a 41.1% market share in 2023

- USDA predict that the demand for high quality imported beef in Chinese restaurants and retail will persist

Production

The USDA’s latest forecasting predicts China’s beef production will grow by 2.7% in 2024 to total 7.7 million tonnes, a historically high level. This is mainly driven by a large live cattle inventory, following a period of expansion of the domestic beef herd. However, the rate of growth may be tempered by a slowing of the economy, causing a flattening in consumer demand for beef.

Chinese domestic beef production

Source: USDA

Prices

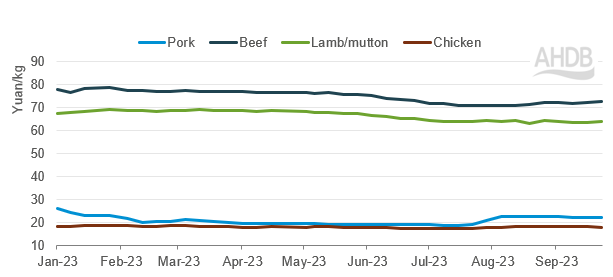

Chinese wholesale beef prices were reasonably stable for the first quarter of 2023, reaching a high of 78.6 yuan/kg. There was then a period of gradual decline, with prices reaching lows of 70.8 yuan/kg, before stabilising in the last few weeks. In the last week of September, the average beef wholesale price in China was 72.5 yuan/kg, down 6% on the same point last year. This is likely a reflection of ample supply and easing demand.

Chinese wholesale prices

Source: Chinese Ministry of Agriculture and Rural Affairs

Consumption

Chinese beef consumption is expected to stay flat in 2024, at around 11 million tonnes. The USDA predict that lower-end domestically produced beef products are likely to take market share away from high-end imported beef as consumers downgrade in response to a slowing economy.

Out of home services (hotels, restaurants and institutions) are predicted to continue to be the major outlet for beef consumption in China whilst online beef sales are expected to grow in popularity, due to their ease. The majority of domestically produced beef in China is sold as fresh, but the USDA predict that there will be an increasing proportion that is sold as chilled, particularly driven by online sales.

Imports

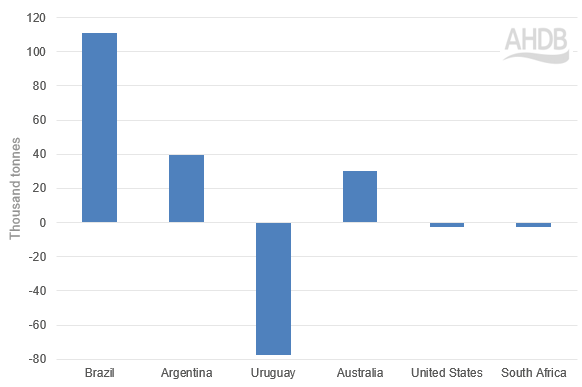

The latest data for 2023 (Jan–Aug) shows that China have imported a total of 1.8 million tonnes (product weight; PW) of fresh & frozen beef. This is a 6% increase compared to the same period in 2022.

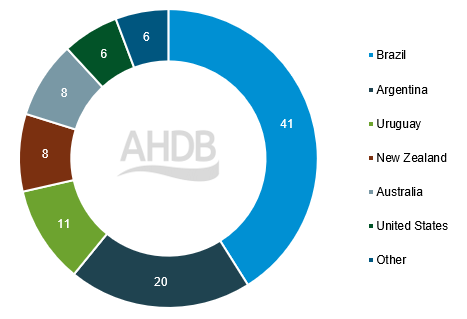

The greatest proportion of fresh & frozen beef imports to China comes from Brazil, some 735,000 tonnes (PW) so far in 2023. Brazil has maintained the greatest market share for several years, followed by other major contributors including Argentina and Uruguay. These countries provide low-priced grass-fed beef to China, with products mostly used in food processing facilities and lower-end restaurants.

As consumer demand flattens, it can be expected that demand for beef imports will also decline as the import deficit reduces. However, the USDA report that there remains a market for beef that is perceived as higher quality, such as that imported from the United States, New Zealand and Australia. These products are able to maintain a niche within retail and high end out of home services which reinforces their value.

Year on year volume change in Chinese fresh & frozen beef imports by key country

Source: China Customs Statistics, compiled by Trade Data Monitor LLC

2023 market share % of imports to China

Source: China Customs Statistics, compiled by Trade Data Monitor LLC

Looking at beef offal, Chinese imports for 2023 so far (Jan–Aug) sum 23,800 tonnes (PW), down 22.3% from the same period in 2022; however, they are up from 2021 figures. The majority of beef offal is coming from Uruguay, the United States and New Zealand, with market shares of 37%, 27% and 20% respectively in 2023.

The USDA forecast that Chinese beef import volume will reduce by 5% in 2024 compared to 2023, reflecting the flattening domestic demand and cost challenges for importers. However, the USDA suggest that global demand will be upheld by small increases in markets such as India and Canada, therefore maintaining export opportunities for big players such as Brazil and Australia. These supply and demand interactions affect beef availability on the global market and, by extension, have potential impacts for prices in the EU and UK.

Conclusion

Beef production in China continues to grow year-on-year and it is now ranked the world’s third largest beef producer. Consumption growth is expected to plateau, as confidence in the economy reduces. Despite this, China remains a vital player in the global beef market, with substantial import volumes from different countries to serve a variety of domestic markets.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.