Assessing the impact of a washed out October? Analyst Insight

Thursday, 31 October 2019

Market commentary

- UK feed wheat futures (May-20) have continued to drift this week, gaining just £0.25/t since Monday, to close yesterday at £147.75/t

- New-crop UK feed wheat futures (Nov-20) have been moving in the opposite direction to US wheat futures (Dec-20) during October. US planting has progressed well compared with the delays in the UK.

- Nearby Paris rapeseed futures continued to climb yesterday closing at €387.25/t. To find out what is behind this take a look at yesterday’s GMD. Prices have fallen back so far today.

- US soyabean futures (Dec-19) continued to drop off yesterday and fell further this morning as harvest progresses.

Assessing the impact of a washed out October?

Wet weather has dominated much of the UK since mid-September, causing delays to drilling of winter cereal crops. Furthermore it is expected anecdotally that some of the OSR planted area for 2020 harvest may have already failed due to Cabbage Stem Flea Beetle (CSFB) attacks. Some of those crops already suffering from CSFB damage could well have now been drowned.

With the delay in drilling and areas of the UK flooded, it could push farmers to switch to spring cropping. The decision may not be confirmed yet but many will have been considering a ‘plan B’ for some time now. Moreover, we are hearing anecdotal reports of an increase in queries regarding seed supply for spring crops.

2012 was a similar autumn and many were forced to switch to spring cropping. The AHDB planting and variety survey showed that the spring barley area for 2013 harvest nearly doubled as a result. The field bean area also increased that year, by 26%, potentially driven by the later drilling dates of winter beans combined with a move to spring beans.

The big difference then, was that 2012 harvest was not as fruitful as 2019 harvest. 2012 barley production was just 73% of this year and therefore the surplus was significantly less. 2012 bean production was even less at just 49% of 2019 harvest. There was also less uncertainty about the trade opportunities available to the UK, especially for barley exports which primarily move to the EU. So what does this mean for 2020/21?

The here and now

The 2019 barley crop is predicted at 8.18Mt according to Defra, the largest since 1988. Based on this production figure the early balance sheet suggests that there is a surplus of 2.34Mt available for export. The first two months of export data shows 329.64Kt of barley has been exported, based on this, an average of 202.5Kt would need to be exported a month in order to clear this year’s crop.

With the added pressure of Brexit uncertainty, trade with the EU was reportedly slow post-October and the extension will not necessarily help. Historically November and December are large export months of both barley and beans but the continued ambiguity surrounding Brexit will likely weigh on trade. Reports suggest that EU traders have stocked up in anticipation of a 31 October deadline and therefore there is limited capacity for the coming months. Even if export trade of barley does continue at pace, the large surplus is still unlikely to all move by the end of the year, and as a result the possibility of a large carry-out from this season is high.

With the feed barley market over-supplied, prices are under pressure and the requirement to be export competitive remains. Ex-farm prices for spot movement are below 2018 and 2017 levels but these crops were smaller. Current prices do however, sit higher than the same point in 2015 when the crop was of a similar size.

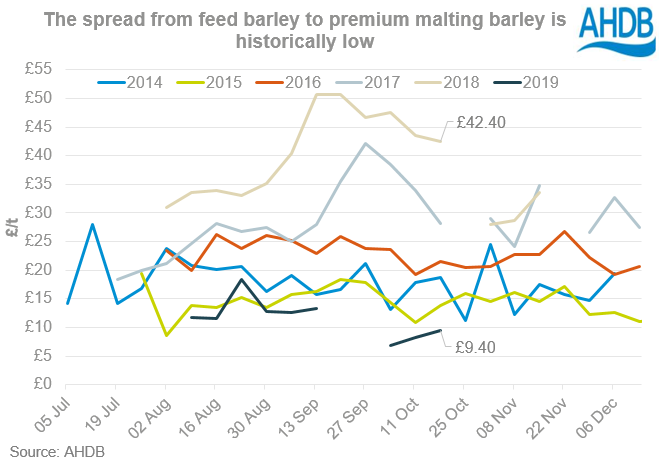

With regards to malting barley decent supply and low nitrogen levels have also pressured prices. The malting premium as at 18 October was just £9.40/t over feed barley, the lowest for this point in the season since 2013. That is a difference of £33.00/t compared to this time last year when the barley crop was much smaller and lower quality.

Brexit uncertainty has less effect on bean exports as beans primarily move outside of the EU. Egypt is generally the largest taker of UK beans with 57% of bean exports heading there last season. PGRO have estimated the 2019 UK bean crop to be 650Kt. Based on the yield data in the latest John Nix pocketbook and the Defra area data this would be up 64% from last year.

The planted area for harvest 2019 was reduced from 2018, partially related to seed availability, but the increase in yields has massively outweighed this. Seed quality is under question again this season with potential for derogations, which may have an effect on seed availability and therefore subsequent plantings.

Throughout August and September the Defra price series for beans shows that GB field bean prices sat closely in line with those seen in 2014. However, the 2014 crop was significantly lower than this year and therefore the high supply could pressure prices. 2016 harvest produced a similar sized crop to 2019 and the August and September prices were £50.67/t and £38.58/t higher than 2016 respectively.

Looking ahead to 2020/21

The 2019/20 season looks to be under continued pressure. Barley in particular will need to remain export competitive, potentially into non-EU destinations as a no-deal Brexit remains a possibility. The potential for a large carry-out is very real and a move to spring barley for 2020/21 could add further pressure to the market.

This will need to be considered when choosing what move to make. Maximising yields but limiting inputs and leaving market options flexible might be the best way to achieve good gross margins. It will be important to know the cost of production in order to understand the price necessary to breakeven or make a profit.

It is a similar story for beans. With a large 2019 crop, a shift to increased bean production for 2020/21 will also likely pressure prices next season. Therefore if considering an increased acreage of beans it could prove prudent to grow pale hilum, high yielding varieties with as minimal inputs as possible in order to maximise gross margins and market options.

For both crops it may also be worth considering contracts.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.