What is driving rapeseed prices higher? Grain Market Daily

Wednesday, 30 October 2019

Market Commentary

- UK feed wheat futures (May-20) ended yesterday unchanged, closing at £147.50/t, Nov-20 closed yesterday at £153.50/t.

- Yesterday, Egypt’s state grain buyer (GASC) purchased 235Kt of wheat for shipment between 5-15 December. The purchase included French, Ukrainian and Romanian origin wheat, at an average CIF price of $235.51/t.

- UK FoB feed wheat is offered at £147.00/t for November shipment (basis 4,000t vessel), bids are below this value.

- Assuming a milling premium of £18.60/t for milling wheat (East Anglia, November) (AHDB Corn Returns), and similar CIF costs to France ($21.35/t) UK wheat is hypothetically competitive into North Africa, at $234.66/t. There are however barriers to trade including availability of quality wheat for export, moisture levels and logistical constraints.

What is driving rapeseed prices higher?

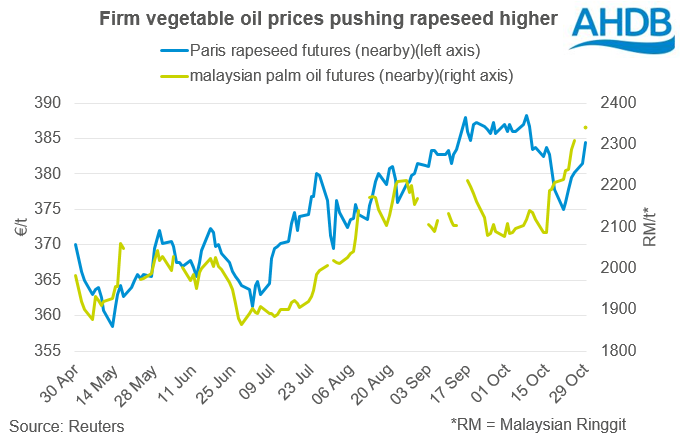

Since last Monday (21 October) Paris rapeseed futures (May-20) have generally followed an upward trend, gaining €5.25/t, to close yesterday at €379.75/t. The recent rise has been driven by support in other vegetable oil markets.

Nearby Malaysian palm oil futures have surged 9% since last Monday. The rise in prices has been driven by heightened activity in the Chinese market, where increased logistics costs have driven demand for domestic supplies.

Paris rapeseed futures have generally been supported this season by the tightness in EU supplies. With supplies of rapeseed tight in the EU, crushers and blenders will have to look elsewhere to fulfil demand. This will increase the relationship between global markets and domestic prices.

So far this season we have seen EU imports of Ukrainian oilseed rape surge. In the 17 weeks to 27 October, EU rapeseed imports stood at 2.57Mt, 1.22Mt ahead of the same time last year. What’s more, imports of soyabeans, soya meal, sunflower seed and sunflower oil are all ahead of last year.

As we move through the remainder of the season, and with Ukrainian rapeseed imports likely to dry up in January, price determination will be increasingly focused on other origins of rapeseed and the wider oilseed complex.

One price relationship to watch closely is that of Canadian canola futures to Paris rapeseed futures. Canola prices have declined in the past few days, as harvests of the crop near completion in Canada and increased farmer selling pressuring prices.

Elsewhere, imports and prices of sunflower and palm oil will be key drivers of vegetable oils going into human consumption markets. Meanwhile, the price of soya, palm and imported biodiesel will continue to drive the biodiesel market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.