Missile strike underpins wheat markets: Grain market daily

Friday, 13 September 2024

Market commentary

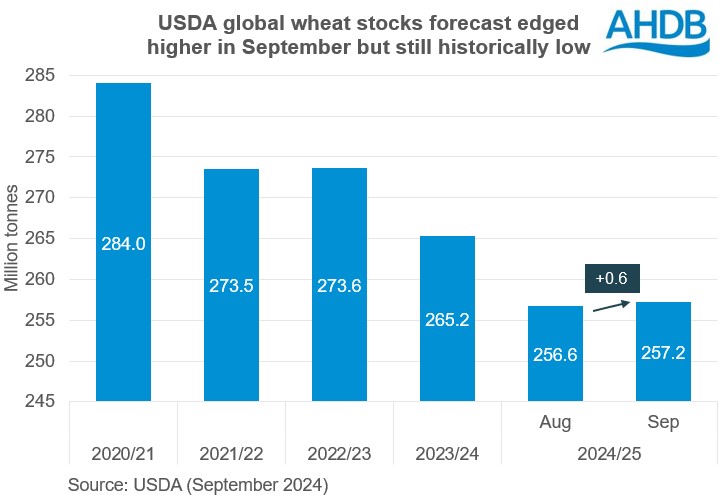

- Wheat markets edged lower yesterday after the USDA unexpectedly raised its projection for global wheat stocks. However, the falls were limited by worries about Black Sea supplies (more below). Nov-24 UK feed wheat futures closed ended trading yesterday at £184.30/t, down £0.50/t.

- In contrast, Chicago maize futures edged up despite the USDA unexpectedly increasing its estimate for the US maize yield. The support came from technical moves and potentially the USDA forecasting stronger global demand for maize.

- Paris rapeseed futures also recorded small gains yesterday, with the Nov-24 contract up €0.50/t to €466.25/t. This followed small gains in soyabean futures linked to buying by speculative traders. Yesterday’s USDA report contained only minor adjustments for soyabeans.

- AHDB’s latest harvest report shows progress has slowed down over the past two weeks. Rain and humid conditions have led to stop-start progress. In Scotland, progress centred on spring barley, with growers looking to preserve quality. The Scottish spring barley harvest was 50% complete by 11 September.

Missile strike underpins wheat markets

A Russian missile strike against a ship carrying Ukrainian wheat underpinned global wheat markets yesterday. The damaged ship is reported to be a civilian ship which was near Romania and bound for Egypt (Refinitiv). This escalation is adding to uncertainty in markets given the importance of exports through the Black Sea to global supplies.

Wheat futures markets traded higher through much of yesterday, supported first by wider supply concerns and then the news of the missile strike. In recent days there’s been more uncertainty over Russian and Ukrainian crop sizes, and so export potential.

In addition, yesterday Strategie Grains cut its estimate for EU-27 wheat crop by 2.1 Mt to 114.4 Mt. The cut follows the very wet weather in France and Germany and the crop is now the smallest crop in 12 years. The company also cut 2.1 Mt from the maize crop to 57.9 Mt, making it the third lowest in a decade, after hot, dry weather in key growing regions. It trimmed (-0.1 Mt) the barley crop to 50.5 Mt.

These factors limited the pressure from the latest monthly USDA World Agricultural Supply and Demand Estimates (WASDE).

USDA surprise on wheat stocks

An industry poll, carried out by Reuters before the WASDE’s release, showed that the USDA was expected to cut global and US wheat stocks.

However, the USDA increased its projection for global end of season (2024/25) stocks for wheat by 0.6 Mt to 257.2 Mt. Globally, higher Canadian stocks carried in from 2023/24 plus larger crops for Australia and Ukraine more than offset the 4.0 Mt cut to EU wheat production. The USDA also left its forecast for US wheat stocks at the end of 2024/25 unchanged from last month.

Key global wheat futures prices moved lower after the WASDE’s release and settled below Wednesday’s close, despite trading higher earlier in the day.

The uncertainty over global wheat supplies is back in focus this morning and could help underpin markets in the short term. Markets are trading higher this morning and could record week-on-week gains.

However, as we’ve seen before, time will tell if this support is short-lived or sustained. If tensions ease or we see no further cuts to crop estimates, this support could prove short-lived. Conversely, further support could be found if crop estimates continue to decline or if the conflict escalates further.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.