Arable Market Report - 09 January 2023

Monday, 9 January 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

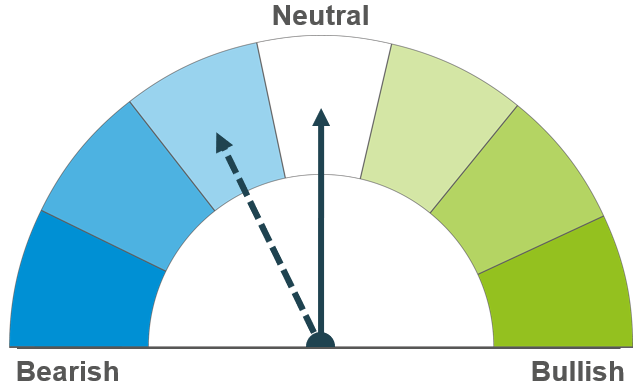

Grains

Wheat

Maize

Barley

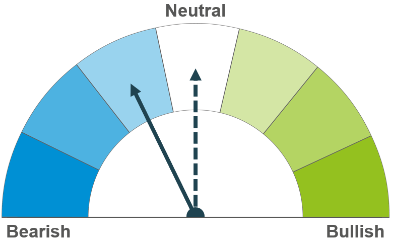

Competitive Black Sea supplies, a large Australian crop and demand concerns continue to weigh on markets in the short-term. Longer term, US crop conditions remain a key watch point.

Global maize markets continue to track wheat markets. Longer-term Argentinian weather remains a bullish factor, though Chinese demand concerns and large expected Brazilian production could cap gains.

Barley markets continue to track the wider grain complex.

Global grain markets

Global grain futures

Global grain markets were pressured last week (Friday-Friday) by competitive Black Sea exports, demand concerns following increasing COVID-19 cases in China and a weakening global economy. Furthermore, the bumper Australian wheat crop has also weighed on markets, with traders and analysts estimating it at a record 42Mt (Refinitiv).

With Russian wheat exports now forecast at 44.1Mt this season (2022/23) (SovEcon) and January exports forecast at c.3.6Mt, ample Russian supplies continue to pressure global grain prices. Whilst a weaker rouble is increasing the export competitiveness of Russian wheat, should it continue to fall, the Russian export tax will become more significant. Alongside this, the insurance of vessels and cargo may become an issue this year. According to Refinitiv, reinsurers have increased rates on some key business lines by as much as 200% from the start of this calendar year. There have also been reports of the cost of hiring vessels to ship commodities from the Black Sea region increasing by more than 20% since the start of the year, to factor in the increase in insurance rate (Refinitiv).

Last week, Tunisia put out a tender to purchase c.100Kt of wheat and c.75Kt of feed barley. While the origin of the grain that won the tender is yet to be confirmed, it is expected that EU origin supplies made up some of the volume (Refinitiv).

US weather is a key watch point, following the recent extreme cold/dry conditions. The impact of these conditions is yet to be fully known. However, according to latest USDA monthly crop condition reports, as at 1 Jan, just 19% of the winter wheat crop in Kansas was rated good/excellent, compared with 21% at the end-November. Crop condition scores also fell in Kentucky, Montana, Nebraska, North Dakota and South Dakota. However, ratings improved on the month in Illinois, Oklahoma and Colorado, with the latter benefiting from the snowstorms as it improved soil moisture. Looking forward, much of the Northwest is expected to receive rainfall over the next seven days, while the Midwest is expected to remain dry

Total US wheat export sales for the week ending 29 December further pressured markets, as wheat exports sales were below trade estimates at 144.1Kt. Maize exports were also slightly below estimates at 319.2Kt.

On Thursday the USDA is due to release its latest World Agricultural Supply and Demand Estimates (WASDE), and its quarterly stocks report with data as at 01 December 2022. Average trader estimates for wheat indicate stocks will be smaller, with wheat down 2.5% on the year at 36.6Mt and maize down 4.2% on the year at 283.3Mt (Refinitiv). This would represent the smallest stocks as at 01 December since 2007 and 2013 respectively.

Across the week, maize markets tracked wheat and crude oil lower, with reduced bioethanol demand resulting from a weaker global economy and reduced Chinese demand weighing on prices too. With little rain forecast over the next week for key maize producing region Buenos Aires, drought in Argentina could continue to add underlying support to markets.

UK focus

Delivered cereals

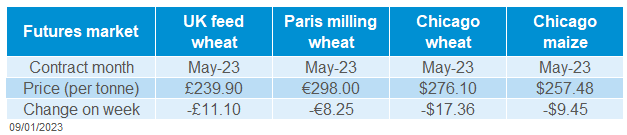

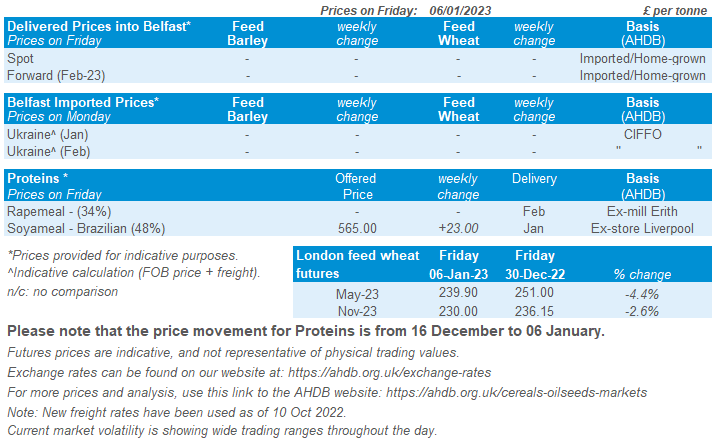

UK feed wheat futures (May-23) fell £11.10/t last week (Friday-Friday), closing at £239.90/t on Friday. New crop futures (Nov-23) closed at £230.00/t on Friday, down £6.15/t over the same period.

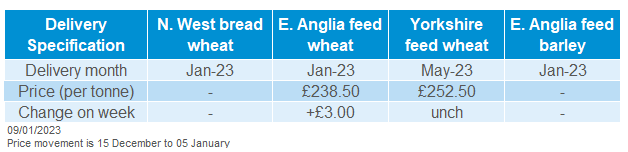

Delivered feed wheat into East Anglia (Jan delivery) averaged £238.50/t, up £3.00/t from the previous survey (15 December). Bread wheat for delivery into Northamptonshire for February averaged £306.50/t, down £1.00/t compared to 15 December.

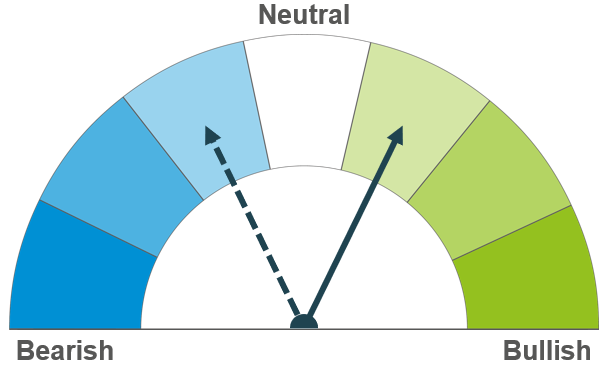

Oilseeds

Rapeseed

Soyabeans

A large Australian crop is coming to market currently, but support for soyabeans could filter into rapeseed prices, balancing the market. Long-term, the European rapeseed crop is faring well, with a large crop expected.

Argentina’s weather is in focus, limited rains in key productive regions over the next week could support soyabeans. Longer-term though, a large Brazilian crop combined with questions over Chinese demand could weigh on markets.

Global oilseed markets

Global oilseed futures

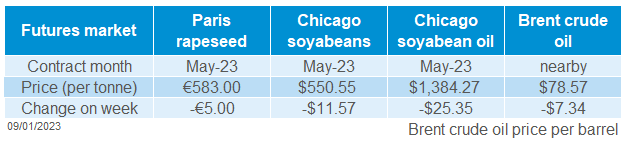

Chicago soyabean futures (May-23) were pressured last week, losing 2.1% from Friday to Friday, to close at $550.55/t (06 Jan). The pressure across the week was mainly from worries about a global recession and weakening demand for commodities. However, the contract did settle higher on Friday, gaining 1.4% from Thursday’s close, off the back of drought concerns in Argentina.

Oilseed markets are currently focused on Argentina’s soyabean crop; with plantings at 81.8% complete, 11% behind the previous five-year average (Buenos Aires Grain Exchange), due to severe drought. We are approaching the end of the planting window and some areas may not be sown due to the drought. Over the next seven days some rains are expected, however there are very productive regions of Buenos Aires, Cordoba and Santa Fe that may receive little to no rainfall, which could support markets this week.

The trade this week awaits the latest USDA World Agricultural Supply & Demand Estimates (WASDE), along with the U.S. quarterly stocks report (as at 01 Dec 2022), which are both out this Thursday. In a Reuters survey, the average trade estimate for quarterly soyabean stocks is 85.2Mt, down 0.6% from a year ago. Interestingly, in another poll, the average trade estimate for Argentina’s soyabean crop is 46.7Mt, down from 49.5Mt in December’s WASDE.

There was pressure across the week for Malaysian palm oil, from export concerns on growing worries for Chinese demand, as COVID-19 infections increase. This is despite an average Reuters poll estimating that December stocks are going to shrink 5.3% from November to 2.17Mt. Palm oil output from Malaysia has reduced, as tropical storms and heavy floods disrupt production. The market awaits the official data from the Malaysian Palm Oil Council, which is out tomorrow (10 Jan).

Rapeseed focus

UK delivered oilseed prices

Rapeseed markets followed the wider oilseed complex down last week. Paris rapeseed futures (May-23) closed Friday at €583.00/t, down €5.00/t across the week.

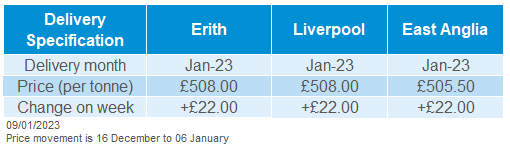

Delivered rapeseed (Erith, Jan-23) was quoted at £508.00/t on Friday, with no comparison on the week. For harvest the price was quoted at £514.50/t for the same location.

Pressure on crude oil will have filtered into rapeseed values. Brent crude oil futures (nearby) closed Friday at $78.57/barrel, down 8.54% across the week.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.