Arable Market Report – 28 April 2025

Monday, 28 April 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

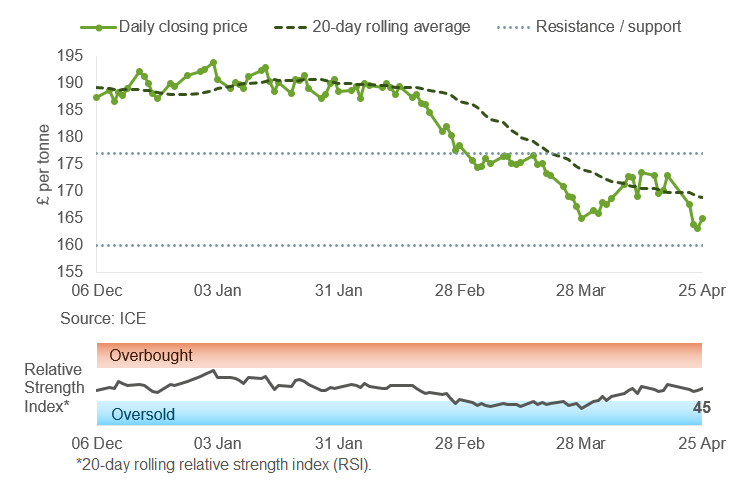

UK feed wheat futures (May-25) fell further last week and moved below the 20-day rolling average. Market momentum remained relatively consistent with last week. Tentatively, there may be some support around £160/t.

Find out more details on the graphs in this report, including how to use them.

Market drivers

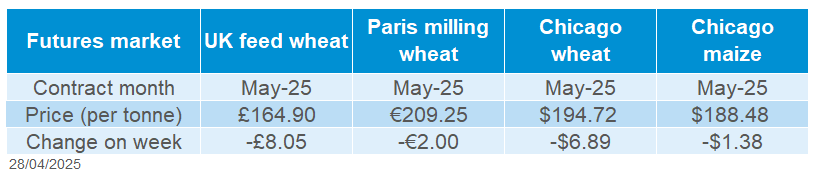

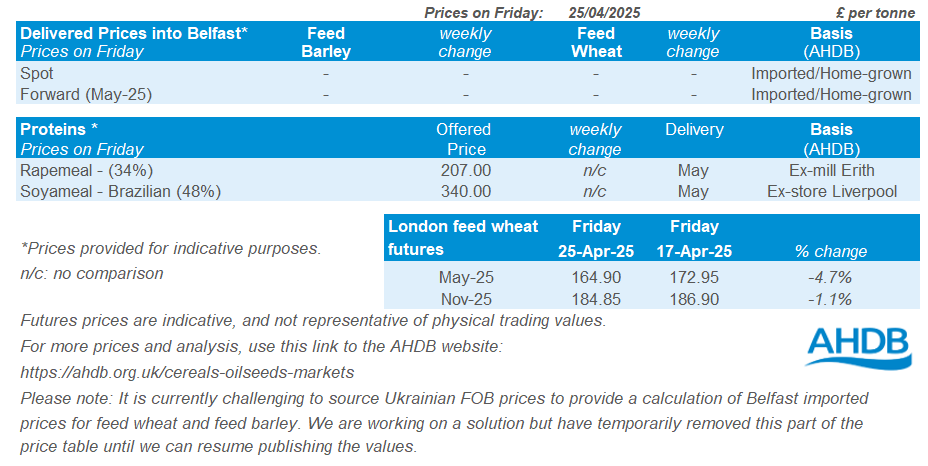

UK feed wheat futures (May-25) fell £8.05/t last week (17–25 April), ending Friday’s session at £164.90/t. The new crop contract (Nov-25) closed at £184.85/t, down £2.05/t over the same period. Domestic prices followed falls in global markets, with Chicago wheat and Paris milling wheat futures (May-25) down 3.4% and 0.9% respectively. The key drivers of this downwards pressure were stable yield forecasts despite concerns over dryness impacting northern hemisphere winter crop development and spring planting progression, currency fluctuations and slow export demand.

On Friday, FranceAgriMer released its latest crop condition scores, rating 74% of the country’s soft wheat crops in good or excellent condition by 21 April. This was down 1 percentage point from a week earlier, though well above 63% at the same point last season. Maize plantings in the country were also progressing ahead of usual pace with the drier weather. However, earlier in the week, the EU commission revised down its EU soft wheat production estimate for 2025, due to the drier conditions and delays to spring plantings in some areas.

Looking ahead, conditions look to remain warm and dry in some key producing regions such as northern France, Germany and Poland (as well as the UK) over the next seven days. This will pose a risk to yield formation in winter crops, and emergence in recently planted spring crops.

Currency fluctuations have also played a key role in grains markets over recent weeks. The euro has continued to strengthen against the US dollar over the last couple of months, and on Friday ended the day at €1 = $1.1364, strengthening 5% on the month. This in turn makes European exports less price competitive and has impacted the EU export pace this season. The resulting lessened requirement on the continent also filters through to curb export demand for UK grain.

UK delivered cereal prices

Domestic delivered feed wheat prices followed futures price movement last week (Wednesday 16 April – Thursday 24 April). Feed wheat delivered into East Anglia for May delivery was quoted at £168.00/t on Thursday, down £6.00/t on the week. Bread wheat delivered into Northamptonshire for the same month, was quoted at £195.50/t, with no weekly comparison available.

Rapeseed

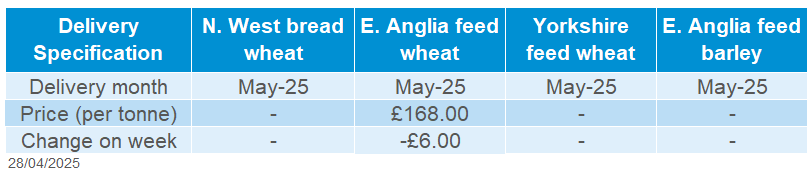

Nov-25 Paris rapeseed futures traded around the 20-day moving average last week, with recent resistance and support levels holding firm. This suggest prices are stabilising and new information is required to break out of this range.

Find out more about the graphs in this report and how to use them here.

Market drivers

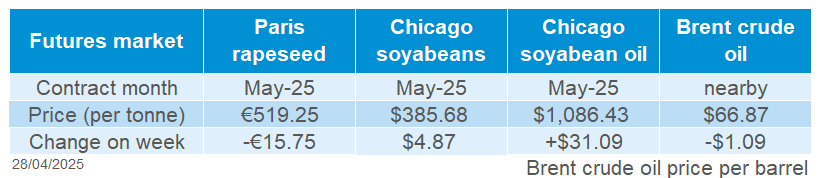

Paris rapeseed futures fell last week after reaching recent highs, as the old crop (May-25) contract dropped €15.75/t (Thursday–Friday), finishing at €519.25/t. The new crop (Nov-25) contract saw a smaller decline, down €5.25/t to €474.25/t. This narrowed the old crop premium over new crop to €45.00/t. Although the euro stabilized somewhat against the US dollar last week, its stronger value continues to put some pressure on prices.

The greater fall in the May-25 contract is due to limited trading as it approaches expiry on Wednesday (30 April), coupled with growing optimism around this year’s harvest. On Tuesday, the EU’s crop monitoring body, MARS, kept its 2025 yield forecast unchanged, still expected to be around 9% higher on the year.

In its latest monthly report released on Friday, Stratégie Grains slightly raised its estimate for EU rapeseed production in 2025/26 by 30 Kt. This puts production 13.1% above last year. While yields were revised down a little, they are still expected to be 6.7% higher than in 2024.

European rapeseed futures moved in the opposite direction to the wider vegetable oil market last week, which saw gains over the same period. May-25 futures for Winnipeg canola and Chicago soybean oil rose by 4.4% and 2.9% respectively.

In Canada, canola (rapeseed) prices continued to climb due to forecast low stock levels and strong export demand. As the world’s largest producer of rapeseed, Canada is facing tighter supplies this season, combined with high demand, and ongoing trade issues.

Meanwhile, US soybean oil export activity picked up pace. Net export sales for the 2024/25 season rose to 12.4 Kt for the week ending 17 April 2025. That is up 21% from the previous week, although still 44% below the four-week average.

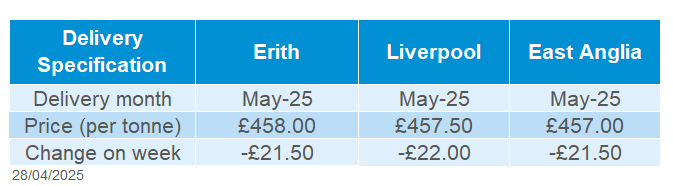

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £458.00/t on Friday, down £21.50/t from the previous week. Delivery to East Anglia in May was quoted at £457.00/t, also falling £21.50/t.

Domestic delivered prices followed the downward movement in Paris rapeseed futures, but losses were made steeper by the stronger pound against the euro, which added extra pressure to UK values.

Extra information

Look out for an update on how UK crops are progressing in our upcoming crop development report due out this Friday.

The summer edition of Arable Focus, your update from AHDB, is now available to download.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.