Arable Market Report – 15 December 2025

Monday, 15 December 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

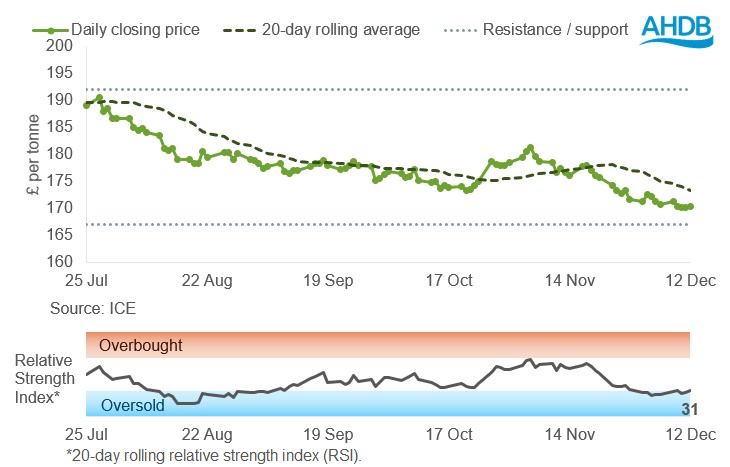

UK feed wheat futures (May-26)

Last week (5–12 December), UK feed wheat futures (May-26) finished below the 20-day average but above the support level of £167/t.

The relative strength index (RSI) increased to 31 from 27 the previous week, indicating a slight easing of oversold conditions.

Find out more about the graphs in this report and how to use them

Market drivers

UK feed wheat futures eased last week, with the May-26 contract closing at £170.30/t on Friday, down £0.40/t (0.2%) across the week. The decline reflected ongoing pressure across global wheat markets, with abundant supplies and strong competition weighing on prices.

Chicago wheat futures (May-26) fell 1.1%, while Paris milling wheat futures (May-26) were unchanged, despite other old and new crop contracts being pressured.

The USDA’s December World Agricultural Supply and Demand Estimates report raised the 2025/26 global wheat crop forecast to 837.8 Mt. This is up 8.9 Mt from last month, driven by larger expected harvests in Argentina, Australia, Canada, Russia and the European Union.

Global wheat stocks were also lifted to 274.9 Mt, the highest since 2021/22, adding further pressure to prices.

In South America, the Rosario Grains Exchange has raised Argentina’s 2025/26 wheat crop estimate to a record 27.7 Mt, up from 24.5 Mt, following favourable weather, with harvest now around 58% complete.

The Argentine government has also cut export taxes on wheat, barley and soyabeans, which could increase its competitiveness. Argentina remains one of the cheapest sources of wheat on the global market.

In Brazil, Conab estimates the 2025/26 maize crop at 138.88 Mt (USDA: 131.0 Mt), slightly above November’s forecast of 138.84 Mt.

The Grain Industry Association of Western Australia (GIWA) estimates Western Australia wheat at 13.0 Mt, slightly down from 13.1 Mt previously but up 4% on 2024/25.

Coceral forecasts EU-27 + UK wheat production for 2026 at 143.9 Mt, down from 147.5 Mt this year, with barley down to 58.2 Mt and maize up slightly to 58.9 Mt.

On the demand side, several importers, including Jordan, Tunisia, Thailand and South Korea, were active last week, taking advantage of lower prices with multiple tenders for feed wheat and barley.

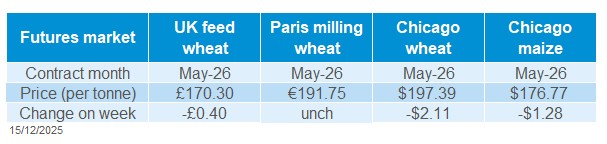

UK delivered cereal prices

Domestic delivered wheat prices were mixed last week, with UK feed wheat futures falling from Thursday to Thursday.

Feed wheat delivered into East Anglia for December was quoted at £170.00/t, up £1.50/t on the week. By contrast, bread wheat for December delivery into Northamptonshire was down £1.00/t, at £181.00/t.

In the Northwest, December-delivered bread wheat was quoted at £191.00/t, with no week-on-week comparison available.

Rapeseed

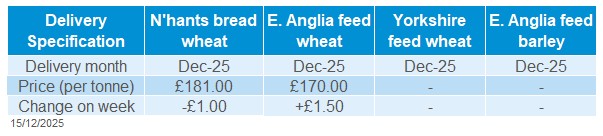

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased last week (05 – 12 December) and closed again below the 20-day moving average, but higher than the nearest support level of £400/t.

The RSI fell from 37 to 36, signalling weaker momentum as it moved closer to the oversold zone.

Find out more about the graphs in this report and how to use them

Market drivers

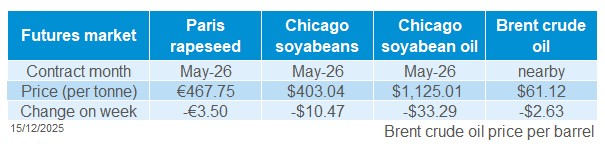

Paris rapeseed futures (May‑26) fell by €3.50/t (0.7%) across the week to close at €467.75/t on Friday. The price of new crop rapeseed futures Aug-26 also fell during the week, closing at €453.50/t, €14.25/t lower than the old crop futures (May-26).

The global oilseed complex came under pressure last week due to China's lower-than-expected import of US soyabeans and the approaching new crop soyabean harvest in Brazil. Chicago soyabean and Winnipeg canola futures (May-26) fell by 2.5% (reaching the lowest level since late October 2025) and 2.0%, respectively.

Last Wednesday, Germany’s cabinet approved a draft biofuels law that will permit the continued use of food and animal feed as biofuel ingredients, this is despite the previous government having planned to phase this out.

It’s proposed the use of food and feed ingredients will continue at current permitted levels, which will aid demand for rape oil.

Conab trimmed its 2025/26 Brazilian soyabean forecast by 550 Kt to 177.12 Mt, which is still a record crop. It’s estimated that 90% of the crop had been sown by early December, in line with normal progress.

Widespread rains are forecast over Mato Grosso this week with mean temperatures slightly cooler than averages.

Nearby Brent crude oil futures were pressured by 4% last week, amid expectations of a global surplus.

The International Energy Agency reaffirmed its forecast for a record supply glut, though slightly lower than last month’s estimate, and noted that global inventories have climbed to a four-year high in October.

The USDA World Agricultural Supply and Demand Estimates (WASDE) report showed last Tuesday that global rapeseed production increased by 3.0Mt, with rises in Canadian, Australian and Russian output.

However, higher rapeseed production is partly offset by lower global sunflower seed production, which is down by 2.5 Mt due to harvest results in Ukraine and Russia.

UK delivered rapeseed prices

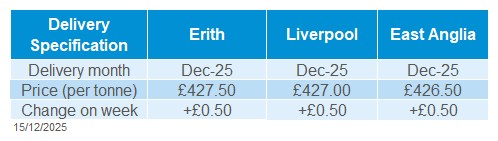

UK delivered rapeseed prices for the 2025 crop increased, while prices for the new 2026 crop remained unchanged.

December delivery into Erith was quoted at £427.50/t, up £0.50/t from the previous week, while Harvest-26 was quoted at a £22.00/t discount at £405.50/t, unchanged week-on-week.

Prices for December delivery into Liverpool and East Anglia increased by £0.50/t to £427.00/t and £426.50/t, respectively, compared to the previous week.

These values are based on a survey conducted mid to late Friday morning and may not fully capture movements in Paris futures by the close of trading.

Extra information

On Thursday (11 Dec), Defra released its final estimates for 2025 UK cereal and oilseed production. As expected, the adverse conditions in the spring and summer, have led to yields coming in lower on the year for most crops in the UK.

The shining light from harvest 2025, was oilseed rape (OSR), with OSR yields climbing 30% on the year to 3.7 t/ha. Read more on this in our Analyst insight.

The latest trade data from HMRC, published on Friday, shows wheat (including durum) imports from July to October reached 894.2 Kt, down 23% on the same period last year.

Maize imports fell 22% to 687.2 Kt, while barley exports declined 2% to 126.4 Kt over the same period.

The final results of the AHDB Early Bird Survey (EBS) will be released in the coming days. So, watch out for that to get a clearer picture of what intentions could be for harvest 2026.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.