ASF in Germany – what happens now?

Thursday, 10 September 2020

By Bethan Wilkins

Earlier today, Germany announced its first confirmed case of African swine fever (ASF), found in a wild boar near the Polish border.

It remains to be seen whether China will follow its usual approach, and place a total ban on all German pork imports. Germany has previously been hopeful that it might be able to achieve a regional agreement with China, whereby unaffected areas could still trade.

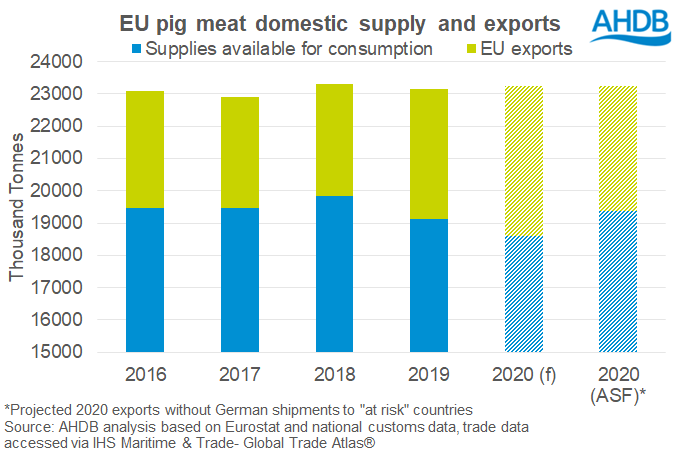

We have previously talked about how the loss of German pork exports to China, and a number of other key markets, could effectively 'trap' a large volume of pork on the EU (+UK) market. Prices would then be expected to come under pressure. However in the past 18 months, the EU has been sending so much pork to China, that even if Germany did lose much of its export market, the volume that would become available for consumption within the EU would not be large by historic standards. This is because this is pork that has been exported instead of being consumed in Europe. It is not 'extra' pork that the EU market would have to absorb, but rather volume that the EU market had been consuming until recently.

EU pig meat production has been lower so far this year, influenced by COVID-19 related disruption, but is expected to be broadly stable in 2020 overall. Ongoing strong demand from China has continued to draw pork from the EU market, and for January-May, exports were up by 16% (+260,000 tonnes carcase weight equivalent). If exports continued with this level of growth throughout 2020, and production increased by 0.5% (EU short-term outlook), supplies available on the EU market in 2020 would fall by 3% (-540,000 tonnes), compared to 2019.

A key part of the EU’s export growth so far this year have been German exports to countries that tend to ban suppliers with ASF. These volumes increased by 54% between January and May, to 270,000 tonnes. If this growth rate was maintained for 2020 overall, volumes would reach 780,000 tonnes.

Looking on an annualised basis, if the 780,000 tonnes earmarked for export in 2020 remained in the EU instead, total EU exports would be below 2019 levels, but still higher than 2018. Supplies on the EU market would be a little higher than 2019 levels (+1%), but still below supplies available in 2015-2018.

This assumes no compensatory behaviour takes place, such as Germany exporting to other non-EU countries, or other EU exporters taking Germany’s market share on the markets it can no longer access. In practice, both of these would likely take place and reduce the volume on the EU market, further reducing potential negative impacts.

Of course this year, the situation is complicated by the COVID-19 pandemic. While the EU has been able to consume this volume of pork in the past, it is unclear if this could be achieved in the current market conditions, which are far from normal. If the German export market is restricted, downward price pressure would always be expected to some extent, to stimulate latent European demand. Current conditions may accentuate the situation.

Further complications may also arise from the practicalities of processing the pork for consumption in the EU. Shipping pork to China is particularly attractive as less processing is required on the products in the EU. This is especially useful at present when EU processing capacity has been challenged by coronavirus regulations and outbreaks, while China has an excess of processing capacity due to its own ASF situation.

For now, we wait to see how China will react to this latest development. UK producers have already seen how disruption on the German market can quickly feed through to lower cull sow prices this year. With the potential for even more significant disruption to the German market now looming, the outlook for finished pigs looks more uncertain than ever.

The ASF in Germany impact report, published earlier this year (pre-coronavirus) can be found here.

Please note the pig meat trade, production and supply volumes in this analysis are all expressed in carcase weight equivalent, and so may differ from numbers reported elsewhere. Offal is not included in carcase weight equivalent volumes.

The UK is not included as part of the EU in the figures above.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.