Are regenerative practices improving profitability? Grain market daily

Tuesday, 8 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £188.25/t, up £0.75/t from Friday’s close. The May-25 contract ended the session at £202.75/t, up £1.45/t over the same period.

- Both geopolitical risks and weather risks remain at the start of this week. Concerns about dry weather for winter wheat areas in Russia and US contributed to the rise in wheat prices yesterday. Forecasts of heavy rain in France keep weather risks in focus for winter wheat planting. The combination of increasing wheat price and tenders from importers (Egypt, Saudi Arabia and Japan) are supporting physical prices.

- Nov-24 Paris rapeseed futures closed at €490.50/t yesterday, gaining €3.75/t from Friday’s close. The May-25 contract gained €4.75/t over the same period, ending at €499.25/t, just below the technical price level of €500.00/t.

- The European rapeseed prices gained yesterday in contrast to soyabean prices, which fell. It seems that crude oil prices helped Paris rapeseed futures to rise. The US based WTI crude oil future for Nov-24 increased yesterday +3.7% from Friday’s close.

Are regenerative practices improving profitability?

Key points:

-

As the number of regenerative practices used on farm increased, average yield decreased.

-

Before environmental scheme payments, farms doing the least practices were slightly more profitable on average.

-

Farms carrying out a higher number of regenerative practices have more SFI options available, which if selected carefully, could make them the most profitable group on average.

Regenerative farming practices are increasingly popular within the UK, with the claimed benefits ranging from soil health to improved profits. As outlined in the previous article, systems using more regenerative practices on average had the lowest cost of production, making key cost savings in fertiliser, labour and machinery use. Within this article we will see how this affects production and as such, profitability.

There are 241 harvest 2023 winter wheat enterprises recorded in this analysis, including milling and feed varieties.

Each farm was asked which of fifteen practices they carried out (shown below) and split into the following groups: ‘High’ (9-14 practices), ‘Medium’ (5-8 practices), and ‘Low’ (0-4 practices).

- Composting farmyard manure

- Catch cropping

- Cover cropping

- Maximum 10% cultivation per year

- Minimising fungicides

- Nil insecticide use

- Reducing all synthetic inputs

- Using organic manures

- Multi-variety blends

- Adding livestock into the rotation

- Growing a long and broad rotation

- 90% no tillage

- Reducing all inorganic fertiliser use

- Companion cropping

- Including herbal leys in the rotation

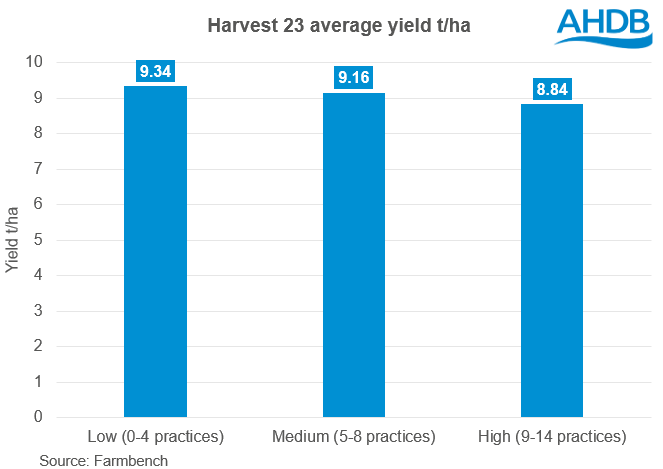

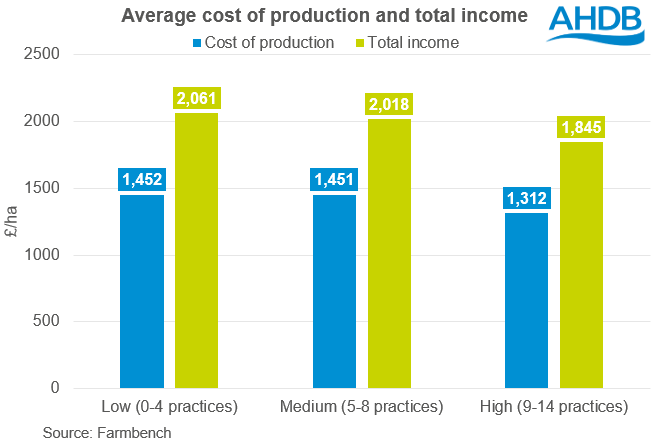

The ‘high’ group’s (9-14 practices) average crop output was £212/ha less than the ‘low’ group (0-4 practices). While this was partly because they sold their wheat for a lower price, it was also due to lower yields. As each group carried out more practices, the average yield dropped, as seen in Figure 1. The ‘low’ group produced on average 9.34t/ha of winter wheat, in comparison to 8.84t/ha in the ‘high’ group.

The data can’t tell us whether the practices used on farm caused the lower yield, or if the ‘high’ group were originally less productive farms. If the latter, this seems to have been an effective way to reduce spend in line with possible productivity of the farm. While the ‘high’ group had the lowest yield, they still had the lowest cost of production per tonne (£148/t). This was £7-10/t lower than the ‘low’ and ‘medium’ groups, respectively.

Despite a low cost of production, the lower income impacted the profitability. The ‘high’ group average profit was £533/ha, compared to £609/ha in the ‘low’ group. Though making £77/ha less profit, the English farms in the ‘high’ group could access further options under the SFI. For example, a farm in the ‘high’ group could boost profit by £118/ha using two 2024 options: no insecticide use and no tillage. In this scenario, this would make the ‘high’ group the most profitable, with the lowest input costs.

On average each group was profitable, though increased use of regenerative practices does seem to have a financial effect. A lower cost of production benefits the system, but with lower average yields there is still pressure on profitability, looking to harvest 2024 and onwards. The Sustainable Farming Incentive offers English farmers a chance to top up these margins and potentially mitigate risk, when selected carefully, as seen in AHDB’s SFI Stacking analysis.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.