Arable Market Report – 11 March 2024

Monday, 11 March 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

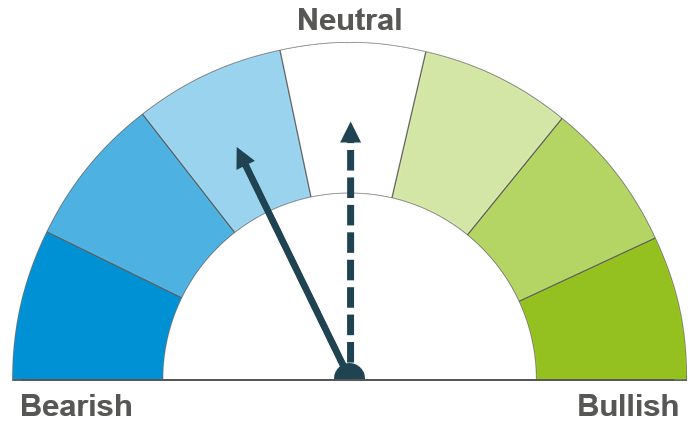

Wheat

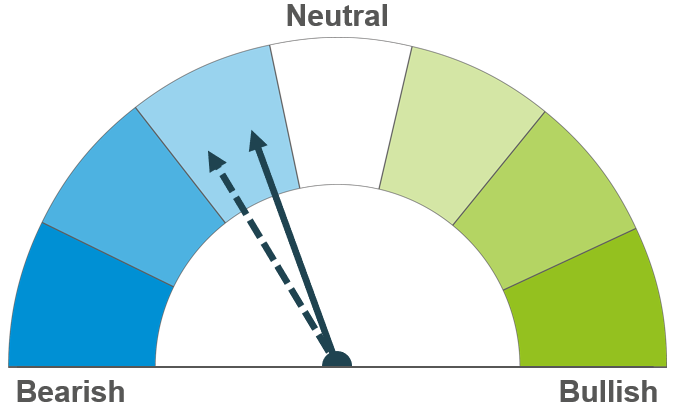

Maize

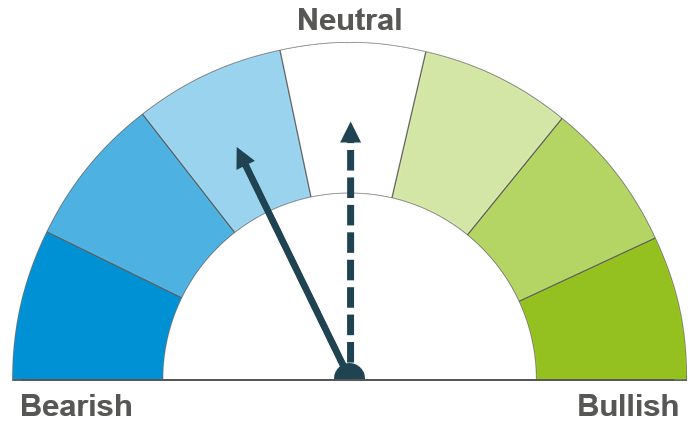

Barley

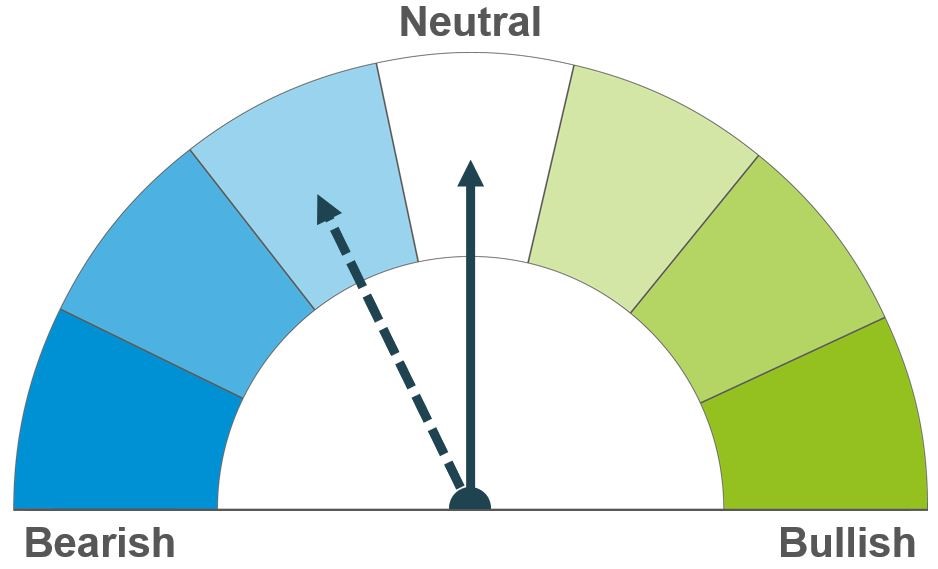

In the short term, pressure from competitive Black Sea supplies continues to weigh on prices. In the longer term, EU and domestic wheat production is in focus, with concerns over conditions of winter crops and spring plantings.

Friday’s WASDE confirmed expectations of heavy South American maize supplies, which will likely continue to weigh on global feed prices in both the short and long term.

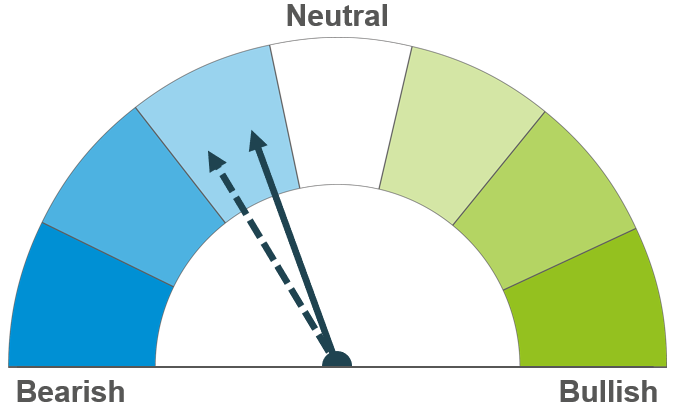

Barley prices continue to follow the wider grains complex. In the longer term, focus is on progression of spring plantings in Europe, with speculation over the size of next season’s crop.

Global grain markets

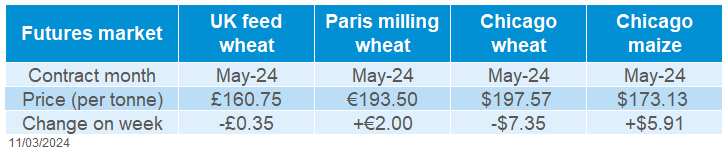

Global grain futures

Global grain markets ended mixed last week. Despite some support on Friday following the release of the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE), Chicago wheat futures (May-24) were pressured 3.6% on the week (Friday–Friday). Paris milling wheat futures (May-24) moved in the opposite direction, up 1.0% over the same period as traders assessed export demand. Chicago maize futures (May-24) gained 3.5% across the week, largely due to short coverings ahead of Friday’s WASDE.

Friday’s WASDE release saw little price reaction in grain markets, with any adjustments largely as expected, though heavy maize supplies were indicated yet again. While a Reuters pre-report poll had estimated the Brazilian maize crop would be cut to 121.95 Mt, the USDA left its estimate at 124 Mt – unchanged from February’s estimate. The USDA also raised its Argentinian maize crop estimate to 56 Mt, from 55 Mt last month.

US and European markets remain reactive to any news on demand. Exports remain relatively lacklustre, and tenders that are coming forward are tempered by competitive Black Sea prices. There is also an absence of new Chinese demand. On Thursday and Friday, the USDA reported the cancellation of 130 Kt and 110 Kt of US wheat due to be delivered to China in 2023/24.

European weather remains a watchpoint, with wet conditions in France continuing to delay spring barley plantings. By 4 March, just 28% of the French spring barley crop was in the ground. This is virtually unchanged from a week earlier (27% complete) and well behind the average for the time of year of 71% complete. The condition of winter crops in Europe is also something to monitor. As at 4 March, 68% of the French soft wheat crop was rated in good or excellent condition, remaining at a four-year low (FranceAgriMer).

While Argentinian maize prospects this season look plentiful, concerns are rising over next season’s wheat crop. The Rosario Grain Exchange said on Wednesday that an analysis carried out by multiple international organisations showed that there is a 77% possibility of a La Niña weather event in the month of October. The phenomenon usually brings dry weather with lower rainfall, which could impact the development of the country’s wheat crop – something to watch out for.

UK focus

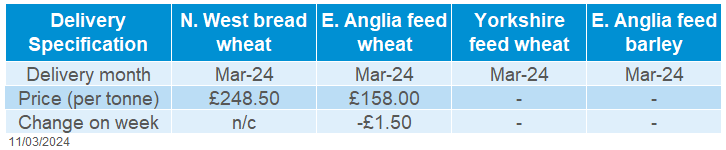

Delivered cereals

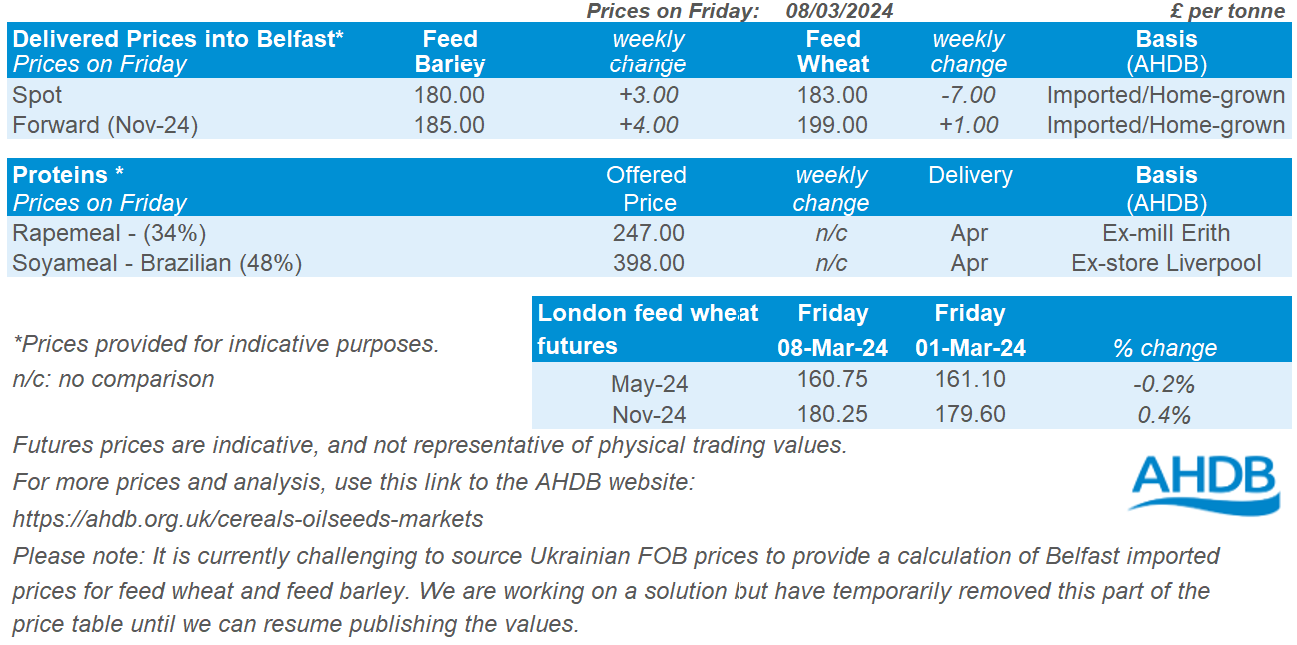

Old crop domestic feed wheat futures saw some pressure last week. The May-24 contract closed at £160.75/t on Friday, down £0.35/t over the week. However, new crop (Nov-24) futures were up over the same period by £0.65/t, closing at £180.25/t.

UK delivered prices generally followed futures movements Thursday to Thursday. Feed wheat delivered into East Anglia for March delivery was quoted at £158.00/t on Thursday, down £1.50/t over the week. Bread wheat delivered into the North West for March delivery was quoted at £248.50/t on Thursday, with no comparison on the week.

The most recent UK human and industrial cereals usage data shows total wheat milled this season to date (Jul–Jan) increased by 6.0% on the same period last year. The latest GB animal feed usage data has also been released, showing a decline of 0.8% in total feed production so far this season (Jul–Jan) compared to the last.

After an extremely challenging autumn, AHDB is re-running its Early Bird Survey of planting intentions to capture the potential cropped areas for harvest 2024. These results were originally due for release on Friday 8 March. However, the continued wet weather made it difficult for farmers to finalise spring planting decisions. In these tough conditions, the survey was delayed slightly to hopefully allow more plans to be finalised. The results are now due to be published on Friday 15 March.

Oilseeds

Rapeseed

Soyabeans

Focus is currently on EU crop conditions as Europe enters spring. In the longer term, rapeseed prices will broadly follow soyabeans, unless there are issues with Canadian plantings in the coming months.

Large supplies coming from South America have the ability to continue weighing on prices. In the longer term, without unforeseen strong demand or a weather event, soyabeans will likely continue to be pressured.

Global oilseed markets

Global oilseed futures

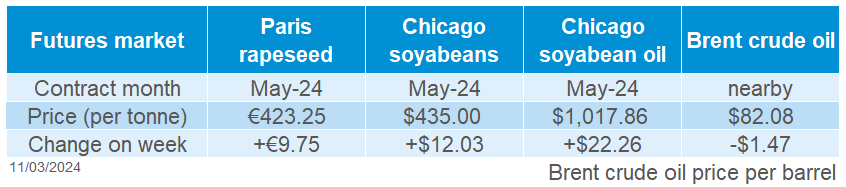

We saw the second successive week of gains for Chicago soyabean futures (May-24), which gained 2.8% across the week to close Friday at $435.00/t. Up until Wednesday, the market was pressured week-on-week. However, with commodity funds holding a sizable net-short position in Chicago soyabean futures, this leaves the market open to episodes of short covering, which adds support to the market.

Despite this gain, the global soyabean supply is heavy for the marketing year. The USDA World Agricultural Supply and Demand Estimates released last Friday received a fairly muted market reaction. Brazil’s soyabean production was lowered by 1 Mt to be estimated at 155 Mt; this was above the average analyst expectations of 152.3 Mt from a Reuters Poll.

Private and other government estimates of Brazil’s soyabean crop range from 143.9 Mt (Ag Resource) to 151.5 Mt (StoneX). The variation in estimates reflects the unpredictable weather from the El Niño and the different methodologies used for assessing production. However, what we can conclude is that the crop is plentiful and could continue to weigh on the global oilseed market. It was reported last Friday that Brazil’s soyabean harvest is at 52.7% complete versus the 53.4% at the same time last year (Patria Agronegocios).

Last Thursday, the USDA reported US soyabean net-export sales (to week 29 Feb) of 613.5 Kt for 2023/24. This was up noticeably from the previous week and from the prior four-week average. It also surpassed the top of the trades range of estimates, which were pegged at 175–600 Kt.

Chinese imports of soyabeans were estimated at 13.04 Mt for January and February, a five-year low, and down 8.8% from the same period a year ago (General Administration of Customs). The reasons for this included poor crushing margins, fewer ships arriving during the Lunar New Years holidays and slow customs clearance. Furthermore, China’s demand for soyabeans may be reduced this year by new regulations to control the nation’s pig production capacity. This is after an aggressive expansion of farms which has led to an oversupply and contributed to squeezed livestock margins (LSEG).

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices were supported last week with support in Chicago soyabeans from short covering and support in Malaysian palm oil futures, from expectations that stagnating global palm oil production and higher biodiesel mandates are likely to curb supplies.

Paris rapeseed futures (May-24) rose across the week by €9.75/t, closing at €423.25/t. New crop (Nov-24) futures were up €6.50/t over the same period, closing at €428.25/t on Friday.

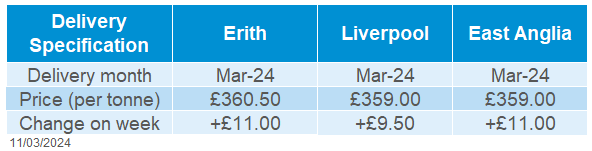

Domestic prices gained with the futures market as delivered rapeseed (into Erith, March-24) was quoted at £360.50/t on Friday – up £11.00/t across the week.

Untimed rainfall and hailstorms have impacted India’s rapeseed crop, which is delaying harvest and reportedly expected to reduce their output (LSEG). Lower-than-expected rapeseed production may force India to import further supplies of edible oils from overseas.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.