Arable Market Report - 10 October 2022

Monday, 10 October 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

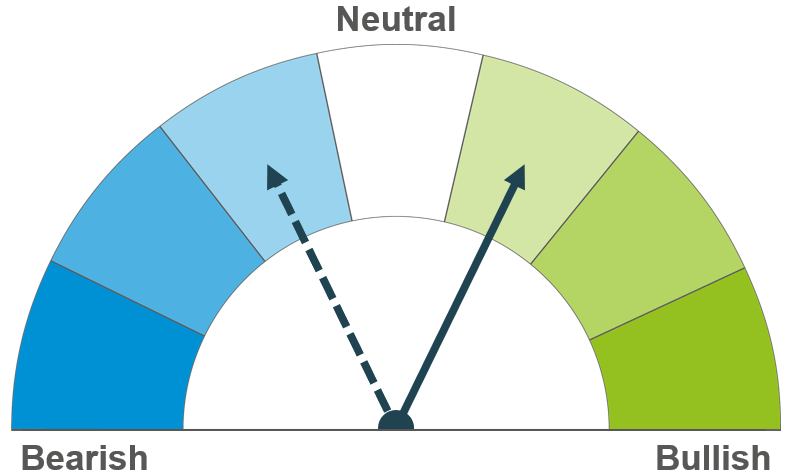

Grains

Wheat

Maize

Barley

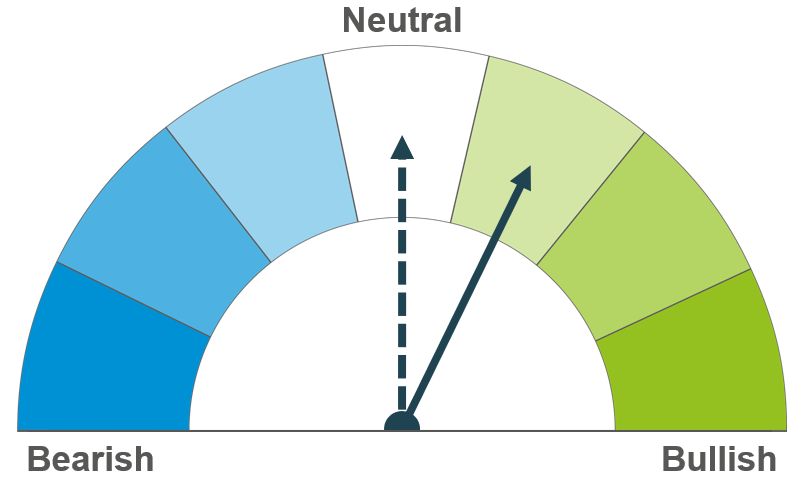

The conflict between Ukraine and Russia continues to keep markets supported in the short term. Longer-term, recessionary concerns could see some pressure on markets.

Tight global supply and tensions in Ukraine keep prices supported in the short term. Longer term focus is on South American plantings which could see increased supply on the global market.

Barley markets continue to follow the wider grain complex, with supply outlooks remaining tight.

Global grain markets

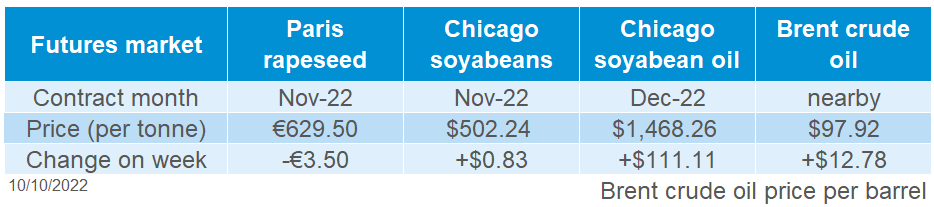

Global grain futures

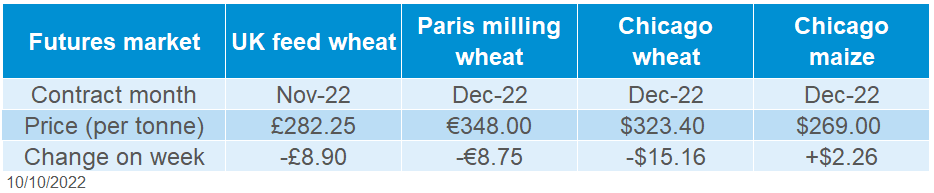

Global wheat markets felt some pressure last week, as Chicago wheat and Paris milling wheat futures (Dec-22) were down 4.5% and 2.5% respectively Friday to Friday.

The main drivers of this downwards pressure were ongoing recessionary concerns impacting demand, progressing global maize harvest (with favourable US weather), and slow US export sales with increased competition from South America for competitively priced maize. The US dollar movement, which weakened mid-week but regained some strength at the end of the week, continues to be a key factor in global markets too.

Having said this, Chicago maize futures were up 0.9% across the week. Ahead of the USDA’s next World Supply and Demand Estimates (WASDE) released on Wednesday (12 Oct). StoneX group analysts are expecting US 2022/23 maize yields to be cut to 4.37t/acre, which could add a bullish sentiment to the market. However, this is higher than analyst estimates in a Refinitiv poll that estimate maize yields could be cut to 4.34t/acre. In addition to maize supply, other watchpoints for the report are global demand for cereals considering recessionary concerns, as well as the size of the forecasted Black Sea crops.

Going forward, the focus for global maize supply is on South American plantings. The 2022/23 planting season in Argentina is said to be getting off to a problematic start. Due to dry weather, there are large soil moisture deficits. The Buenos Aires Grain Exchange has estimated that the country will plant 7.5Mha of maize this season, down 2.6% on the year. As rainfall over the next few days in Argentina is expected to be minimal, plantings will remain something to watch.

The conflict in Ukraine has escalated over the weekend and this morning. After a bridge linking Russia with occupied Crimea was blown up on Saturday, Russia has carried out various missile strikes on cities across Ukraine. These strikes are said to be the most widespread attacks since the first few weeks of the war. As the Russian president is expected to chair a meeting of his security council today, uncertainty is heightened regarding Ukrainian exports, and will also be something to watch over the coming week.

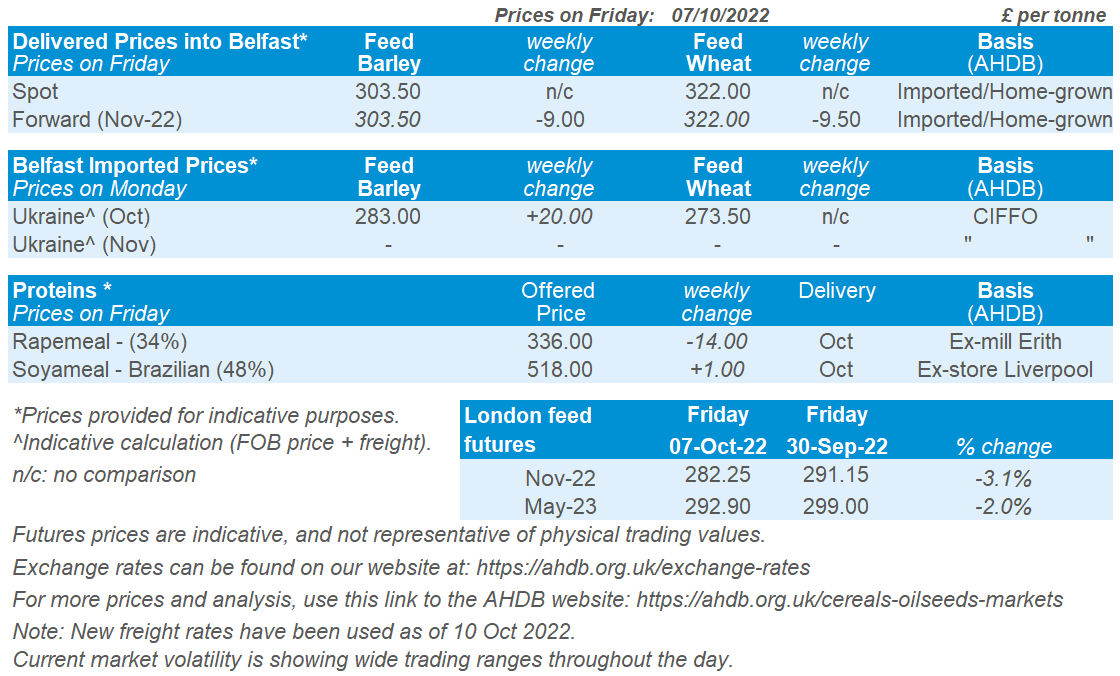

UK focus

Delivered cereals

Provisional cereal and oilseed production estimates for England 2022 were released by Defra this morning. Total cereal production in England is estimated to have increased by 9.4% on the year, to nearly 21Mt in 2022. The higher yields across the main cereal crops outweighed a small decrease in total area. The provisional estimate of the 2022 England wheat crop is 14.4Mt, up 12% on the year, using a yield of 8.6t/ha. The 2022 England barley harvest was pegged at 5.2Mt, up 6.6% from the previous season. In 2022 production of oats is estimated to have fallen by 8% from last year, to 825Kt.

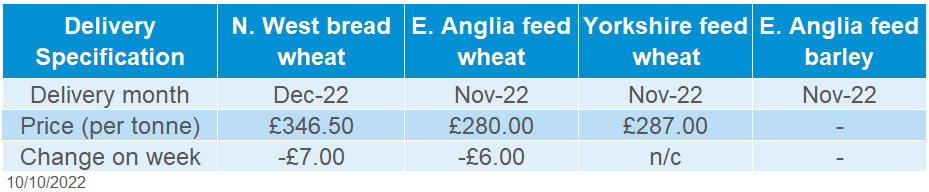

Domestic wheat prices tracked the global complex last week. UK feed wheat futures (Nov-22) were down 3.1% Friday to Friday.

UK delivered prices followed this movement. On Thursday, feed wheat delivered into East Anglia (for October delivery) was quoted at £279.00/t, down £6.00/ from the previous week. For February 2023 delivery into East Anglia, this was quoted at £284.50/t, also down £6.00/t.

Bread wheat delivered into the North West for December delivery was quoted at £346.50/t on Thursday, down £7.00/t from the previous week.

Feed barley delivered into Devon for November delivery was quoted at £262.00/t on Thursday.

The pound sterling weakened slightly last week against the US dollar (Friday-Friday). Sterling closed on Friday at £1 = $1.1084, down 0.7% over the week. Read more about how this could impact markets here.

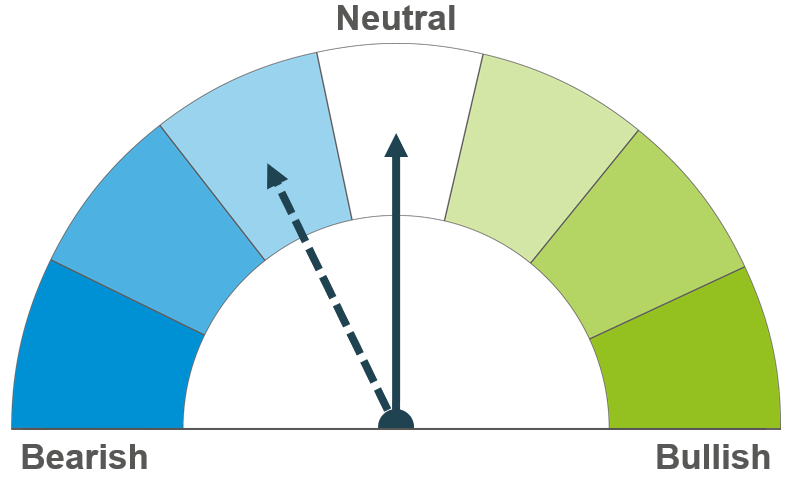

Oilseeds

Rapeseed

Soyabeans

Short term rapeseed markets will be reactive to energy markets and news from the Black Sea. Long-term, soyabean markets will have greater influence on prices and Canada’s large canola crop comes to market into the new calendar year.

There is anticipation of increased global ending stocks to be reported in this Wednesday’s USDA report which could ease the global S&D. Long-term, a record combined crop from Brazil and Argentina is expected to be bearish on the market and demand remains a key driver as recessionary concerns grow.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (Nov-22) tracked sideways across the week, overall gaining just 0.2% to close on Friday at $502.24/t. Last Thursday (06 Oct) the contract closed at its lowest point since the end of July but gained some support on Friday from bargain buying.

However, there were more clear weekly gains in the Chicago soybean oil futures (Dec-22), which were up 8.2% on the week. This followed a strengthening of Brent crude oil futures (nearby), which were up 11.3% across the week. On Friday, the contract reached its highest point since the end of August. This support was from OPEC+ decision to cut production by 2M barrels per day, their largest production cut since 2020.

This support filtered through into Malaysian palm oil futures (Jan-23), up 12.3% on the week. There was further support for palm oil too, on concerns that the year-end monsoon season will impact Malaysian production. This came as the Malaysian Meteorological department has forecast heavy rains from October onwards (peak palm production spans Sept to Nov).

All eyes are towards the USDA World Agriculture Supply & Demand estimate which is scheduled to be released this Wednesday (12 Oct).

Rapeseed focus

UK delivered oilseed prices

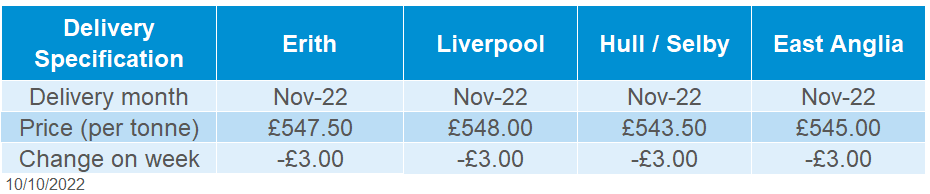

Paris rapeseed futures (Nov-22) closed Friday at €629.50/t, down €3.50/t across the week. Delivered prices tracked this slight pressure, with delivered rapeseed (into Erith, Nov-22) being quoted at £547.50/t on Friday, down £3.00/t on the week.

Defra released their provisional cereal and oilseed production estimates for England 2022 this morning. Oilseed rape production is estimated to have increased by 43% from harvest 2021, to 1.2Mt in 2022. This was driven by a 20% annual increase in area (to 322.8Kha) and a 19% annual increase in yield from last year (to 3.7t/ha). England yields provisionally are estimated up from the 5-year average of 3.3t/ha.

Flood warnings have been issued in New South Wales, Australia. Parts of NSW and Victoria could receive up to 6 inches of rain over the next seven days. With these two regions growing large quantities of canola, this is a key watchpoint to whether this will have impacts on the canola as it enters its final stages of development.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.