Bioethanol and starch demand stayed strong in September: Grain market daily

Tuesday, 7 November 2023

Market commentary

- May-24 UK feed wheat futures closed at £199.85/t yesterday, down £0.65/t from Friday. The Nov-24 contract fell £1.60/t to £207.80/t. This followed a similar trend to Paris milling wheat futures, which declined due to a stronger euro and uncertainty over if Algeria will buy European wheat in its tender today.

- The condition of US winter wheat crops improved last week according to the USDA. 50% of the crop for harvest 2024 is now rated as good or excellent (as of 5 November), up from 47% last year and the highest rating for the time of year since 2019. Winter wheat planting is now nearing the end at 90% done, with the 2023 maize and soyabean harvests also into the closing stages at 81% and 91% complete, respectively.

- May-24 Paris rapeseed futures edged higher gaining €1.00/t to €452.00/t, while the Nov-24 contract gained €0.75/t to €456.75/t.

- Rapeseed prices were supported by gains in both Chicago soyabean futures and Winnipeg canola (rapeseed) futures. Soyabean prices are still supported by concerns about uneven rainfall in Brazil, and a weaker US dollar. Buying by speculative traders in both the US and Canadian markets was also likely a factor.

- Brazilian crop authority Conab reports that 48% of the soyabean area was planted by 4 November. This is behind last year’s 58% complete and the slowest since Conab began reporting planting progress in 2019.

Bioethanol and starch demand stayed strong in September

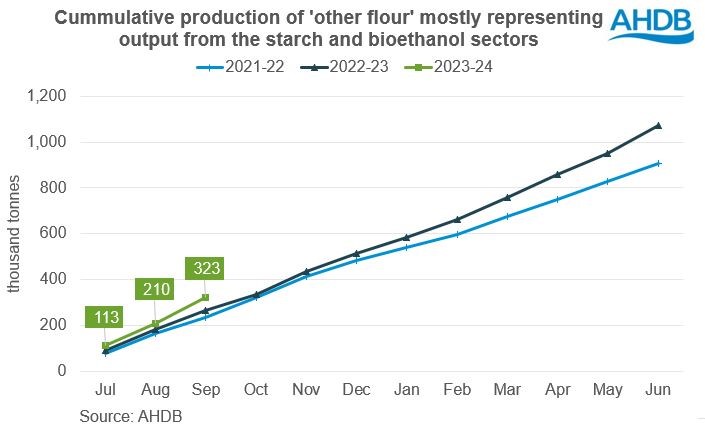

Demand from the UK bioethanol and starch sectors remained strong in September, indicates the latest UK usage data. Production of ‘other flour’ mostly represents output from the starch and bioethanol sectors, so higher ‘other flour’ production indicates higher demand for wheat by the sector.

In September 112.9 Kt of ‘other flour’ was produced, 34% more than September 2022 and the highest figure for the month since 2018-19. It takes the season to date total (July – September) to 323 Kt, up 21% on the year.

The total volume of flour milled in the UK so far this season (July – September), including for starch and bioethanol production is 585.6 Kt. This is an 8% rise on the same period last season.

Higher demand from the bioethanol and starch sectors was an important part of AHDB forecasting total wheat usage in 2023/24 higher than 2022/23. Along with a predicted rise in usage as animal feed, total domestic usage of wheat in the 2023/24 season is pegged at 15.1 Mt, up 534 Kt or 4% on the year. Please note the current forecasts assume there’s resolution to the renewable energy directive (RED II) requirements following the UK’s exit from the EU.

While demand is higher, production in the north of England is lower than last year. Wheat output in both Yorkshire and the Humber and the North East of England are down 8% from 2022 and are the lowest since 2020.

Combined, the current higher demand and smaller crop than last year are supporting delivered feed wheat prices in the North East of England relative to the futures price. Feed wheat delivered to North Humberside in May-24 was £212.50/t as of last Thursday (02 November). This was £14.00/t above the May-24 UK feed wheat futures price on the same day. A year ago, (03 November 2022), feed wheat delivered to North Humberside in May-23 was £12.50/t above the May-23 UK feed wheat futures price on the same day.

Higher premiums to UK futures have been recorded in the area, but these were in seasons linked to higher import levels. For example, two years ago (04 November 2021), the price for feed wheat delivered to North Humberside in May-22 was £15.00/t above the May-22 futures contract on the same day.

Could premiums rise?

This season, UK wheat supply and demand look finely balanced, with 734 Kt of wheat currently estimated to be available for either export or to be held as free stocks. This is down 64% on last season due to the smaller crop and higher demand. ‘Other flour’ production has started strong, with the starch and bioethanol sectors contributing to higher expected usage overall. If demand exceeds current expectations, could we see prices move to attract imported grain?

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.