Spring barley planting still stalled in France: Grain market daily

Friday, 8 March 2024

Market commentary

- UK feed wheat futures rose yesterday, supported by Paris milling wheat futures. The Paris market rose on hopes of stronger exports with French and Bulgarian wheat looking competitive for the latest Egyptian tender. However, Egypt’s state buyer, GASC, later cancelled the tender without buying anything.

- May-24 UK feed wheat futures gained £1.90/t to close at £161.60/t, while the Nov-24 contract rose £2.15/t to £180.10/t.

- While European and new crop Chicago wheat prices gained, old crop Chicago wheat prices fell. China cancelled its purchases for 130 Kt of US soft red winter wheat; prices have fallen since China reportedly bought the wheat last year (LSEG).

- The market’s focus is now on tonight’s USDA World Agriculture Supply and Demand Estimates, due at 5pm GMT. Repositioning by speculative traders ahead of the report supported Chicago maize and soyabean futures yesterday. The market is generally expecting the USDA to cut its forecasts for Brazilian maize and soyabean production.

- Paris rapeseed futures benefited from the rise in Chicago soyabean futures, with the May-24 contract up €3.25/t to €425.75/t (approx. £364.00/t). The Nov-24 contract rose €2.50/t to €429.00/t (approx. £366.50/t).

Spring barley planting still stalled in France

Wet weather has stalled spring barley planting in France, posing early risks to production in the EU’s top barley exporter.

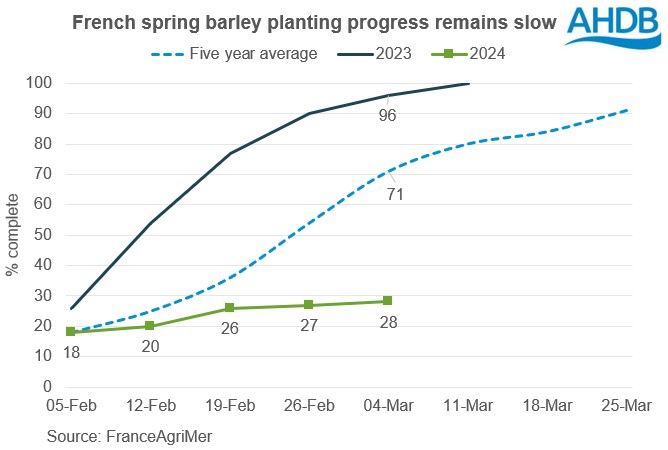

By 4 March, just 28% of the 2024 French spring barley crop was in the ground. This is virtually unchanged from a week earlier (27% complete) and well behind the average for the time of year of 71% complete.

There has been some drier weather in the past few days, so there’s been potential for some more progress to be made, depending on soil conditions. However, the forecast looks wetter over the weekend and into next week, which could again interrupt planting.

From 2019 to 2023, just under 30% of the French crop was spring sown (French Ag Ministry). In 2023 the French spring barley area was particularly low and a rebound in the area is expected.

Despite a potential recovery in spring plantings, French barley output is still expected to be lower in 2024 than 2023. The winter barley crop has got off to a challenging start with the area down 7% (French Ag Ministry) and crop conditions much poorer than last year. By 4 March, FranceAgriMer estimated 69% of the crop was in a good or very good condition, down 1% from a week earlier and sharply below last year’s 92%.

Later planted crops can often suffer a yield penalty, or there’s the potential for the area to shrink further, either of which could further curb French barley production in 2024. We need to continue to watch conditions and planting progress to understand the potential picture.

At a total barley level, the impact of a smaller crop is likely to be offset by heavy carry-over stocks. At 2.11 Mt the current forecast for French stocks at the end of 2023/24 is double the level at the end of 2022/23 and the largest since 2009/10 (FranceAgriMer).

However, spring crops across Europe are important to malting barley availability. The difficult 2023 harvests squeezed malting barley availability in Europe, and supported prices, including in the UK. The size and quality of the 2024 barley crops cross Europe will have a large bearing on feed barley’s price relationship to wheat, and malting premiums.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.