Arable Market Report – 16 September 2024

Monday, 16 September 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

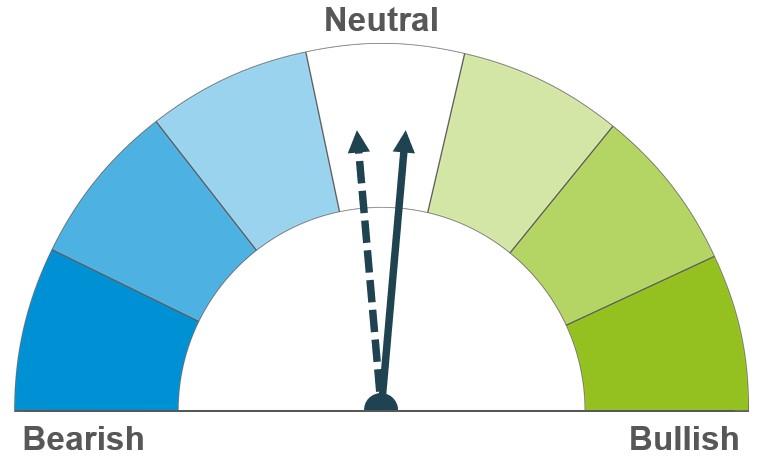

Wheat

Maize

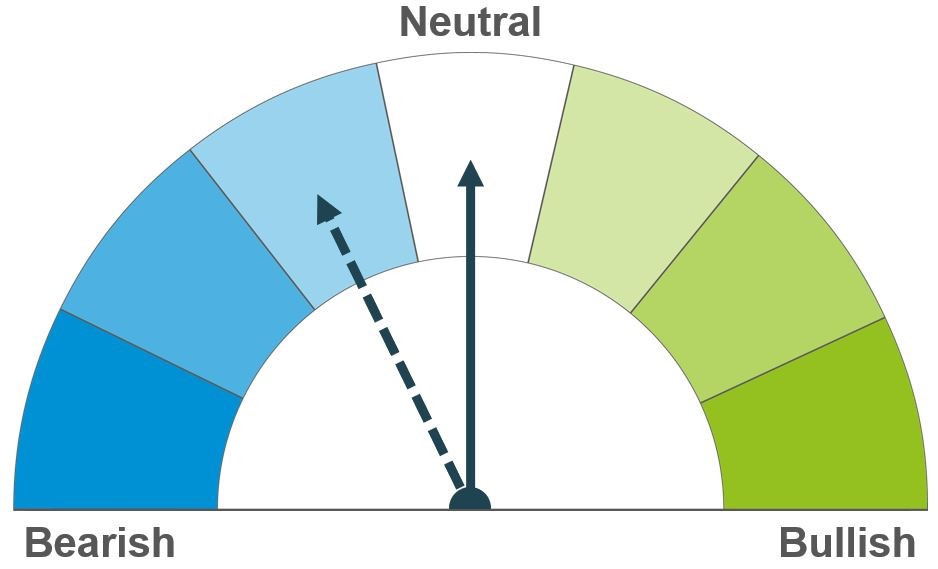

Barley

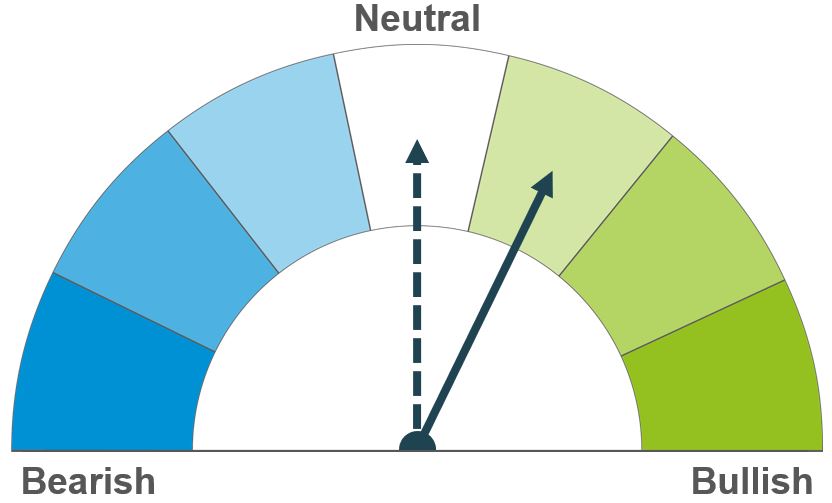

Concerns over production in the EU, coupled with production cuts in Russia and escalating tensions in the Black Sea region, could support prices in the short term. However, higher stock levels and improved production in Australia and Ukraine could help steady prices long term.

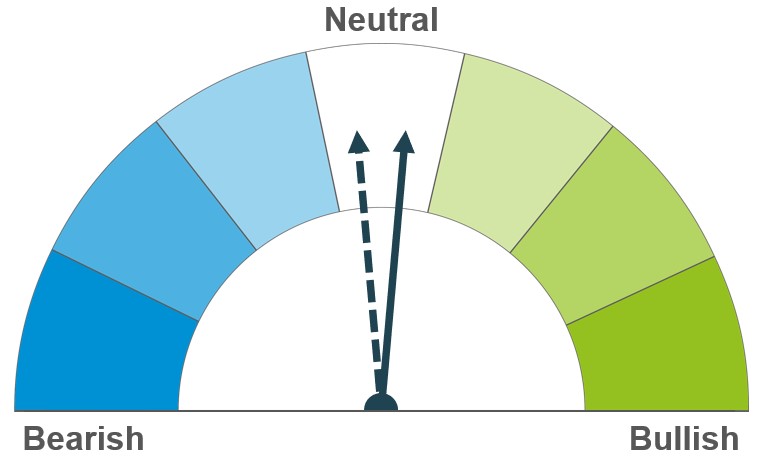

Cuts to global maize production and stock levels could keep the market supported in the short term. Robust production in the US and sluggish global demand will also balance the market longer term.

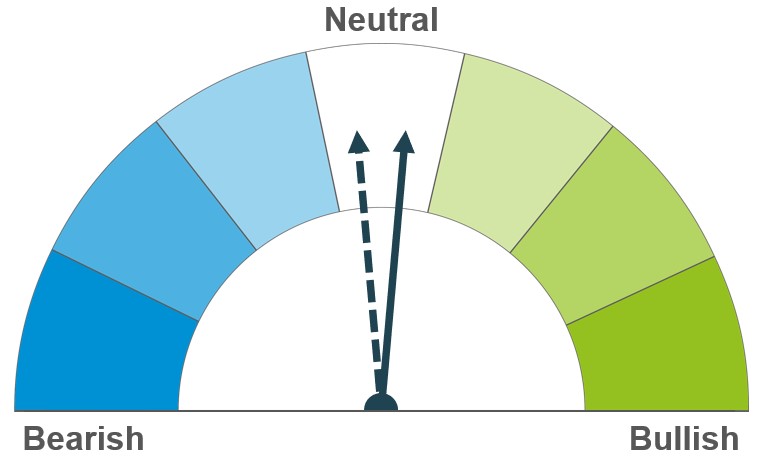

Reduced crop estimates in the EU and Canada are being counterbalanced by higher production estimates in Australia. Although barley will continue to follow trends of the broader cereals market.

Global grain markets

Global grain futures

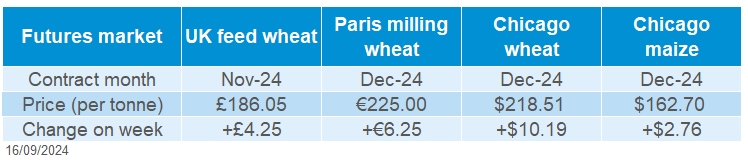

Global grain prices were generally up last week (Friday to Friday). Both Dec-24 Chicago wheat and Paris milling wheat futures increased by 4.89% and 2.86% to close at $218.51/t and €225/t respectively. While Chicago maize futures (Dec-24) rose by $2.76/t to settle at $162.7/t. Support for prices came mainly from adjustments ahead of the USDA’s WASDE report released on Thursday, along with reports of a tighter-than-expected supply from the Black Sea region due to the escalating tensions and production cuts.

In its September WASDE report, the USDA trimmed global wheat production for 2024/25, primarily due to a significant drop in the EU. However, global wheat supply, consumption, trade, and ending stocks are predicted to rise. The increase in global wheat stock is driven by higher Canadian stocks from 2023/24, with larger crops in Australia and Ukraine, which more than compensated for the 4.0 Mt reduction in EU wheat production. This however contrasts with a Reuters industry poll that expected the USDA to reduce global wheat stocks.

Earlier in the week, agricultural consultancy, IKAR cut its forecast for the Russian wheat crop to 82.2 Mt from 83.8 Mt, citing adverse weather conditions. The company also reduced Russia’s wheat exports to 44.0 Mt from 44.5 Mt, with the total grain export forecast lowered from 55 Mt to 53 Mt.

Stratégie Grains reduced its estimates for the EU-27 wheat and maize crop by 2.1 Mt each, to 114.4 Mt and 57.9 Mt, respectively. The company cited very wet weather in France and Germany for the reduction in wheat crop, making it the smallest in 12 years. On the other hand, the cut in the maize crop estimate was due to dry conditions in key growing regions. The barley crop estimate was also trimmed 0.1 Mt to 50.5 Mt.

On Thursday, an Egypt bound Ukrainian grain vessel was hit by a Russian missile in Black Sea waters near Romania, escalating the geopolitical tension between the two countries. The reports of the attack increased market uncertainty due to the importance of Black Sea exports for global supplies.

Global demand for wheat continues to strengthen, with more exports and international tenders last week. The Jordan state grain buyer issued an international tender to purchase 120 Kt wheat. While Egypt's state grains buyer, GASC purchased 430 Kt of Russian wheat for October delivery. The USDA reported export sales of wheat for the 2024-25 marketing year at 475 Kt, close to the upper-end of a range of analyst estimates.

UK focus

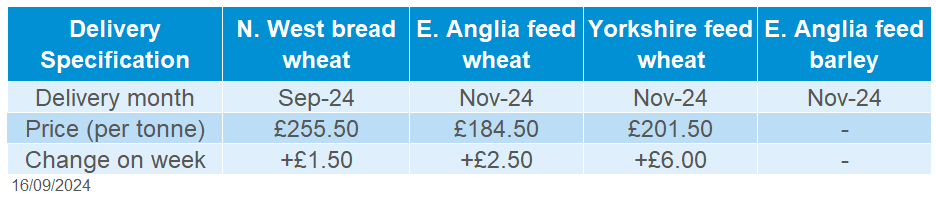

Delivered cereals

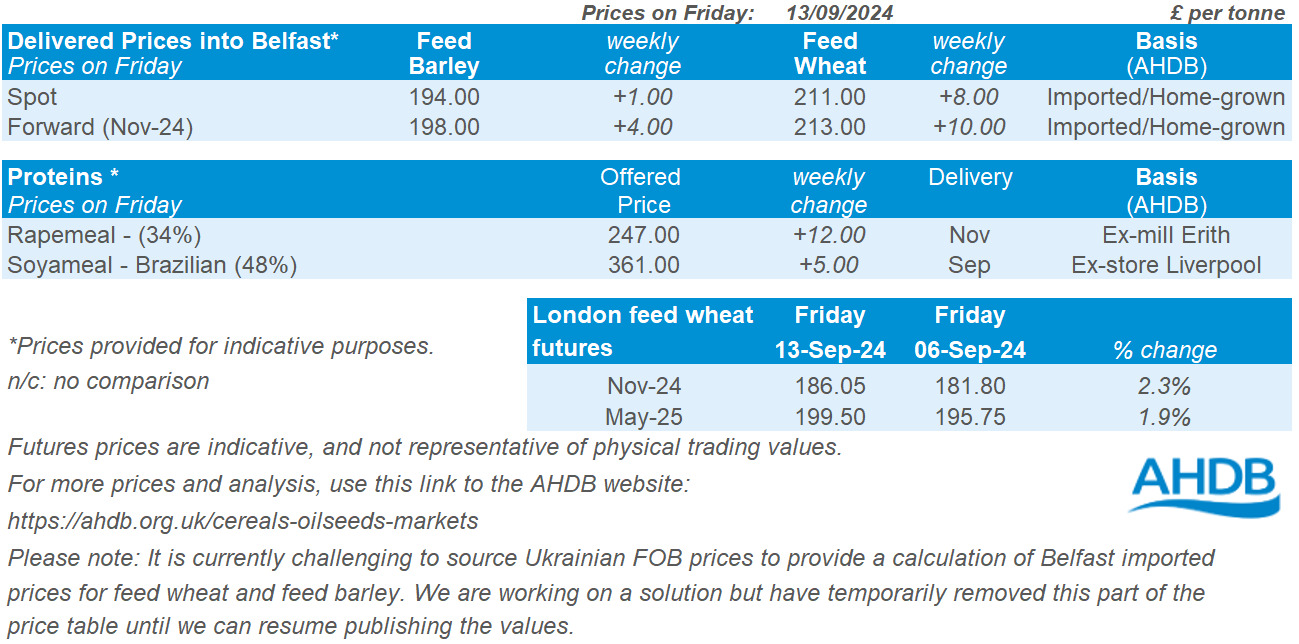

UK feed wheat futures for November 2024 gained £4.25/t over the week (Friday to Friday) to close at £186.05/t, tracking global wheat prices. Similarly, the contract for May 2025 closed at £199.50/t, up £3.75/t over the same period.

Domestic delivered feed wheat prices also followed futures up Thursday to Thursday. Feed wheat delivered into East Anglia for October delivery was quoted at £183.50/t on Thursday, up £2.50/t on the week. October delivery of bread wheat into Yorkshire increased by £1.00/t, quoted at £253.00/t.

The latest AHDB UK trade data, published on Friday, includes import and export figures for cereals and oilseeds, as compiled by HMRC. Wheat and maize imports reached 321 Kt and 280 Kt in July, up 227 Kt and 82 Kt respectively, from the same time last year. While total barley exports stood at 35 Kt in July compared to 82 Kt at the same point last year.

Oilseeds

Rapeseed

Soyabeans

Developments regarding China’s anti-dumping investigation on Canadian rapeseed will continue to influence rapeseed markets. However, the fundamentally tight global balance largely due to lower EU production offers support.

Dryness in key soyabean growing areas is forecast to continue in the short-term and US soyabean sales uphold recently strong pace. Although, the record US soyabean crop estimate continues to support global supply.

Global oilseed markets

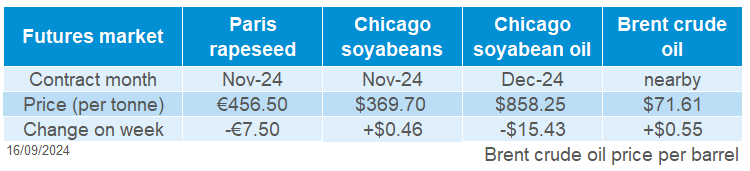

Global oilseed futures

Global oilseed markets tracked sideways last week (Friday – Friday) as Chicago soyabean futures (Nov-24) gained a meagre 0.1% to close at $369.70/t. Pressure in the first half of the week from better-than-expected US soyabean condition scores, was offset by gains made later in the week following the USDA World Agricultural Supply and Demand Estimates (WASDE) and continued strength in US soyabean sales.

Last Tuesday, US soyabeans were scored as 65% in good or excellent condition, unchanged on the week and two percentage points higher than the average analyst estimate. Analysts had anticipated some deterioration in quality due to the on-going dryness over the US Midwest which had pushed the proportion of the US soyabean area in drought up 7 percentage points on the week to 26% (as at 10 September).

On Thursday, the USDA’s WASDE report tweaked US soyabean production for 2024 down marginally, in line with analyst expectations. Globally, soyabean ending stocks for the 2024/25 marketing year were increased marginally by 0.28 Mt to 13.58 Mt, in line with a range of analyst estimates.

The latest net sales of US soyabeans (30 August – 05 September) was near the upper-bound of a range of analyst estimates at 1.47 Mt, of which China accounted for 0.96 Mt. However, to compare, outstanding sales for 2024/25 (13.93 Mt) still remain behind the pace seen at this time of year for the previous four seasons.

Earlier last week, it was reported that soil moisture in two key soyabean growing states in Brazil (Mato Grosso and Parana) dropped to its lowest level in 30 years (EarthDaily Agro). The persisting dryness is expected to continue next week, with some forecasts suggesting that more favourable weather is due towards the end of September in key growing regions. As commented in the latest Conab (Brazil’s Ministry of Agriculture’s Supply Management) report, delayed planting last year was a key factor as to why the country’s most recent soyabean harvest fell short of the record harvest in 2023.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) fell €7.50/t over the week (Friday – Friday) to close at €456.50/t after tracking the wider oilseeds complex earlier in the week. The Nov-24 contract lost €9.75/t on Friday following losses in Winnipeg canola futures (Nov-24) from continued concerns regarding China’s anti-dumping investigation of Canadian rapeseed imports. In addition, India’s government announced on Friday that it has raised the import tax on several vegetable oils (soyabean, sunflower, and palm) in efforts to support its own domestic rapeseed market, casting pressure over the vegetable oils complex.

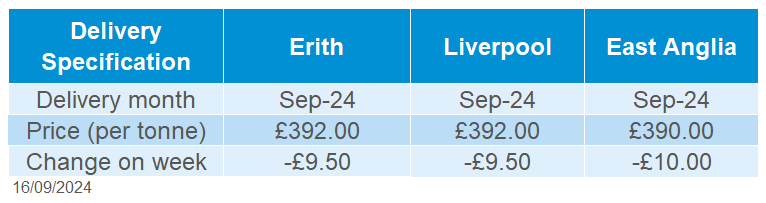

Delivered rapeseed prices followed the trend of global prices. Rapeseed delivered into Erith for September was quoted at £392.00/t on Friday, falling £9.50/t on the week. Meanwhile, delivery for May was quoted at £401.00/t, losing £8.50/t over the same period.

In the WASDE, oilseed production outside of the US for the 2024/25 marketing year was reduced partly due to lower rapeseed production in the EU. The USDA estimated EU rapeseed production at 17.65 Mt, 1.25 Mt less than August’s estimate. This compares with the European Commission’s estimate of 18.0 Mt (29 August) and Stratégie Grains at 16.9 Mt (30 August).

EU demand for Ukrainian rapeseed has been strong recently with imports up last week by 55% in comparison to this time last year at 505 Kt . This has helped to support the value of Ukrainian rapeseed which has also been supported by its smaller 2024 rapeseed crop and expectations of a smaller 2025 crop too (UkrAgroConsult). Planting for the 2025 crop is underway and was reported 48% complete (as at 09 September), however drought in the region is causing concerns regarding the 2025 crop.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.