- Home

- News

- Beef market update: Latest BCMS data suggests prime cattle supply tightness is here to stay

Beef market update: Latest BCMS data suggests prime cattle supply tightness is here to stay

Wednesday, 4 June 2025

The most recent British Cattle Movement Service (BCMS) data for April 2025 reports continued declines in total GB cattle numbers, suggesting further supply tightness on the horizon.

Key points

- The beef breeding herd has once again contracted more than the dairy herd to stand at 1.23 million head

- Slight increases in the population of cattle aged 0–6 months indicates that producer semintent might be changing in light of exceptionally high beef prices

- However, Q1 calf resistrations are down slightly on the year by 1.2% to total 681,100 head

Population

BCMS data reports the total cattle population at 1 April 2025 at 7.54 million head, down 1.7% on the year.

A key driver of this decline was contraction in the beef breeding herd; down 3.4% from the same time last year. The dairy breeding herd has remained more constant, down by only 0.2 % from last April. These declines are broadly in line with those observed at January this year.

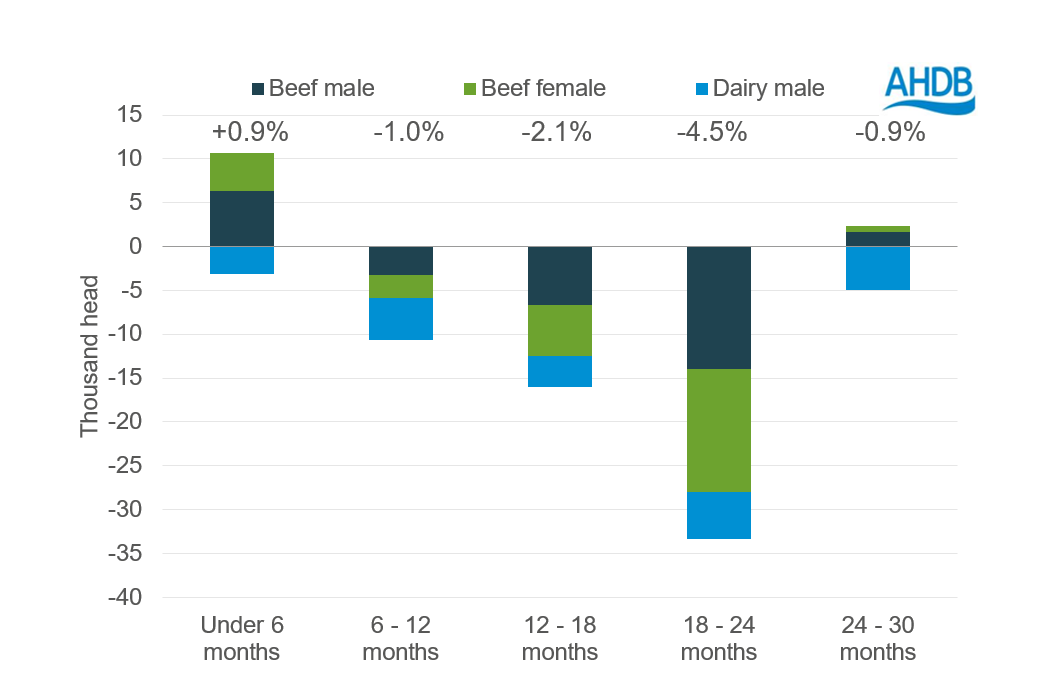

The cattle population available for beef production aged 12-30 months was recorded to be down by 52,000 head (-3%) compared to April last year, with the biggest reduction being seen in the 18-24 month age group. This indicates continued beef supply tightness moving forward, potentially lending support to prices over the next 6 to 12 months.

However, the number of cattle for beef production recorded aged 0-6 months has increased by almost 8,000 head compared to April last year, with year-on-year increases in beef animals of both sexes. Market signals, such as the exceptionally high beef prices of the past few months may have encouraged producers to restock over the past six months, supporting this increase. The registrations data gives further insight into this trend, which we will explore in this analysis and AHDB will continue to monitor over the coming months.

Year-on-year change in number of cattle in GB (1 April 2024/25)

Note: Data includes beef animals + dairy males

Source: British Cattle Movement Service, AHDB calculations.

Registrations

Total Q1 (Jan–Mar) calf registrations are down by 1.2% on the year to 681,100 head. However, this represents a slower rate of decline to that observed last year (-2% for 2024 versus 2023).

However, calf registrations intended for the beef supply chain (beef males, beef females and dairy male calves) fell by only 0.5% year-on-year.

Dairy beef calf registrations continue to increase; with the number of dairy beef males and female registrations rising by 4.5% year-on-year to make up 41% of total beef calf registrations in Q1.

Meanwhile, Q1 dairy male registrations have fallen by 6.4% to 37,900 head.

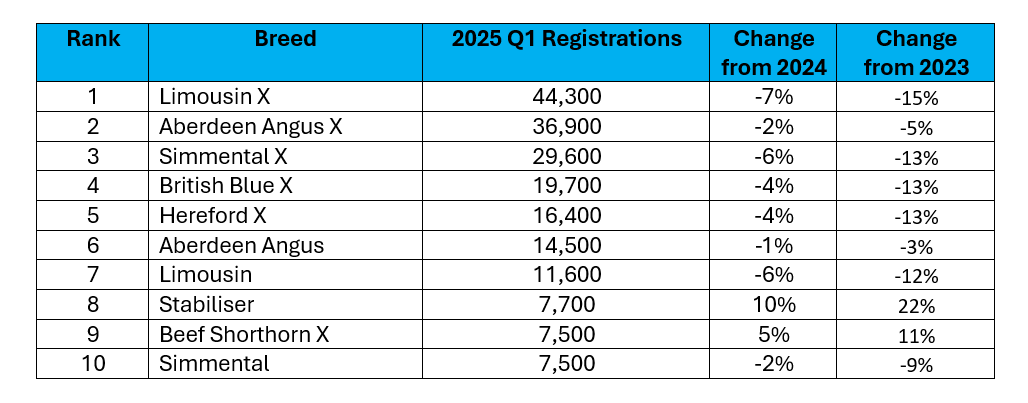

Focusing in on the suckler herd, for which spring is the primary calving time, the most common calf registrations across Q1 demonstrates that continental breeds are experiencing the steepest rates of decline whilst native and composite breeds gain prominence.

Top ten beef calf registrations to beef dams, Q1 2025

Source: BCMS

The growth in dairy beef registrations, coupled with a smaller year-on-year contraction in suckler registrations, has supported the uplift in cattle available for beef aged 0–6 months (described above in the population totals).

Conclusion

In short, from the most recent data it appears that, in the short term, falling cattle GB populations are here to stay, especially influencing the beef supply chain. However, the recent record high beef prices may be beginning to support the production decisions of farmers, leading to annual growth in the 0–6 month population of cattle available for beef as of 1 April.

The composition of the GB beef herd is also continuing to shift, with breed types changing and dairy beef becoming ever more prevalent as dairy bull numbers continue to fall.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.