Are UK grain imports slowing? Grain market daily

Thursday, 17 April 2025

Market commentary

- UK feed wheat futures (May-25) closed at £170.15/t yesterday, up £0.60/t from Tuesday’s close. The Nov-25 contract gained £0.65/t over the same period, to close at £186.00/t.

- Domestic wheat tracked movement in US grain markets yesterday. Chicago wheat (May-25) gained 1% yesterday. This was on the back of a weaker US dollar, and rain in key cropping regions of the US wheat belt. While rain was well-needed in some areas to boost moisture for winter crops, it also disrupted planting of spring crops (LSEG).

- May-25 Paris rapeseed futures ended yesterday’s session at €541.50/t, down €3.25/t from Tuesday’s session. The new crop contract (Nov-25) gained €1.50/t over the same period, to close at €483.50/t.

- New crop global oilseed prices were generally supported yesterday, as reports suggested that China, the biggest buyer of US soyabeans, would be open to trade negotiations with the US, creating some positive market sentiment.

Are UK grain imports slowing?

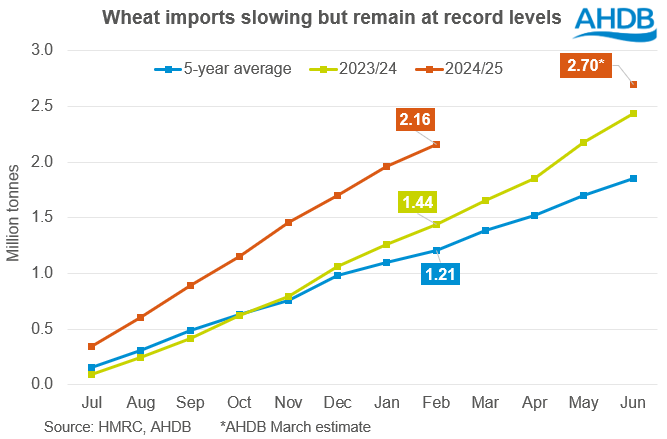

On Friday, the latest UK trade data was published by HMRC, including figures up to the end of February. As has been well reported, shorter domestic grain supplies this season, as well as a strengthening sterling, saw a particularly strong pace of wheat and maize imports for the first half of this marketing year (2024/25). However, as we progress towards the end of the season, and with less competitive imports, are we seeing pace slow in line with expectations?

Wheat imports (incl. durum wheat) totalled 2.16 Mt from July – February, up 50% on the same period last year, and up 78% on the five-year average. However, for the first time this season, monthly imports fell below 200 Kt, at 194.6 Kt in February. This is well below the average monthly pace of 269.7 Kt for this season so far.

In March, AHDB estimated that full-season wheat imports would reach 2.70 Mt. As such, in order to reach this estimate, imports would need to average 135.6 Kt a month for the remainder of the season. With the majority of imports expected to be of milling quality, reports that suggest importers ‘front loaded’ stocks, and the fact that millers are now well supplied, means it is likely we will see pace pull back further, in line with expectations.

Season-to-date (Jul-Feb) maize imports totalled 1.99 Mt, up 12% on year earlier levels, and 19% on the five-year average. In March, AHDB estimated full-season imports would total 2.65 Mt. To reach this figure, the import pace would need to average 165.4 Kt, well below the 260.8 Kt imported in February.

The flow of imports over the next few months will remain a key focus for the domestic supply and demand balance, and will impact how much grain we carry into the new season. Focus now also turns to new crop expectations in the UK, and what this will mean for import requirements in the 2025/26 season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.