Arable Market Report – 23 June 2025

Monday, 23 June 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

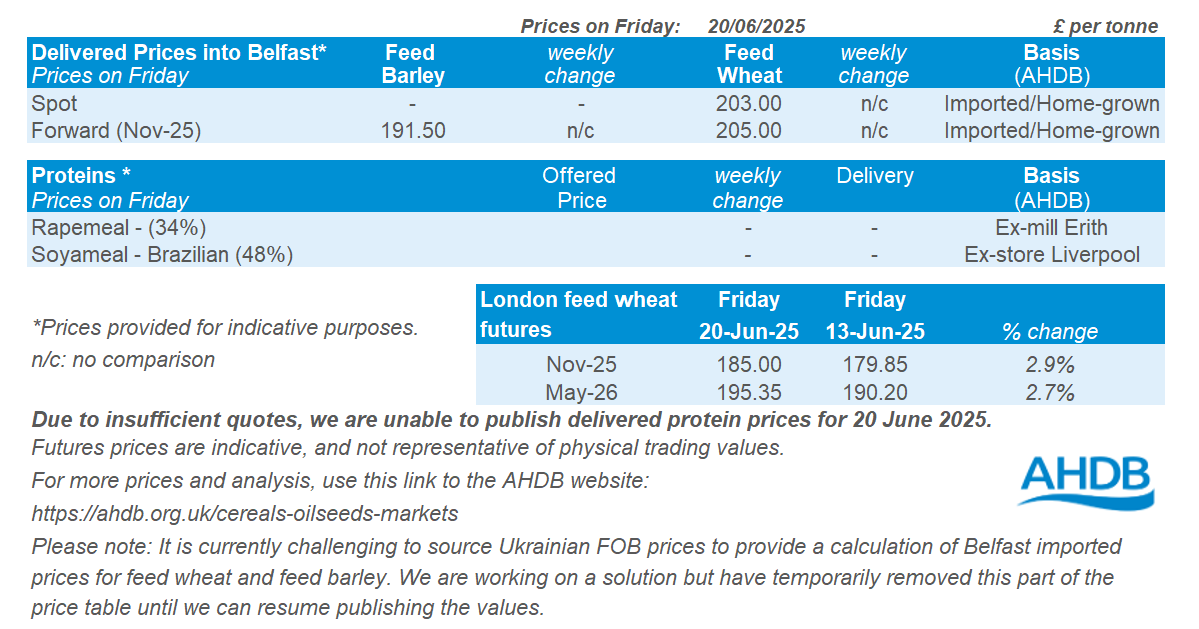

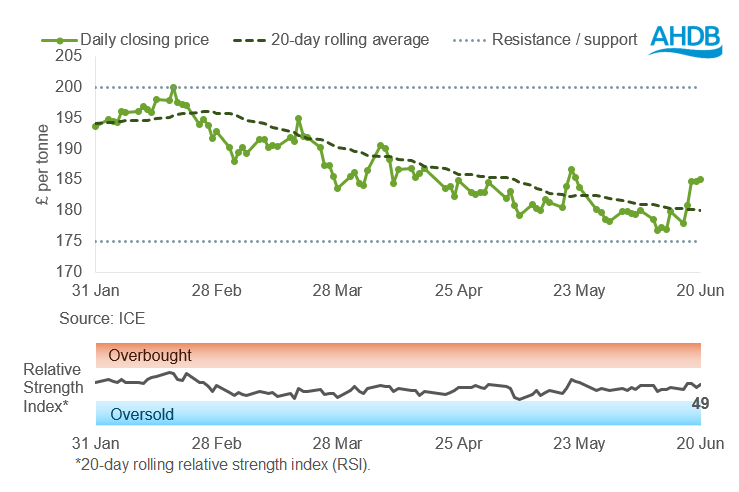

UK feed wheat futures (Nov-25)

UK feed wheat futures increased last week (Friday to Friday), surpassing the 20-day moving average. However, it is too early to comment on a potential change in the downward trend observed since January. The next strong resistance level is £200/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

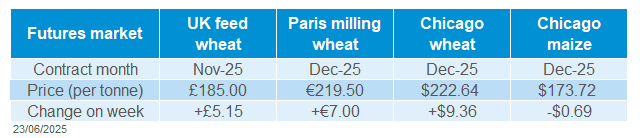

UK feed wheat futures (Nov-25) increased last week (13–20 June), rising by £5.15/t (2.9%), to close at £185.00/t on Friday. Chicago wheat and Paris milling wheat futures (Dec-25) rose by 4.4% and 3.3% respectively. The Bank of England decided not to change the interest rate, and as a result the influence of the currency on UK grain prices was limited last week.

Escalating tensions in the Middle East and rising energy costs could affect global economic growth, leading to unpredictability in grain prices. Grain prices are attempting to determine an appropriate reaction to the current market conditions.

Chicago wheat futures were supported last week by the decrease in US winter wheat crop conditions, the delay in the harvesting campaign in the US, and short covering by managed money funds.

Prices on Paris wheat futures were also buoyed by dry weather in Russian wheat-growing regions. Increased projections for French wheat exports were also a factor, driven by strong late-season sales.

On Friday, FranceAgriMer showed that 68% of French soft wheat crops were in good or excellent condition as of 16 June, down from 70% the previous week. Over the same period, the proportion of spring barley and maize in the same condition decreased by four and two percentage points, respectively.

Germany's wheat crop for 2025 is forecast at 21.51 Mt, up from the 21.01 Mt forecast in May, according to the country's association of farm cooperatives. Crops have benefited from welcome rainfall after a dry spring.

In the short and medium term, the market could become more volatile. Current price levels are reported to be disincentivising farmers across the Northern Hemisphere from selling as the harvesting period gets underway. Furthermore, global weather-related risks persist, particularly with regard to the quality of milling wheat.

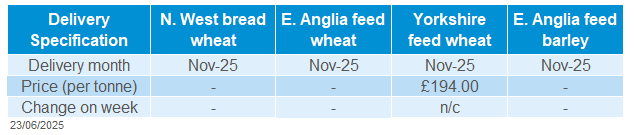

UK delivered cereal prices

Bread wheat delivered into Northamptonshire in July 2025 was quoted at £203.00/t. Feed wheat for delivery to Yorkshire in November 2025 was quoted at £194.00/t, while for July 2025 delivered to Avonmouth, the quote was £179.50/t.

Rapeseed

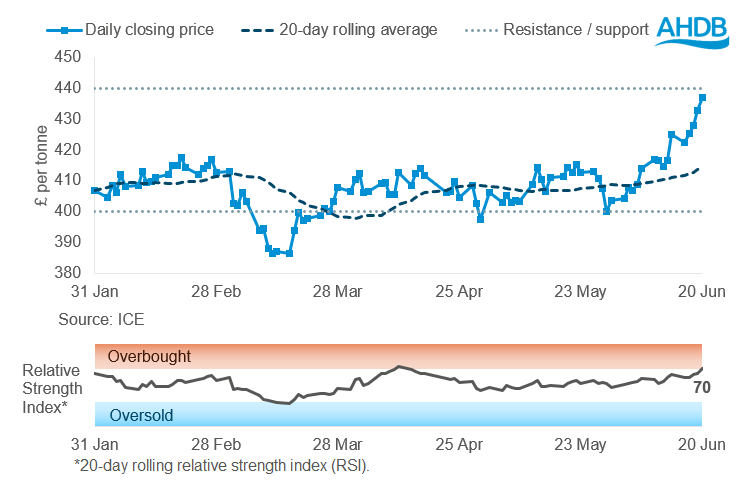

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures (in £/t) were well supported last week, ending the week just below a new resistance level set at £440/t. A new support level is also set at £400/t. The RSI rose again last week (13–20 June) from 63 to 70, now within the overbought zone. This could mean some resistance to further gains and is a signal to watch markets more closely.

Find out more about the graphs in this report and how to use them here.

Market drivers

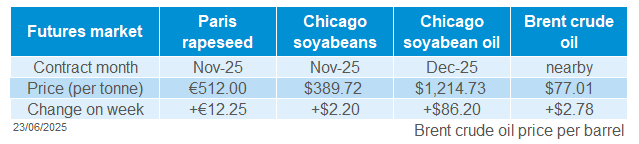

Prices rose across the oilseeds markets last week. Paris rapeseed futures (Nov-25) rose €12.25/t (+2.5%) last week (Friday-Friday), to close at €512.00/t. Chicago soybean oil futures (Dec-25) were up 7.6%, while Winnipeg canola (Nov-25) gained 2.7% on the previous week.

Brent crude oil futures (nearby) closed at $77.01/barrel on Friday, up 3.8% on the week and the highest level since late January, driven by renewed supply concerns, particularly around Iranian exports. The situation has also heightened fears over the security of the Strait of Hormuz, a vital transit route for global oil shipments. Tensions in the Middle East intensified into the weekend as the US intervened militarily in Iran.

Biodiesel demand could rise globally as it has become more price-competitive with conventional diesel due to higher crude oil prices. As a result, rapeseed prices are seeing price support from the broader vegetable oil complex, given its usage for biodiesel production.

The tensions driving up oil prices are having broader implications across agricultural commodities, including the fertiliser and fuel.

Uncertainty surrounds the amount of Canadian rapeseed (canola) planted and what it may yield. Dry conditions continue to be a concern, particularly in the Saskatchewan region. Statistics Canada is set to release its crop area report this Friday (27 June); the last report on farmers’ planting intentions in March showed a 1.7% fall in area on the previous year.

In Europe, the German association of farm cooperatives, DRV, released its June 2025 harvest estimates and put the rapeseed crop at 3.92 Mt. This is up 8.1% on the year, plus an increase of 100 Kt from the previous months report due to beneficial rain after a dry spring.

Looking ahead, ongoing tensions in the Middle East and elevated crude oil prices are likely to keep a level of volatility across the markets. Geopolitical developments will continue to be a key watchpoint for vegetable oil and oilseed market direction in the weeks ahead.

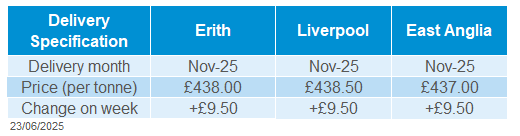

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in November was quoted at £438.00/t up £9.50/t (+2.2%) from the previous week. Liverpool in November was quoted at £438.50/t, also gaining £9.50/t (+2.2%) on the week. Domestic rapeseed followed Paris rapeseed futures.

Extra information

AHDB’s economics team has released an article looking at the recent spending review announced by Defra on 11 June 2025. Read the full article to see what the key changes could mean for farm businesses.

The latest trade data from HMRC shows that wheat and maize imports remained high in April, while the pace of barley exports also picked up slightly. Read more on this in Tuesday’s Grain market daily.

The final AHDB crop report of the growing season, covering crop conditions and development for June, will be released this Friday (27 June).

Norhtern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.