Arable Market Report – 2 February 2026

Monday, 2 February 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (May-26)

Figure 1. UK feed wheat futures prices, May-26 contract

May-26 UK feed wheat futures increased at the end of last week and closed slightly above the 20-day moving average. Despite coming under strong pressure again during the week, the nearest support level of £167/t is still in place. When analysing price trends, a ‘support level’ is seen as a level that it may be harder for prices to fall below.

The relative strength index (RSI) increased from 32 on 23 January to 43 on Friday, moving away from the oversold zone. The RSI currently does not indicate any potential price momentum.

Find out more about the graphs in this report and how to use them

Market drivers

May-26 UK feed wheat futures price increased by £1.05/t (0.6%) last week (23–30 January), following global market trends, to reach £168.45/t. Over the same period, Chicago wheat and Paris milling wheat futures (May-26) increased by 1.3% and 0.9%, respectively. Although domestic feed wheat futures were supported by global wheat futures, strong sterling limited the increases. On 27 January, sterling reached £1 = $1.3846, its highest level against the US dollar since September 2021 (LSEG). However, sterling eased at the end of the week.

The global wheat market was mainly supported by weather risks for winter crops in the USA and Ukraine. Recent weather in Ukraine has been extremely cold, and some regions have experienced low levels of snow cover or ice crusts on the snow, which could affect winter crop conditions.

Competition between the main wheat exporters (the USA, Canada, Argentina, the EU, Australia and the Black Sea region) remains strong, and the influence of currencies is once again apparent. The stronger euro against the US dollar, which reached its highest level since June 2021 on Tuesday, will make EU wheat less competitive than that of other exporters.

The EU Commission's monthly forecast increased EU common wheat ending stocks by 1.3 Mt to 13.0 Mt for the 2025/26 season, compared to December's figures. This is primarily due to a reduction in common wheat exports, which are now estimated at 29.5 Mt, down from 31.0 Mt.

SovEcon, an agricultural consultancy, updated its forecast for Russian wheat exports in the 2025/26 season, increasing it by 1.1 Mt to 45.7 Mt, due to the strong pace of shipments and higher-than-expected crop figures. SovEcon also set its initial forecast for wheat exports in the 2026/27 season at 39.6 Mt.

In the short term, the pace of maize exports from the USA and the weather in Argentina and Brazil are important factors to consider. More rain is needed to support maize crop development in parts of Argentina after below-normal rainfall in January.

Table 1. Global grain futures prices

| Futures market | UK feed wheat | Paris milling wheat | Chicago wheat | Chicago maize |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | May-26 |

| Price (per tonne) | £168.45 | €193.00 | $200.60 | $171.55 |

| Change on week | +£1.05 | +€1.75 | +$2.57 | -$0.89 |

UK delivered cereal prices

Feed wheat delivered to East Anglia in February was quoted at £168.50/t, which is £2.00/t lower than the previous week.

Meanwhile, the price of bread wheat for delivery in February to the North West and Northamptonshire was quoted at £189.50/t and £179.50/t, down by £3.00/t and £2.00/t respectively.

Table 2. UK delivered cereal prices

| Delivery specification | N. West bread wheat | E. Anglia feed wheat | Yorkshire feed wheat | E. Anglia feed barley |

|---|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £189.50 | £168.50 | £178.50 | £155.50 |

| Change on week | -£3.00 | -£2.00 | n/c | -£0.50 |

Rapeseed

Paris rapeseed futures in £/t (May-26)

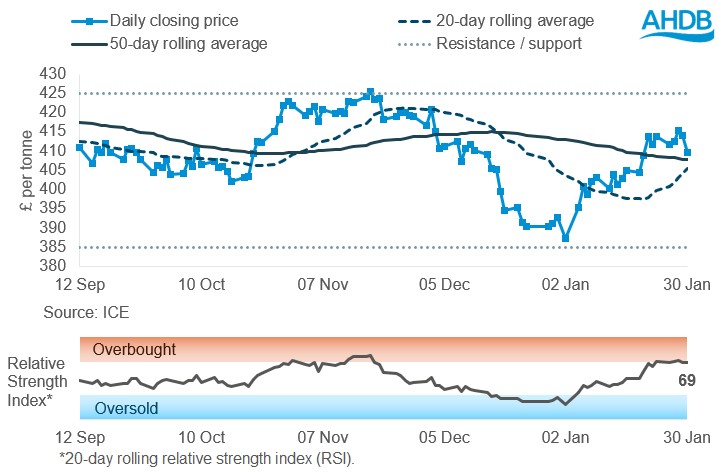

Figure 2. Paris rapeseed futures prices, May-26 contract, in £/tonne

May-26 Paris rapeseed futures in £/t fell 1.1% last week, to £409.50/t, a bigger fall than in euros due to stronger sterling. However, the price held just above the 50-day moving average, which may act as a ‘support line’.

The relative strength index (RSI) remained on the edge of being overbought, moving from 70 to 69 Friday-Friday.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures prices ended last week lower after notable falls at the end of the week. The May-26 contract ended the week 0.8% lower at €472.75/t, while the Nov-26 contract fell 1.2% to €458.75/t.

For most of the week, rapeseed prices were underpinned by higher crude oil prices, concerns about dry weather in Argentina and increased Canadian canola (rapeseed) exports. But the stronger euro, which reached a four and a half year high of US$1.2041 on Tuesday (LSEG), prevented larger gains.

However, the US dollar mostly recovered on Friday after the US President nominated Kevin Warsh to be the next head of the US central bank. This recovery sparked a sell-off in metal, stock and wider commodity markets, which pulled oilseed prices down. The euro ended the week up 0.2% at $1.1850 (LSEG).

Nearby Brent crude oil futures reached a six-month high of $70.71/barrel on Thursday, largely due to concerns over the rising US-Iran tensions. The nearby price eased slightly on Friday to end the week at $70.69/barrel.

The potential impact of dry weather on soyabean crops in Argentina was also in focus. The Rosario Stock Exchange reports that core growing areas received under 35% of normal rainfall in January, with the most advanced crops beginning seed fill. The Buenos Aires Grain Exchange states that more rain is needed to support yield potential.

Reports that China has bought up to 650 Kt of Canadian canola were positive for prices, though doubt about how much can be shipped in this marketing season limited the market. Data due this Friday on Canadian stocks could give more insight into the export challenge.

Expana increased its forecast for the 2026 EU rapeseed crop on Friday by 0.1 Mt to 20.9 Mt, compared to 20.5 Mt in 2025. However, further deep frosts are forecast in Ukraine this week, which poses a risk to any rapeseed crops without adequate snow cover. This keeps uncertainty over the new crop picture.

Table 3. Global oilseed and oil futures prices

| Futures market | Paris rapeseed | Chicago soyabeans | Chicago soyabean oil | Brent crude oil |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | nearby |

| Price (per tonne)* | €472.75 | $395.69 | $1,191.81 | $70.69 |

| Change on week | -€4.00 | -$0.92 | -$10.14 | +$4.81 |

*Brent crude oil price per barrel

UK delivered rapeseed prices

UK delivered rapeseed prices echoed the pattern seen in the Paris rapeseed futures market at the time of the survey on Friday, with higher old crop but lower new crop prices. The price for rapeseed delivered to Erith in Feb-26 was up £2.50/t week-on-week to £431.00/t, while the price for November delivery fell by £2.50/t to £411.00/t.

Table 4. UK delivered rapeseed prices

| Delivery specification | Erith | Liverpool | East Anglia |

|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £431.00 | £431.50 | £430.00 |

| Change on week | +£2.50 | +£3.00 | +£2.50 |

Extra information

On Thursday (29 January), AHDB released the second official forecasts of UK cereals supply and demand in 2025/26. While animal feed demand for total cereals is expected to remain relatively stable compared with 2024/25, human and industrial demand (H&I) is projected to drop off further to a 20-year low. Compared with November’s estimates, total cereal demand by the H&I sectors is expected to fall by 139 Kt to 9.17 Mt, which is 1.315 Mt lower than in 2024/25.

This Thursday (5 February), AHDB will publish statistics on human and industrial usage of cereals, plus the volume of animal feed produced by manufacturers in GB in December 2025. You can sign up to receive an alert when this is published in our Preference Centre.

Northern Ireland

Table 5. Delivered prices into Belfast*

| Delivery specification** | Feed barley - spot | Feed barley - forward | Feed wheat - spot | Feed wheat - forward |

|---|---|---|---|---|

| Delivery month | Spot | May-26 | Spot | May-26 |

| Price (per tonne) | None | None | £199.50 | £200.50 |

| Change on week | None | None | unch | -£1.00 |

*Prices provided for indicative purposes

**Basis is imported/home-grown

n/c: no comparison

unch: no change in price compared to last week

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.