Arable Market Report – 09 September 2024

Monday, 9 September 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

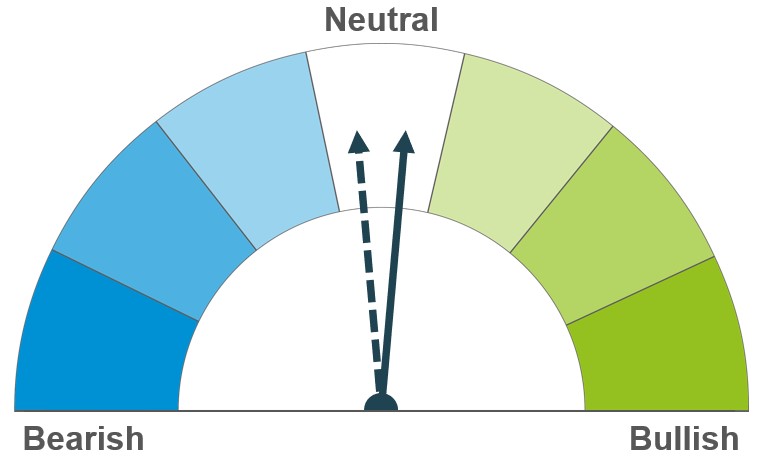

Grains

Wheat

An improved outlook for US wheat exports offers support in addition to the smaller EU crop. However, the competitiveness of Black Sea grain will continue to keep a lid on prices.

Maize

Dryness in the US Midwest has provided support to the market. However, uncertainty regarding the degree of impact this has had on the crop caps gains given the record crop forecast.

Barley

Barley continues to track the wider cereals market for now. Poorer results in Europe and disappointing reports so far from Canada contrast with good prospects in the Southern Hemisphere.

Global grain markets

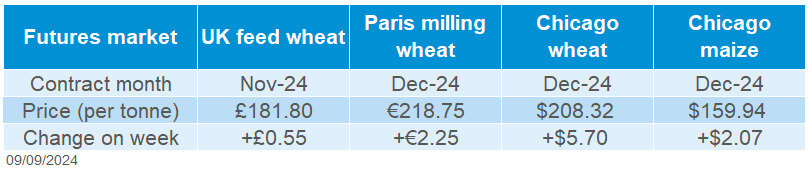

Global grain futures

Global wheat markets were supported last week, as the benchmark contracts (Nov/Dec ‘24) for Chicago, Paris and UK wheat futures all rose on the week (Friday – Friday). Chicago and Paris maize futures (Dec-24 and Nov-24 respectively) also gained. Despite strong Black Sea exports, support in the grains market came from persistent dryness in the US Midwest, some price stability for Black Sea wheat and an improved US wheat exports outlook.

Dryness in the US Midwest continues. The USDA reported that 13% of US maize was in an area experiencing drought (as of 03 September), up 5 percentage points from the previous week. While the US maize crop has passed its most sensitive growth stages, only 19% was fully mature last week and therefore beyond the potential for drought-induced lower yields (Purdue University).

US export inspection data published last week was near the higher end of a range of analyst estimates. Furthermore, the USDA reported that total outstanding wheat sales reached 4.7 Mt last week for the 2024/25 marketing year, 27% greater than the same period last year as well as 0.2% greater than the five-year average.

In Russia, wheat exports for August were estimated at 5.2 Mt, slightly below the record 5.3 Mt shipped last year (SovEcon). The recent stability in prices reported for the major wheat exporter has partially alleviated further pressure on global wheat markets.

Ukrainian wheat prices (CPT Odesa) last week were also reported as stable (UkrAgroConsult). The wheat harvest in Ukraine was completed last week, earlier than usual, and has been estimated at 21.6 Mt (UkrAgroConsult). Ukraine’s farm ministry agreed with grain market associations to cap wheat and meslin (wheat and rye mix) exports to 16.2 Mt for the 2024/25 marketing year, although this could be adjusted in January 2025 depending on export volumes. The current cap for the marketing year is greater than some wheat export estimates of 13.8 Mt (APK-Inform) and 14.0 Mt (USDA) but in line with others such as UkrAgroConsult.

UK focus

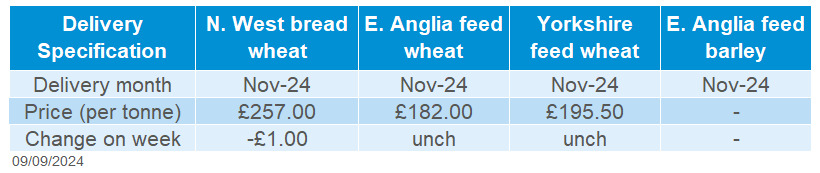

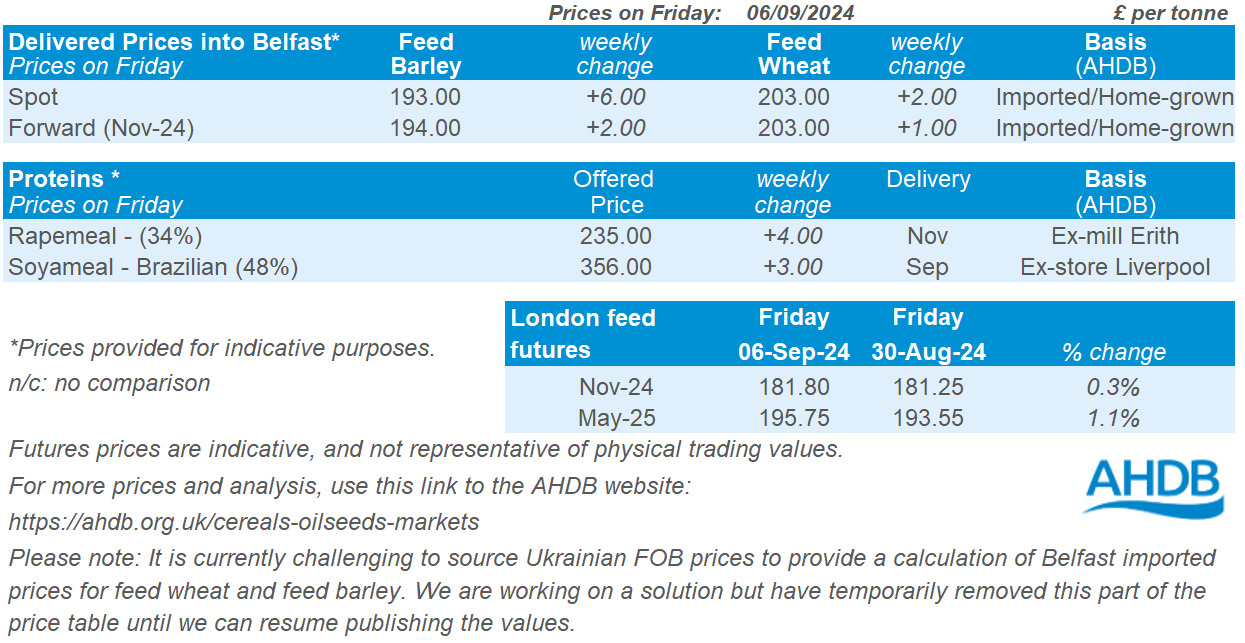

Delivered cereals

UK feed wheat futures (Nov-24) rose £0.55/t over the week (Friday – Friday), to close at £181.80/t. The May-25 contract closed at £195.75/t, gaining £2.20/t over the same period. Continued weakness in the US dollar, due to elevated anticipations of an interest rate cut by the Federal Reserve, has supported the strength of sterling. This in turn has hindered further appreciation of UK feed wheat futures.

Domestic delivered feed wheat prices followed futures up Thursday to Thursday. Feed wheat delivered into East Anglia for September delivery was quoted at £179.50/t on Thursday, up £0.50/t on the week.

The first month’s data on usage in the 2024/25 marketing year was released last week. For GB animal feed, production of compound feed was up from July last year by 2.7% to 845.8 Kt with increases for all livestock categories. However, feed production for integrated poultry units was down 3.7% from July last year. For UK human and industrial cereal usage, total wheat milled is down from last year by 8.7% at 482.1 Kt. Home grown wheat usage was down 12.1% from July last year at 386.2 Kt, while imported wheat was up 8.5% to 95.9 Kt.

Last week, more results from AHDB’s Recommended List trials were released for winter wheat, spring barley, winter rye and winter triticale. For winter wheat, the highest yielding varieties in the fungicide-treated trials continue to be those with good disease resistance. For spring barley, most varieties have performed close to their five-year averages in 2024 thus far.

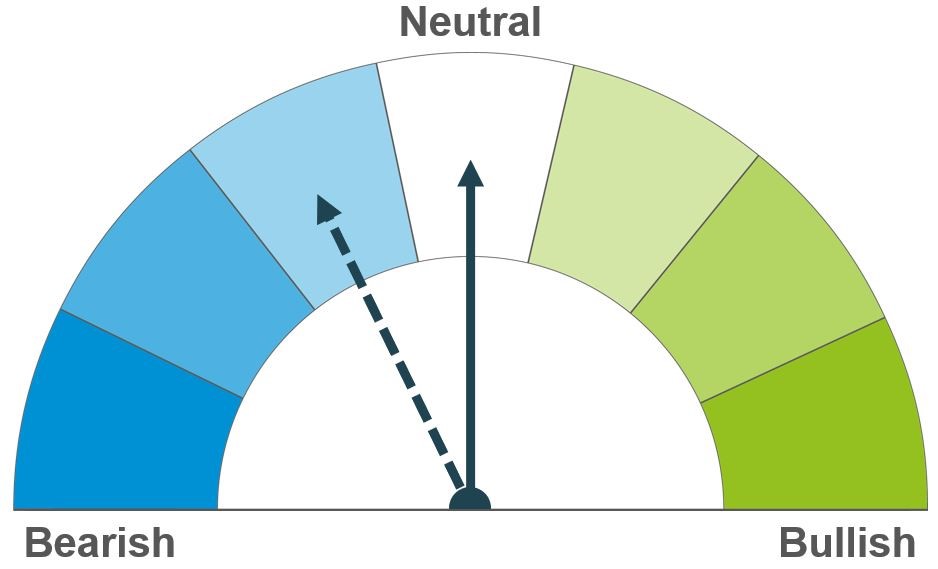

Oilseeds

Rapeseed

Reduced rapeseed production in Europe and a spillover effect of vegetable oil markets continue to offer support. However, the risk to Canadian canola demand and expected abundant soyabeans production could restrain upward price movements.

Soyabeans

Persistent dry weather in the US and Brazil, plus potential for a rise in China’s purchases of soyabeans as alternative to canola, offer supports to prices. However, the ample global supply forecasted in key producing countries like the US and Brazil continues to keep the outlook subdued.

Global oilseed markets

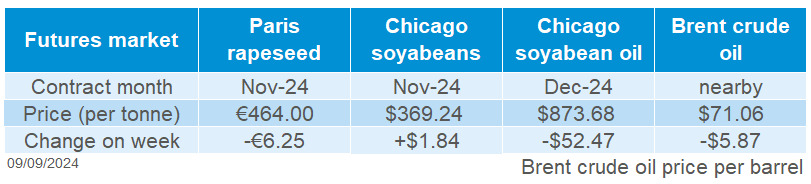

Global oilseed futures

Global oilseed markets saw another slight boost last week (Friday – Friday), with Chicago soyabean futures (Nov-24) rising by 0.5% to close at $369.24/t. This price rise was driven by a combination of factors, including weather risk in the US Midwest, short covering by speculative traders and higher global demand, particularly from China.

The dry weather in the US Midwest has been in focus lately due to its impact on crop conditions. According to the USDA, the proportion of US soyabean crop in good to excellent condition was 65% as of 1 September. This is down from 67% the previous week but 12 percentage points higher than the same time last year. The next report is due out later today.

Also, earlier in the week, soyabean prices gained significant support following reports that China might initiate an anti-dumping investigation into imported Canadian canola. This development was seen as an indication that China, the biggest global buyer of soyabeans, could buy a greater volume of other oilseeds, like soybeans.

US soyabean exports remain firm. The latest USDA data shows that net sales of US soyabeans for the 2024/25 marketing year during the week ending 29 August reached 1.66 Mt, with China accounting for 60% of sales. Also, last week, the USDA confirmed two private sales of US soybeans to China for delivery in the 2024-25 marketing year of 132 Kt and 126 Kt.

Brazil’s export of soyabeans in August was 4.1% less than last year at 8.04 Mt according to government data. This decline is largely attributed to adverse weather conditions. As reported last week, the Brazilian National Weather Service expects above average temperatures and dry conditions from August to October for key soyabean producing regions of the country. With soyabeans planting starting, it is important to monitor the development.

Rapeseed focus

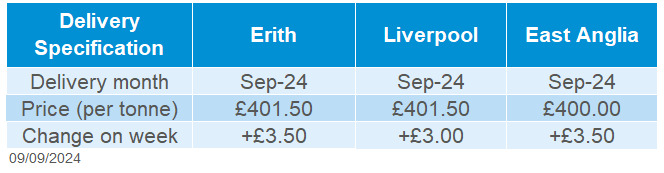

UK delivered oilseed prices

Following the reports of China’s anti-dumping investigation into imported Canadian canola last Tuesday, the Nov-24 Paris rapeseed futures made a significant recovery later in the week, rising to €473.50/t on Thursday, the highest price in over three weeks. However, this was not sufficient for the futures contract to gain on the week; Friday to Friday it declined by €6.25/t to close at €464.00/t, partly also due to strengthening of the euro.

Delivered rapeseed prices rose Friday-Friday due to the time of day when the price survey was conducted, and weakening of sterling to euro. Rapeseed delivered into Erith for November was quoted at £403.50/t on Friday, up £3.00/t on the week. Similarly, delivery into East Anglia was quoted at £402.00/t, rising £3.00/t over the same period.

In its August forecast, Stratégie Grains reduced the 2024/25 rapeseed harvest for the European Union. The consultancy estimates that the EU rapeseed harvest will reach 16.9 Mt, 340 Kt below its July estimate and more than 15% below last year's level. Production was reduced mainly in France, Germany, the Baltic States, Hungary, and Slovakia.

In Saskatchewan, the top grain and oilseed producing province in Canada, the canola harvest was 16% complete as of 02 September, up 8% points from the previous week. This will remain a key watchpoint as Canada is expected to up its production this year compared to last years, despite reports of high temperatures at flowering and drier conditions in some areas.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.