Arable Market Report - 12 September 2022

Monday, 12 September 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

In the short-term, wheat markets are volatile, responding to news from Ukraine and filtering support from maize markets. Concerns around global grain supplies continue to support markets in the longer-term.

Maize

Maize markets feel support as output from the US and EU is lowered, impacting on supply outlook. Longer term, weather is a key factor as maize harvest accelerates across the Northern Hemisphere.

Barley

Markets are following the wider grains complex, with supply outlooks remaining tight.

Global grain markets

Global grain futures

Global grain markets remained supported last week following Putin’s comments over the unfairness of the grain corridor for poorer countries, raising concerns over the corridor’s future. Furthermore, wheat and maize rallied higher towards the end of the week on technical buying. Also, according to a Reuters poll it’s anticipated that the USDA will revise its production forecasts for US maize down in this evenings World Agricultural Supply and Demand Estimates (WASDE) report, which could tighten global ending stocks.

Russian agricultural consultancy IKAR raised its 2022 wheat production estimate to 97Mt. Russian exports are also expected to increase by 0.75Mt in September compared to last month, totalling 4.95Mt. Despite this large Russian crop bearing on the market, supply and demand remains tight.

The Australian government’s (ABARES) crop report released on Tuesday (06 Sept) stated that wheat production is expected to be the second highest on record (32.2Mt), whilst total winter crop and barley production will both be the fourth highest on record at 55Mt and 12.3Mt, respectively.

Meanwhile, the Canadian stocks of principal field crops report released on Wednesday (07 Sept), indicated total wheat stocks were just 3.7Mt as of July 31st, a reduction of 38.3% on the previous year. This is the result of much lower production due to drought in 2021. Canadian production and exports are expected to increase for 2022/23 marketing year.

UK focus

Delivered cereals

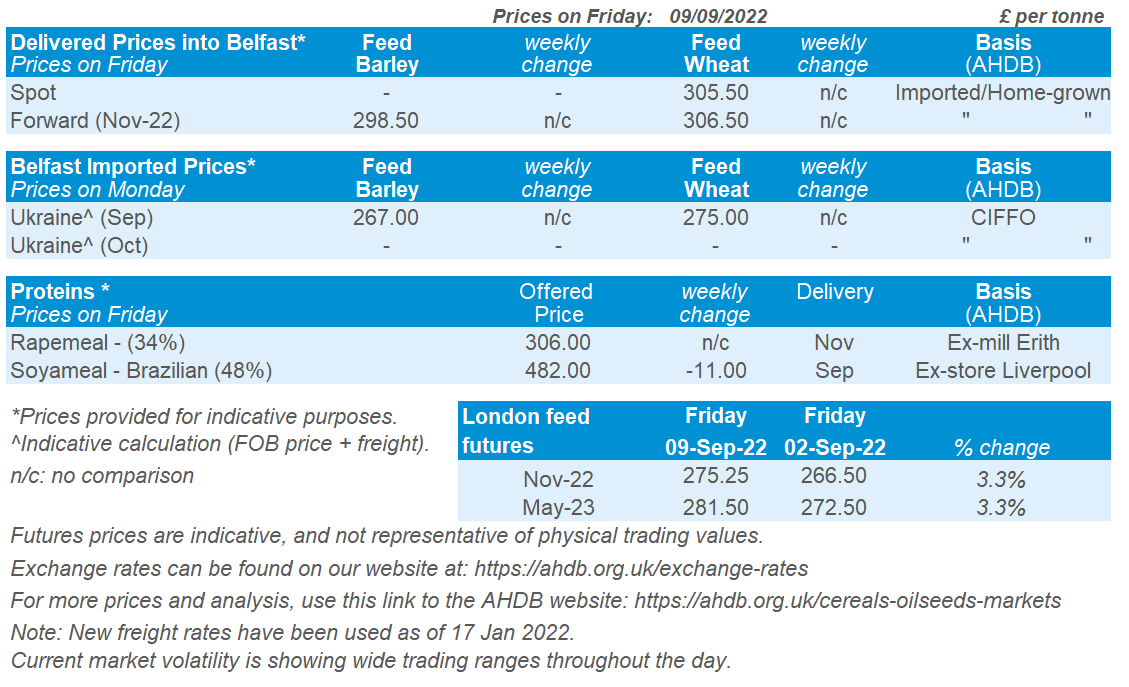

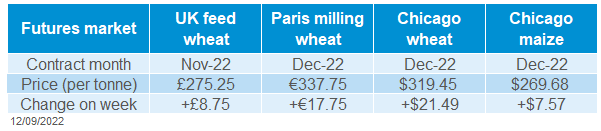

Across the week, UK feed wheat futures (Nov-22) rose £8.75/t, closing at £275.25 after a rally on Friday. The Nov-23 contract closed at £264.75/t, gaining £7.75/t Friday-Friday.

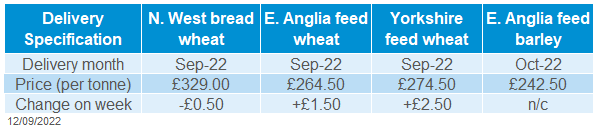

East Anglia delivered feed wheat prices for September delivery were quoted at £264.50/t on Thursday, up £1.50/t on the week. This price increase mirrors UK feed wheat futures movements (Thursday-Thursday).

Bread wheat delivered into London/Essex for October was quoted at £309.50/t, up £0.50/t Thursday-Thursday.

Sterling remains weak against the dollar at £1=$1.1587. This follows surging inflation and a looming recession. UK exports remain cheap and imports expensive as a result, an issue for UK margins due to our reliance on imported nitrogen products. Read more about this in Wednesday’s grain market daily article.

The sixth and final harvest report will be released this coming Friday (16 Sep) and published on our Harvest progress in Great Britain page.

Oilseeds

Rapeseed

Short term, rapeseed tracks soyabean prices down on record US crop prospects, as well as the expectation of a large Canadian canola crop. Longer term, global supply and demand remains tight, though recessionary concerns remain a watchpoint.

Soyabeans

US soyabean crop prospects remain favourable, pressuring markets in the short term. Longer term, large South American crops are also currently forecasted, and recessionary fears could lessen demand.

Global oilseed markets

Global oilseed futures

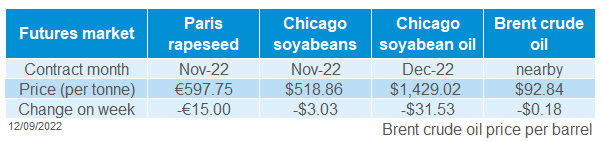

Chicago soyabean futures (Nov-22) fell $3.03/t last week, closing at $518.86/t on Friday. Expectations of a record US crop, as well as higher South American plantings weighed on the market. However, while down slightly across the week, prices gained $9.64/t over Friday’s session because of technical buying ahead of the USDA’s World Supply and Demand Estimates due out later today.

The anticipated bumper crop in the US has caused farmers in Argentina to rush to sell stockpiled soyabeans before prices fall any lower. The favourable exchange rates in Argentina also meant that last week we saw 2.13Mt of soyabeans sold in the country in just two days (Monday and Tuesday), compared to 667Kt sold throughout the entire week before (Refinitiv).

The wider oilseed complex was guided down over the week by losses in palm oil markets. Malaysian palm oil futures (Nov-22) closed down 8.2% across the week. Malaysian palm oil stocks as at the end of August, were at 2.09Mt, up 18.2% from the previous month, and at their highest since November 2019. Though as peak production season continues, low prices mean exports are expected to be stronger over the coming months.

Rapeseed focus

UK delivered oilseed prices

Global rapeseed markets have been pressured by the losses in palm oil and soyabean prices, combined with concerns over slowing demand. Parts of the EU have also experienced some welcomed rain towards the end of last week, boosting the emergence of recently planted rapeseed and further pressuring prices.

The Australian government’s ABARES report released on Tuesday, also indicated that canola production in the country is forecast to reach the second highest level on record at 6.6Mt. This would be a 2% decrease from the record reached last year.

Paris rapeseed futures (Nov-22) were down €15.00/t over the week, closing at €597.75/t. The Nov-23 contract closed at €608.75/t on Friday, down €14.25/t over the same period.

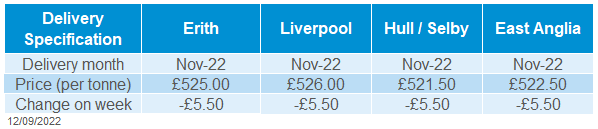

Delivered rapeseed (into Erith, Nov-22) was quoted at £525.00/t on Thursday, down £5.50/t from the previous week. The weakening pound against the euro over the week (-0.4%) continues to limit the pressure put on domestic prices. Trading closed Friday £1 = €1.1538.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.