ASF in Germany- initial market reaction

Thursday, 17 September 2020

By Bethan Wilkins

It has now been a week since Germany first found a case of ASF in a deceased wild boar near the Polish border. How have markets responded so far?

Import bans

So far, the following countries have placed a ban on German pork imports:

- China

- Singapore

- Argentina

- Brazil

- Mexico

- South Korea

- Japan

- South Africa

Most of these countries were included in the “high risk” destinations identified in our previous analysis. Argentina, Brazil and Mexico were not included, but Germany has previously only sent negligible volumes to these destinations.

German pork was also already banned from the Philippines because of ASF fears in mid-2019.

Price reaction

Pig prices in Germany fell sharply in response to the outbreak of ASF. AMI quoted the VEZG Association price as €1.27/kg for the week ended 23 September, the same as last week but 14% down on the €1.47/kg quoted for the week ended 2 September.

The loss of most export markets outside of the EU presents significant challenges with carcase balance, particularly for offal products. Staffing levels also remain a difficulty in German processing plants.

Reports indicate that prices in Belgium, Denmark and the Netherlands have also experienced some downward pressure, though not to the same extent as in Germany. Low priced pork from Germany is undercutting other suppliers within Europe, though the extent to which processors will be willing to buy this pork remains to be seen.

On the other hand, processors with access to China now face the prospect of reduced competition on this market, which may prove price supportive. As a large exporter, Spain particularly stands to benefit, though freezing capacity may limit the volumes that can be traded.

National developments

The original wild boar carcase was found in Brandenburg state, which is in the eastern part Germany, surrounding Berlin. Six more infected wild boar have also been found close to the original location this week.

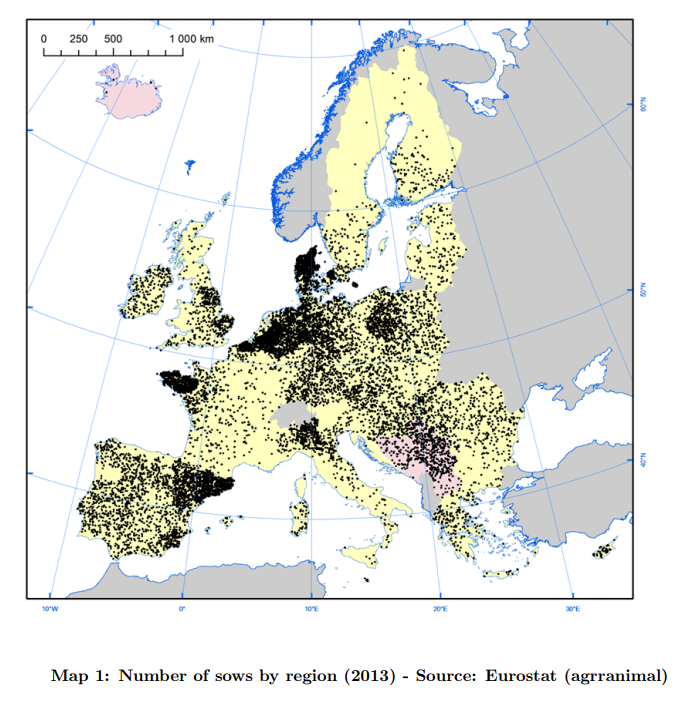

Bradenburg is not the most pig-dense part of Germany, containing about 2% of the overall national herd in 2016 (150,000 head) and about 4% of the breeding herd (45,000 head), according to Eurostat figures.

AMI report that slaughter in eastern Germany totals about 7 million head annually, whereas overall German pig slaughter is in excess of 55 million head. Reportedly, 1.2 million pigs were slaughtered in Bradenburg last year, with Vion operating a large plant in Perleberg. This plant is still about 300km from the location of the infected wild boar carcases though. The only other large plant in Eastern Germany is a Tonnies plant in Weißenfels, which is also nearly 300km away. This plant reportedly slaughters 4.6 million pigs annually.

Interim protective measures are currently in place in the area surrounding the boar carcases, before the formal regionalisation is confirmed. However, as the EU does take a regional approach to ASF-related trade restrictions, and so far, it seems there are relatively few farms near to the outbreak, the number of farms directly affected by restrictions may be low too. Of course, this depends on if, and where, other cases are found. Nonetheless, at present it looks like pig supplies will remain similar, though trade in this pig meat will largely be limited to within the EU.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.