Are UK futures representing new crop values? Grain Market Daily

Tuesday, 11 February 2020

Market Commentary

- UK feed wheat futures (May-20) closed flat yesterday, at £154.25/t. A continued weakening of the euro against the dollar has somewhat protected European markets from the further falls seen in global markets.

- Coronavirus has continued to weigh on both grain and oilseed markets, with prospects for a fall in both economic growth and consumption, impacting both global currency exchange rates and potential Chinese import volumes.

- Set for release later today are the February USDA World Agricultural Supply and Demand Estimates and USDA Crop Production data, which while unlikely to factor in potential coronavirus impacts, will provide an updated global supply and demand outlook.

Are UK futures representing new crop values?

With the uncertainty regarding the supply and demand picture for the UK next year, there is a heightened risk for pricing in new crop values.

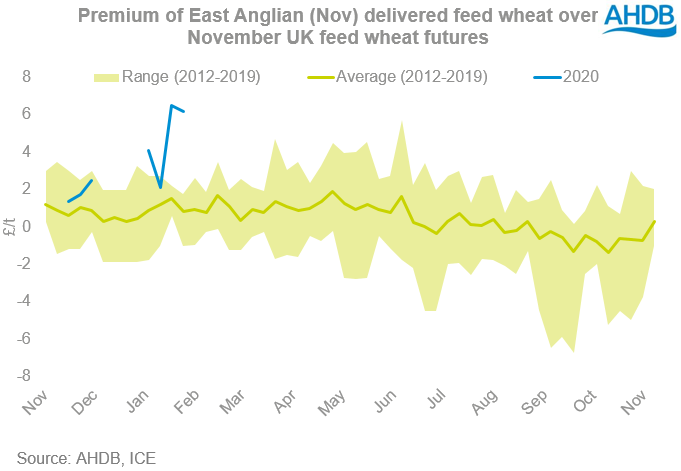

As such, the premium of for new crop delivered feed wheat values above futures has extended to elevated levels across the UK.

At over £6/t, delivered East Anglia new crop feed wheat for November is being quoted at the highest premium over the relevant November UK feed wheat futures since at least 2012.

On a regional basis, the value of delivered feed wheat for Avonrange above that of East Anglia is trading at a traditional minimal premium. Yorkshire and North Humber delivered feed wheat has also been trading at around a minimal £4/t premium to East Anglia, potentially already capped at an import ceiling level.

With delivered premiums across the UK having stretched away from UK feed wheat futures, are UK feed wheat futures truly representing the new crop market?

With the new crop physical market pricing at an elevated level to that of UK feed wheat futures, the physical market suggests a tighter supply and demand outlook than UK feed wheat futures are representing.

With the uncertainty for next season creating a larger risk for trading the new crop, the relationship between your local area and the UK feed wheat futures market will be critical for the effective marketing of grain.

The second release of the Early Bird Survey will be released next week, to provide a clearer picture of how the wet autumn has impacted the potential supply picture for next season with a regional breakdown.

Yet with new crop UK feed wheat futures already at elevated levels relative to Paris milling wheat futures, and a stretched physical market for next season, there may well be a greater downside risk than for potential further gains.

Additionally, while the futures market is not necessarily representing the physical market for next season, there may be less incentive to engage in feed wheat futures. With limited engagement and minimal liquidity, understanding the domestic pricing relationship will be of increased importance. Providing a weekly snapshot for delivered wheat, barley and oilseed rape, the UK delivered survey can provide additional insight into regional supply and demand dynamics and highlight the link between the physical market and the futures market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.