Asia imports more beef during H1 2020 despite COVID disruptions

Thursday, 27 August 2020

There has been plenty of coverage in the media of trade talks between the UK and Japanese governments. The UK would like to build on the existing trade deal that it has as a member of the EU. The EU deal includes favourable access for beef to Japan, which has been receiving modest quantities of UK beef so far this year; 1,500 tonnes, worth nearly £5 million.

In total Japan imported 351,000 tonnes of beef* in the first half of 2020, a 4% increase over last year. The United States and Australia typically vie for market share, and each supply around 40-45% of Japan’s import needs. The US has been increasing its volumes and has supplied 151,000 tonnes of beef to Japan so far this year, 9% more than in the same period of 2019.

South Korea is another market unsurprisingly dominated by US and Australian suppliers. In the first half of 2020, there was a 1% drop in beef imports compared with 2019, to 250,000 tonnes. Here again the US has been increasing its market share.

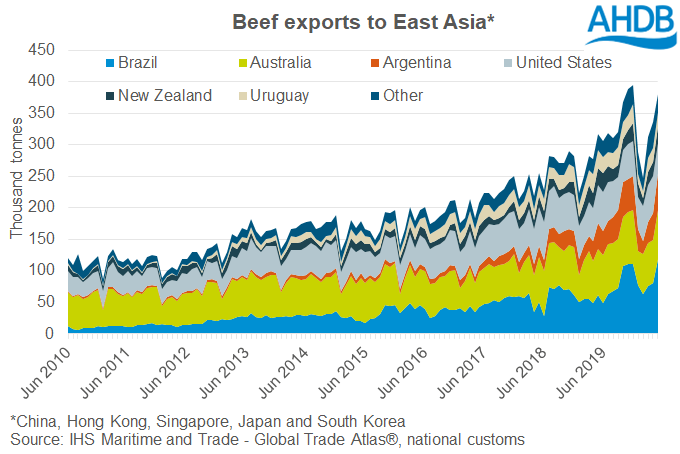

Of course, China dominates imported beef demand in the Asian region. This is driven in the short term by its need for imported protein in the wake of African Swine Fever, but also longer term by growing national per capita income. AHDB is continuing work to develop access to this important market.

In the first half of 2020, Chinese trade data shows imports of over 1 million tonnes of beef, 41% more than a year ago. South American beef has the greatest market share, with Brazil at 35%, Argentina 22% and Uruguay 12%. China’s imports from Brazil, in particular, have grown by 134% year on year to 350,000 tonnes; this trend may well be set to continue as Brazil deals with coronavirus and its huge internal market for beef contracts.

Moving forwards the Asian market is likely to continue to be dominated by the US and South American countries. Recently Australia has been sending a greater share of its exports to the US itself, reducing the quantities going to either Japan and China. As Australia rebuilds its herd following a prolonged period of drought, it is likely that export volumes overall will continue to decline for a while.

*in this article, beef includes fresh/frozen beef, processed beef and offal

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.