What does a weakening pound mean? Grain market daily

Wednesday, 7 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £264.50/t, down £3.00/t on Monday’s close. The Nov-23 contract lost £4.25/t over the same period, closing at £257.00/t.

- Paris rapeseed futures (Nov-22) also fell yesterday, down €7.00/t to close at €605.50/t. This tracked movements in the wider oil complex, with pressure on soyabeans from large US and South American supply expectations, as well as higher interest rate concerns and lower demand pressuring brent crude oil.

- Yesterday, the latest Australian Government (ABARES) crop report stated that Australian winter crop production for 2022/23 is forecasted to be 55.5Mt, the fourth largest on record. Plentiful rainfall improved yield potentials. Wheat production is forecasted at 32.2Mt and canola (rapeseed) production is forecasted to reach 6.6Mt, the second highest on record for both crops. Barley production is forecasted at 12.3Mt, also the fourth largest on record.

What does a weakening pound mean?

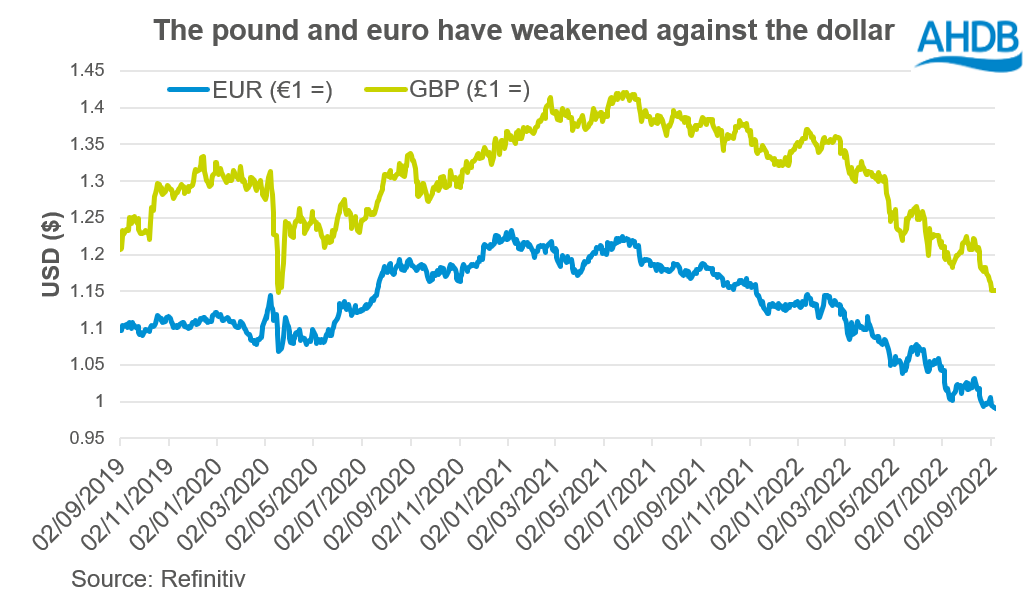

The pound sterling and euro have weakened considerably to the US dollar over the past month. Yesterday, the pound closed at £1=$1.1516 and the euro closed at €1=$0.9902, whilst the US dollar remains strong due to high interest rates tackling inflation (Refinitiv). This is down 6% and 3.5% respectively from 01 August.

Why is the value of the pound sterling and euro falling?

The pound sterling is amid a ‘crisis’ according to Refinitiv, with surging inflation, looming recession, the fourth prime minister in six years, and borrowing set to increase. Whereas, as stated earlier, the US dollar is finding strength as their economy outperforms peers by fighting inflation and job creation (Refinitiv).

Whereas the euro has been impacted by Russia pausing gas flow through the Nord Stream 1 pipeline, leading to spiking gas prices. This gas supply squeeze is creating concerns around reduced economic activity and increasing inflation due to gas reliance across the bloc.

What does that mean for domestic trade and prices?

With a weaker currency (pound sterling) currently, this often results in exports becoming cheaper (making the domestic crop more competitive on the global market) and imports more expensive. Something to watch, as we have especially a plentiful supply of wheat from a speedy harvest and higher stocks carried into this season.

However, when we look forwards, a weaker sterling and imports becoming more expensive is a real risk for UK margins. With domestic production of fertiliser reducing we're going to be more reliant on imported nitrogen products. And so a weaker sterling will mean more expensive nitrogen.

This puts larger question marks over the potential impact on 2023 crops, as costs increase and farmers may make strict decisions on how much nitrogen to use. The weaker sterling adds another layer of uncertainty to 2023 crop production.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.