Below average US wheat conditions gives some support to markets: Grain market daily

Wednesday, 1 June 2022

Market commentary

- Global grain and oilseed markets continued to fall yesterday on the back of news that exports from Ukraine may resume, as discussed in yesterday’s Grain Market Daily.

- UK feed wheat futures (Nov-22) settled at £306.50/t yesterday, down £11.25/t from Monday’s close. The May-23 contract lost £11.70/t to close at £312.55/t on Tuesday.

- Nov-22 Paris rapeseed futures dropped €2.50/t from Monday’s close, settling at €805.75/t yesterday.

- The latest UK human and industrial and GB animal feed cereal usage information has been published today.

Below average US wheat conditions gives some support to markets

Domestic and global grain markets have been falling since the news broke that Ukraine may be able to start exporting food products, including grains, again. However, the release of the latest US crop progress report yesterday, which recorded below average wheat conditions, may limit further losses.

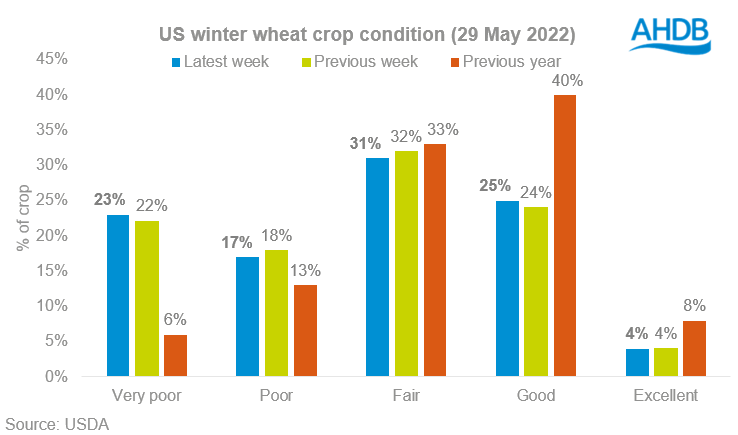

As at 29 May, US spring wheat plantings were 73% complete, according to the latest USDA report. While this is higher than the Refinitiv pre-report poll average of 67%, it remains down on the five-year average of 92% complete. For winter wheat, the main wheat crop in the US, crop conditions have improved slightly on the week. 29% of the crop is now rated good/excellent compared with 28% a week earlier. Despite the slight improvement, US winter wheat conditions remain well below levels recorded last year for the same week, of 48% good/excellent.

US winter wheat conditions are lower than average for this point in the year due to lack of rainfall through the season. While rain is forecast for key growing regions over the coming week, it may be too little too late, as the crop reaches maturity. US winter wheat is typically harvested in June and July.

So why does this matter for us here in the UK? Well as is well known, our domestic market follows global price movements, especially in seasons where the UK is set to be a net importer of wheat. As mentioned above, over the last week we’ve seen grain markets lose ground on the back of the news that Ukraine may start exporting in higher volumes again. However, any issues with the size and quality of the US wheat crop will cap further losses due to continued concerns over global supply.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.