Arable Market Report – 10 November 2025

Monday, 10 November 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

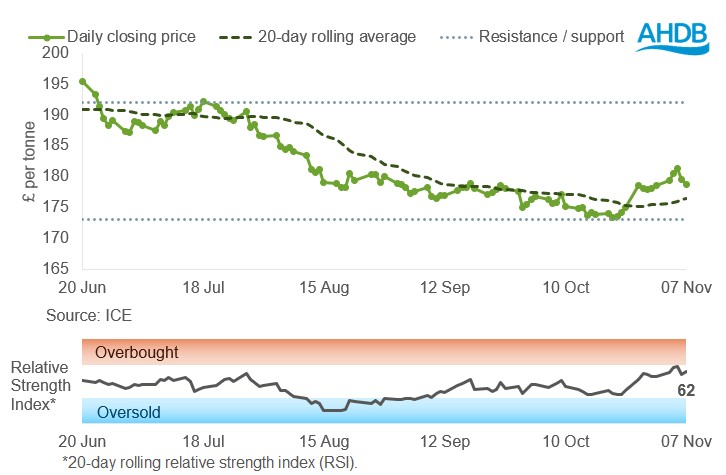

UK feed wheat futures (May-26)

UK feed wheat futures (May-26) traded above the 20-day simple moving average last week (31 October–7 November), remaining above the support level of £173/t.

The relative strength index (RSI) rose to 62, up from 56 in the previous week, suggesting an increase in market momentum.

Find out more about the graphs in this report and how to use them.

Market drivers

Global wheat futures rose to a two-month high in the middle of last week but eased towards the end of the week. The initial gains were driven by hopes of renewed Chinese interest in US-origin wheat, but this soon subsided as expectations fell short. Towards the end of the week, US maize harvest pressure ensued and benign weather in both the US and Europe meant ample global supplies came back into focus.

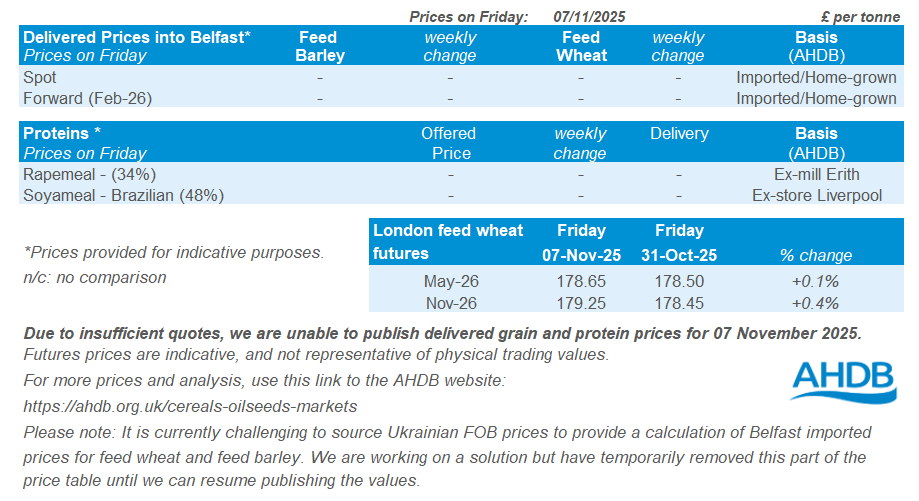

Despite the gains in the middle of the week, UK feed wheat broadly tracked sideways week on week, shadowing the movements in Paris milling wheat futures. The May-26 contract closed at £178.65/t, up £0.15/t (0.1%) on the week, while Paris milling wheat (May-26) ended down 0.3%, pressured by weaker US market sentiment.

The main support last week was reports that Chinese importers had reportedly booked 120 Kt of US wheat for December shipment. Further to that, it was reported that a US sorghum shipment was heading to China (LSEG). This came following a meeting between President Trump and Xi to discuss easing trade tensions. Markets soon subdued back down after digesting this news and awaited fresh commitments.

Across the US, the maize harvest is now 83% complete, helped by dry weather in the Midwest. According to a Reuters poll, not official USDA data, 2026 winter wheat drilling is almost finished, with 91% of the crop sown and 52% rated good to excellent.

In Brazil, planting of the country’s first 2025/26 maize crop is 72% complete in the key centre-south region, broadly in line with 72.5% at the same point last year (AgRural). Brazil’s 2025/26 maize production is estimated at 142.5 Mt by Safra, substantially higher than the USDA’s projection of 131.0 Mt. Meanwhile, in Argentina, the wheat harvest is around 12% complete. The Buenos Aires Grain Exchange has maintained its forecast for a 22.0 Mt for 2025/26, up from 18.6 Mt last year.

Sovecon has raised its forecast for Russian wheat exports in 2025/26 by 0.4 Mt to 43.8 Mt, reflecting better crop prospects. Furthermore, it was reported last week that the Russian government is considering introducing a 20 Mt grain export quota for the period 15 February–30 June 2026, following a draft document published by the Russian Grain Union lobby group. Last season’s quota for the same period was 10.6 Mt and covered only wheat and meslin, but the proposed quota would also include maize and barley (LSEG).

For 2026 harvest the European winter grains campaign is progressing well. French soft wheat and winter barley planting (to 3 Nov) were 79% and 87% complete, respectively, both ahead of five-year averages.

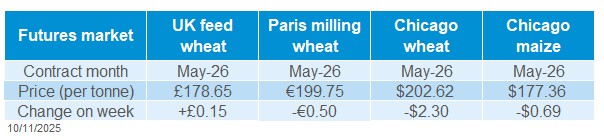

UK delivered cereal prices

Domestic delivered wheat prices broadly followed the movement in UK feed wheat futures Thursday to Thursday.

Feed wheat delivered into East Anglia for November was quoted at £171.00/t, up £0.50/t on the week.

Bread wheat for November delivery into the Northwest was quoted at £201.00/t, with no comparison on the week. Bread wheat for November delivery into Northamptonshire was quoted at £190.50/t, up £2.00/t on the week.

Rapeseed

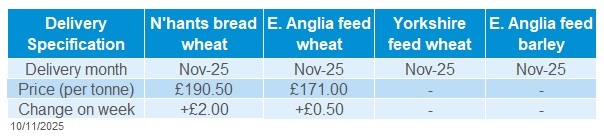

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased last week (31 October–7 November), closing again above the 20-day moving average near £420/t. The 20-day moving average could be the nearest potential support price level.

The relative strength index (RSI) fell from 71 to 68, indicating a decrease in market momentum and signalling a move away from the overbought zone.

Find out more about the graphs in this report and how to use them.

Market drivers

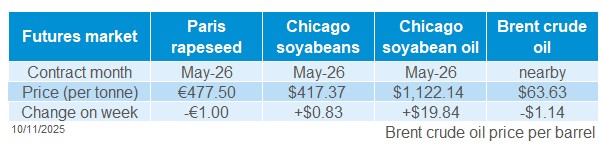

Chicago soya bean futures (May-26) were set for their first weekly drop in 4 weeks, but ended the week up 0.2% from bargain buying, as new around US and China’s trade deal is in the spotlight. Meanwhile Paris rapeseed futures (May-26) fell €1.00/t (0.2%) on the week (Friday–Friday) closing at €477.50/t on Friday, following marginal pressure in crude oil and benign news around EU rapeseed crop development.

The oilseed market is still focused on the relations between the US and China following a truce agreement made recently that China would purchase 12 Mt of US-origin soya beans over November and December, which currently have not materialised. Furthermore, the US government shutdown is adding to uncertainty over Chinese demand as the USDA flash export sales reporting system is not operating.

In Europe, there are anticipations that the EU rapeseed area for 2026/27 will rise, with Expana publishing last week that the sown area is estimated to rise by 7% with provisional estimates at 6.46 Mha, with early-sown rapeseed seeing an increase due to better margins than cereals, for the most part sowing of winter crops in Europe has been benign and without a significant weather event.

Brazilian soya bean plantings for 2025/26 (to 06 Nov) have reached 61% of the expected area, up from 47% a week earlier. This is slightly behind last year of 67% due to irregular rainfall. Although this isn’t a concern for the market yet, it is a key watchpoint given Brazil’s market share.

Key watchpoint for this week is for the USDA's World Agricultural Supply and Demand Estimates (WASDE) report, which is scheduled for release this Friday (14 Nov). The report will include the first updated government estimates of US corn and soya bean yields and production since September, when most of the harvest in the Midwest had not even started, markets will be particularly interested in this given the recent lack of information.

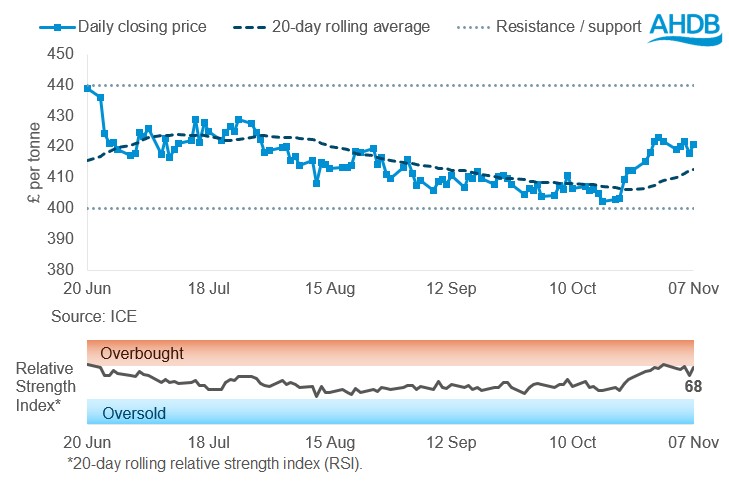

UK delivered rapeseed prices

Delivered rapeseed into Erith for December delivery was quoted at £424.50/t, down £6.00/t from the previous week. While December into Liverpool and East Anglia were at £423.50/t, also falling £6.00/t week-on-week.

These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play. The week on week drop is greater in the delivered prices due to Paris rapeseed futures gaining on Friday after the AHDB delivered survey was conducted.

Extra information

The AHDB Early Bird Survey (EBS), which gathers national cropping intentions each autumn, will be released this Thursday 13 November. You can view last year’s report here.

Meanwhile, results from the 52nd AHDB Cereal Quality Survey show good wheat quality for 2025 but highlight challenges for barley, particularly for spring barley. Read more about the findings here.

On Thursday 6 November, AHDB published UK cereal usage data for September, covering human and industrial consumption as well as GB animal feed production. Between July and September 2025, the use of home-grown milled grain fell by 3.5%, while imported milled grain fell by 15.9% compared with the same period in 2024.

HMRC will release UK trade data for September 2025 on Thursday 13 November. Look out for our analysis the following week, which will highlight first-quarter trends in both imports and exports.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.