Bulls in commodity markets: Grain market daily

Friday, 25 February 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £245.25/t, gaining significantly on Wednesdays close by £10.00/t. Nov-22 closed at £224.00/t, an increase of £7.85/t on Wednesday’s close and setting another contract high.

- Currently the domestic market has receded some of yesterday’s gains and has opened lower this morning. May-22 is trading as low as £235.00/t and Nov-22 is trading as low as £217.90/t (as at 10:00am).

- Paris rapeseed futures (May-22) closed at €763.50/t, gaining €23.25/t on Wednesday’s close, this contract is currently up €59.75/t since last Friday. New crop rapeseed futures (Aug-22) followed suit gained €21.75/t yesterday to close at €666.75/t.

- Nearby Brent crude oil closed yesterday at $99.08/barrel, up 5.92% across the week so far. The contract as of 09:00 this morning was trading at $101.07/barrel. If this contract closes at over $100, this will be the first time since 2014.

Bulls in commodity markets

Markets are very bullish at the moment. Yesterday, commodity markets skyrocketed as Russian troops made the move into Ukrainian territory with a series of attacks.

Both Ukraine and Russia are significant global wheat exporters, forecast to contribute 29% of worldwide wheat shipments this season (USDA). Yesterday’s events will have cause for concern on what will happen to Black Sea exports.

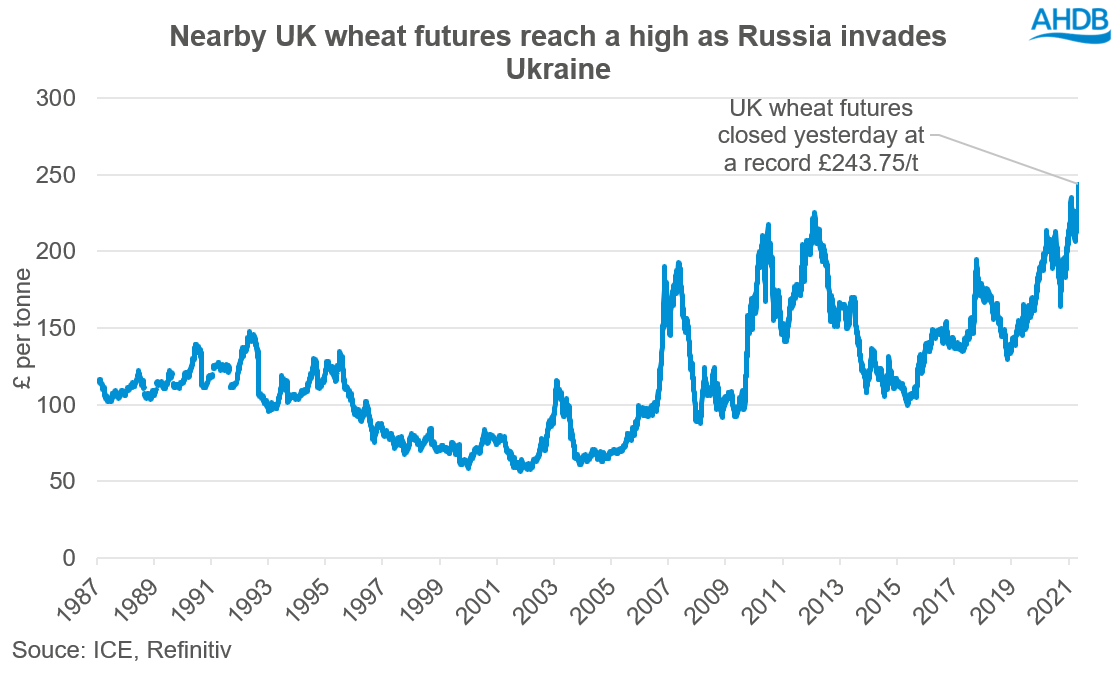

Nearby UK wheat futures closed yesterday at £243.75/t, gaining £10.00/t across the day and £22.85/t across the week so far, resulting in the highest nearby price since at least 1987.

Helen’s analysis yesterday pointed out also that there is still a sizable quantity of agricultural commodities to be shipped from the region and disruptions to exports could ensue. Further to that, it’s not just grains; both Russia and Ukraine are expected to account for 78% of global sunflower exports this season (USDA).

As this Ukrainian-Russian news evolves markets will react accordingly to what happens next. There remains a lot of uncertainty. However, if there is support to global prices this will filter down into domestic ex-farm prices.

The AHDB delivered survey will be published this afternoon with a series of prices and further insight into what this recent global news has done to our physical domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.