Analyst insight: Good wheat quality but challenges for barley

Tuesday, 4 November 2025

Market commentary

- UK feed wheat futures rose yesterday. The May-26 contract closed at £179.40/t, up £0.90/t (0.5%) from Friday’s close. Compared to other wheat futures, domestic wheat futures recorded smaller price increases yesterday.

- Chicago wheat and Paris milling wheat futures (May-26) increased by 1.7% and 0.9% respectively. Chicago grain futures rose significantly yesterday, supported by news of China's interest in US wheat and strong export demand for US wheat in general. You can find more details in our latest Market Report.

- Grain consultancy SovEcon increased its forecast for Russian wheat exports in the 2025/26 season by 0.4 Mt to 43.8 Mt yesterday, reflecting improved crop estimates and increased export activity (LSEG).

- Paris rapeseed futures (Feb-26) fell €1.00/t to €479.50/t yesterday, while futures for May-26 decreased by €0.25/t to €478.25/t. The current difference in value between these futures would not offset the storage costs.

- Chicago soyabean futures and Winnipeg canola futures (May-26) rose by 1.4% and 1.7%, respectively yesterday. Optimism about the US-China trade deal (important for soybeans) and the progress made between Canada and China (important for canola), supported the increases yesterday.

Good wheat quality but challenges for barley

AHDB’s 52nd Cereal Quality Survey shows good wheat quality in 2025 but some notable challenges for barley, especially for spring barley.

High protein supports bread wheat supply

The average protein levels for UK Flour Millers group 1 varieties in 2025 is 13.4%, which is significantly higher than the average of 12.5% in 2024, reflecting the dry weather this year. It is also the highest level since 2017, when the level of proteins was the same.

It’s important to note that reports during harvest showed that the wheat harvest had arguably the greatest level of variation of all cereal crops. There was significant variation in yield between and within farms, regions and across the UK. So, while the overall quality is strong in 2025, we need to acknowledge that this won’t reflect all farms’ reality.

Overall, average Hagberg Falling Numbers (HFN) and specific weights generally meet or exceed the requirements for milling wheat samples. A wider standard deviation than last year supports earlier reports that for some, HFN levels declined slightly after heavy rain in early August.

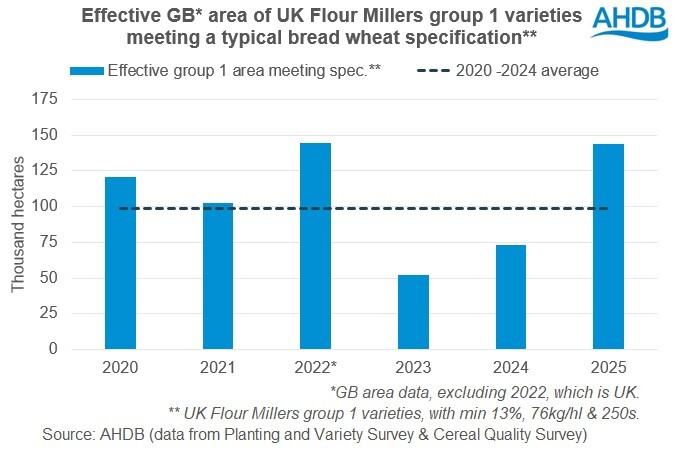

In 2025, 47% of group 1 milling wheat samples met or exceeded the typical group 1 bread wheat specification (specific weight of 76kg/hl, protein content of 13.0%, and HFN of 250 seconds or more). This figure has more than doubled since 2024 (20%), representing a record high since 2003.

This points to a greater availability of wheat suitable for bread-making in 2025 and a reduced reliance on imported grades for blending, though two factors will reduce the rise. AHDB’s Planting and Variety Survey showed a further drop in the area of group 1 varieties for harvest 2025. When the information from the two surveys is combined it suggests the area of group 1s effectively meeting spec this season would be still well above average. However, yields suffered across much of England due to the dry weather in 2025, which will limit the total rise in availability. Lower bread wheat prices will also add pressure to farm margins.

Challenges for barley quality

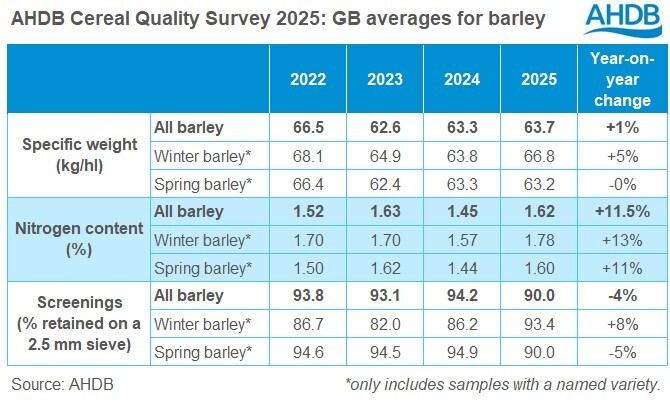

2025 has been a mixed year for barley quality because of the dry weather. Some sizeable challenges with screenings in barley, especially in Scotland, plus higher nitrogen levels are likely to cause difficulties in meeting some malting specifications.

For spring barley samples across GB, just 90.0% was retained by a 2.5 mm sieve, down from last year’s 94.9% and likely the lowest level since 2012.

In Scotland, with spring barley as the main crop, screenings are a serious challenge. On average (across all samples) just 88.0% is retained by a 2.5 mmm sieve, down sharply from 95.3% last year. While acknowledging the unavailability of data for 2022 and differences in validation methodology, this is still likely to be the lowest retention level in Scotland since 2003.

Winter barley has generally fared better with higher retention rates (screenings) and improved specific weights overall in 2025 than 2024. At 66.8 kg/hl, the average specific weight for winter barley samples is well above last year’s 63.8 kg/hl. However, the highest average nitrogen content since 2011, at 1.78%, could still cause difficulties in meeting some malting specifications.

The quality challenges, combined with the smallest barley crop since 2012, will likely reduce the available crop for malting. However, human and industrial demand is expected to fall another 4% this season as the rising cost-of-living continues to impact alcohol consumption. The challenges to domestic and global demand for malting barley is weighing on prices, and adds further pressure to growers.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.