Beef tariffs and quotas in a no-deal Brexit

Thursday, 14 March 2019

By Tom Forshaw

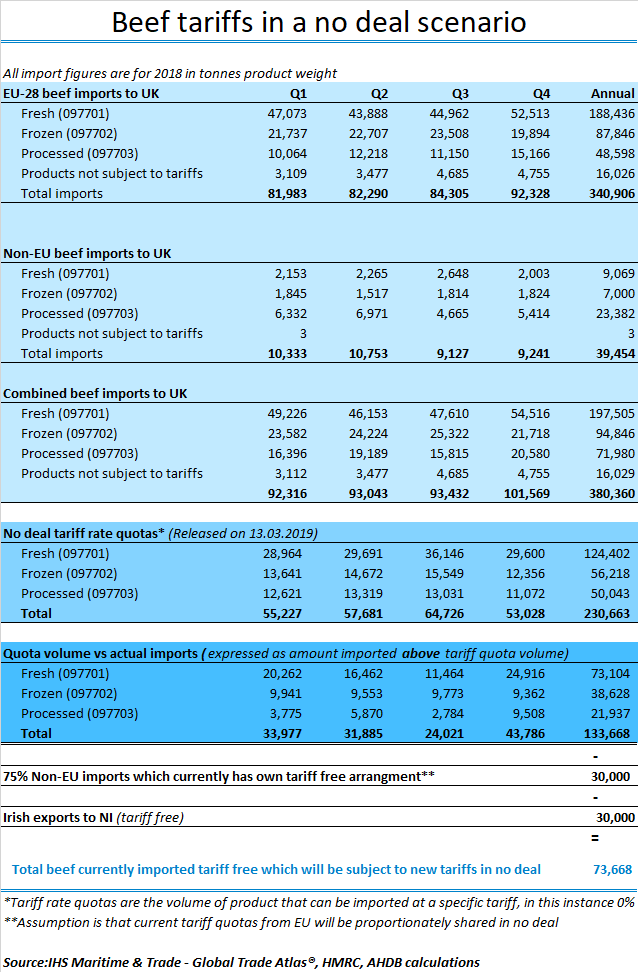

In 2018 the UK imported 380,000 tonnes of beef, either fresh, frozen or processed. Of this, 340,000 tonnes was imported tariff free from the EU. An estimated 30,000 of the other 40,000 tonnes would have come in at a reduced tariff under pre-existing EU quotas, from countries outside the bloc.

Under the new tariff rates published on Wednesday, tariffs applied to beef imports will be applied, albeit at a lower rate than current EU tariffs. For instance the tariff level for fresh of chilled boneless beef would be 6.8% + €160.1/100kg, rather than the EU rate of 12.8% + €303.4/100kg..

The government has also announced that there will be a tariff rate quota, for which the tariff rate will be 0%. This will be based on a first come first served basis and is open to all countries including EU member states. The quota totals around 230,000 tonnes, lower than the UK’s current imports. Any volumes imported outside of this quota, or other pre-existing EU tariff quotas that the UK will inherit its share of when it leaves Europe, will be subject to full tariffs published in the government guidance. These full tariff volumes are thought to be in the order of 75,000 tonnes.

Further to this, as announced by the UK government, there will be tariff free trade between the Republic of Ireland and Northern Ireland. Irish beef exports to Northern Ireland totalled around 30,000 tonnes in 2018, which would have to be added to the tariff rate quota above.

It is important to note that although the tariff rate set by the UK government is lower than the current EU tariff for third countries, currently the vast majority of beef entering the UK does so tariff free. The proposed quota volumes do not cover current import volumes and as such some beef that currently enters tariff free is potentially subject to tariffs, this is detailed in the table below.

Following on from this initial analysis AHDB will be carrying out more in depth analysis at some of the other potential consequences of the imposition of this tariff regime in a no-deal Brexit. For example, how might the difference between EU and UK tariffs affect imports from Non-EU countries that have previously been ‘priced out’ by the EU tariff rate? How might live bovine imports react, as there is currently no proposed tariff on live imports into the UK? Can we expect some beef imports to be displaced by UK produced beef that would previously have been exported, remaining on the UK market?

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.