Arable Market Report - 08 August 2022

Monday, 8 August 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

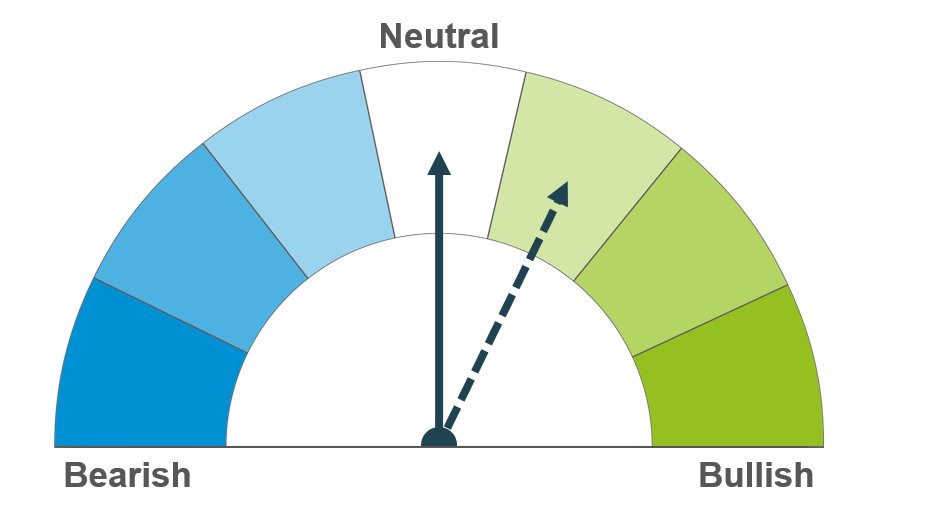

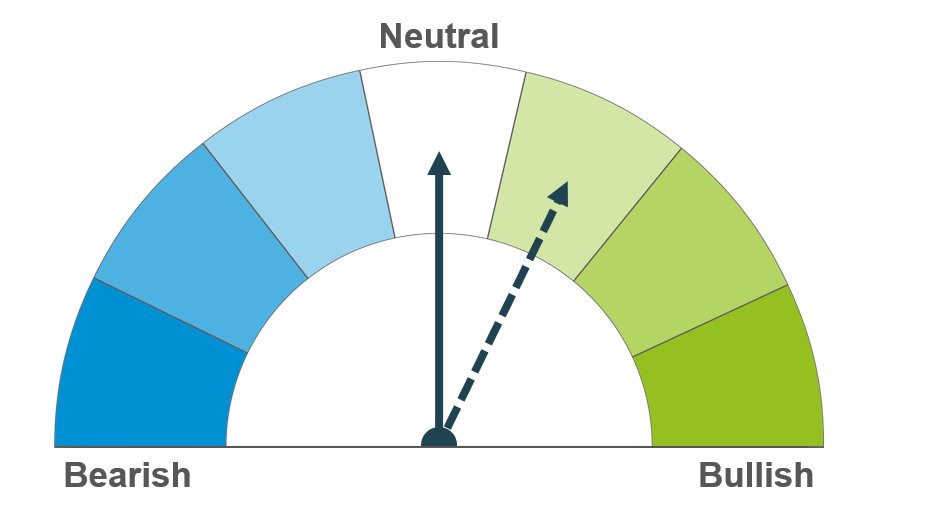

Short term price volatility continues as grain leaves Ukrainian ports by ship, and harvest progresses. Longer term, dry and hot weather remains a watchpoint for harvest 22 and strong demand continues supporting prices.

Short term, US weather news and Ukrainian exports directs price movements. Longer term, hot weather trimming EU yield prospects tightens the supply outlook. US yields remain a watchpoint.

The global and domestic barley balance remains tight. Prices continue to follow wider international grain markets.

Global grain markets

Global grain futures

Global grain futures felt some pressure mid last week, with news on global recession playing into market movements, and Ukrainian exports leaving ports. Though prices remain relatively supported as the market still assesses the size of harvest 22 grain crops.

Ukrainian grain exports continue. Today, two additional ships carrying maize and soybeans departed from Ukraine. This brings a total of 10 ships leaving Ukrainian ports since the first ship departed last week. Of the seven ships carrying maize, this brings the total exported to around 243Kt this month (Refinitiv, Turkey’s Defence Ministry). Other ships carried soyabeans, sunflower oil and sunflower meal.

Hot and dry weather continues to provide underlying price support for global grain markets. Though US weather looks more favourable for maize development over the next few weeks, with some rain due.

France is set for a fourth heatwave, due this week. Drought conditions has led to water restrictions (including hosepipe and irrigation bans) across almost every part of France (Refinitiv). The maize harvest for this year is set to be 18.5% less than harvest 21, according to the French Farm Ministry. This is down to both reduced area, and reduced yield prospects.

In Russia, the pace of harvest has been slower than the Russian Agriculture Ministry expected due to an array of factors such as: a cold spring causing a late start, lack of some foreign agricultural equipment, and some rain. The Ministry said that if harvest does not reach 130Mt target, they may revise down the 50Mt export forecast for 2022/23 (according to Refinitiv).

The next USDA World Agricultural Supply and Demand Estimates (WASDE) are due on Friday (12 August). Key watchpoints will be US maize crop size, as well as Ukrainian and Russian grains production.

UK focus

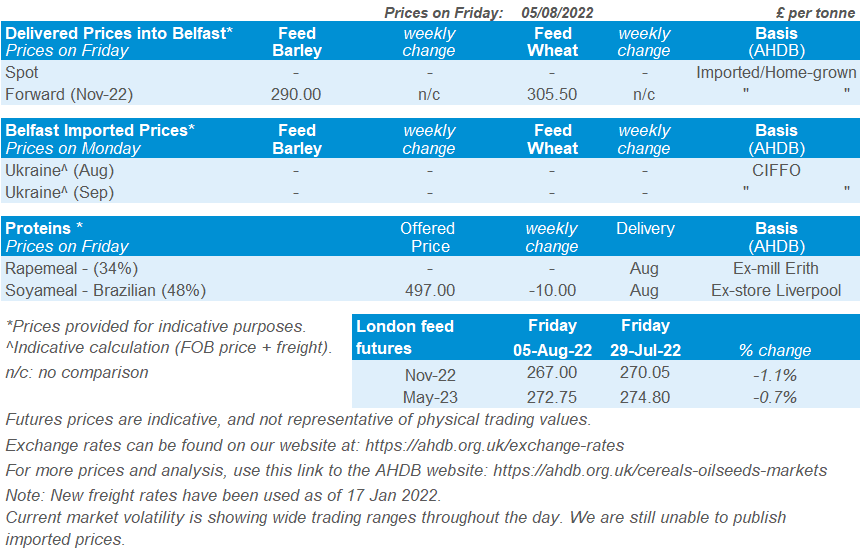

Delivered cereals

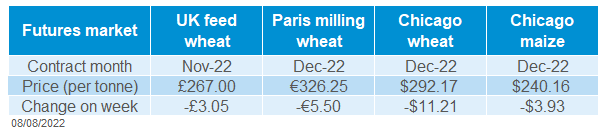

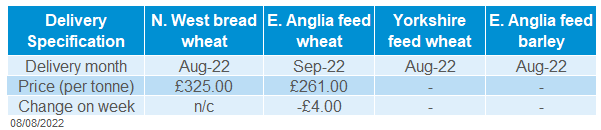

UK feed wheat futures (Nov-22) closed at £267.00/t on Friday, down £3.05/t from the previous Friday. The May-23 contract was down £2.05/t at £272.75/t Friday-Friday. Whilst the Nov-23 contract closed at £241.70/t, down £3.05/t over the same period. The departure of Ukrainian grain shipments through the Black Sea has been the key driver of these small downward movements.

Domestic feed wheat delivered prices into East Anglia were quoted on Thursday at £261.00/t (for Sept delivery), down £4.00/t on the previous Thursday. For November delivery to same location, feed wheat was quoted at £263.00/t, down £6.00/t on the week.

Delivered bread wheat prices into the North West was quoted at £325.00/t on Thursday (harvest delivery). Bread wheat delivered into Northamptonshire (September delivery) was quoted at £306.50/t, down £4.00/t week on week.

On Friday, the latest harvest report was released. In data up to 02 August, 99% of winter barley has now been harvested. Winter wheat harvest is estimated at 30% completion and is accelerating. To read the full report, follow this link.

Full season GB animal feed production for 2021/22 was at the lowest level since 2016/17, totalling 13,991Kt. A fall in poultry and ruminant feed demand outweighed an increase in pig feed demand.

UK human and industrial 2021/22 full season usage is also available. Total wheat milled saw a rise of 5.5% from 2020/21. Oats milled saw a 5.3% decline from the previous year. Whereas, for brewers, maltsters and distillers, barley (+9.3%) and wheat (+22.8%) usage were both up on the year.

The Bank of England increased the base interest rate by 0.5 percentage points (the 6th consecutive rise) to 1.75%. as inflation is expected to hit 13% in October. Globally there are recessional fears that could potentially impact the global demand for cereals and oilseeds.

Oilseeds

Rapeseed

Soyabean

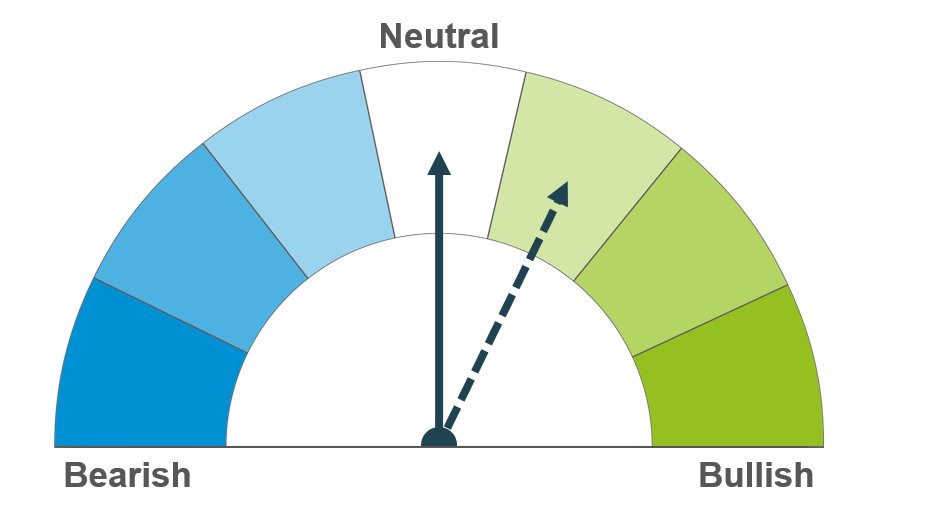

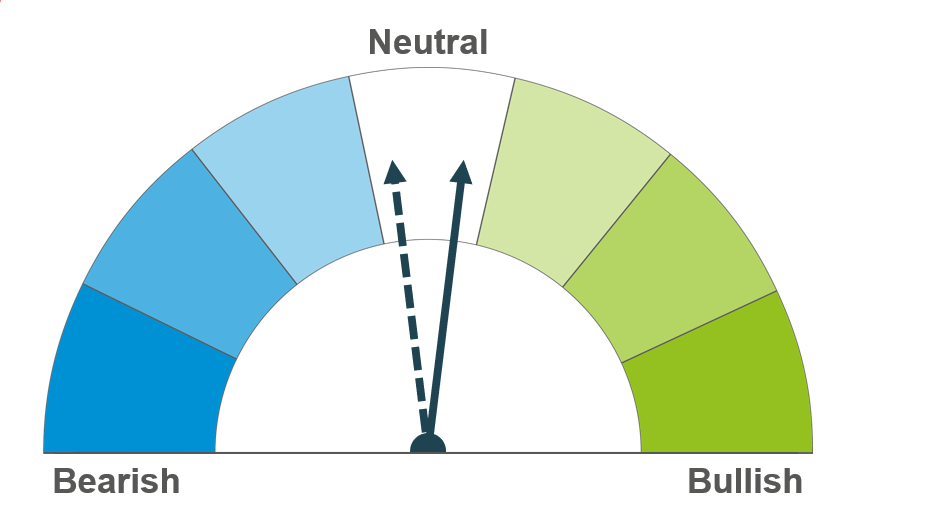

In the short-term, rapeseed prices continue to react to crude oil price changes and US soyabean crop development. It is expected that longer term sentiment will be closer aligned to soyabeans. Rains across the Canadian prairies over the coming week will aid canola crop development.

Soyabean prices will remain reactive to US weather in the short term, as the crop enters critical stages of development. Long-term, estimated large South American crops will likely weigh on the market.

Global oilseed markets

Global oilseed futures

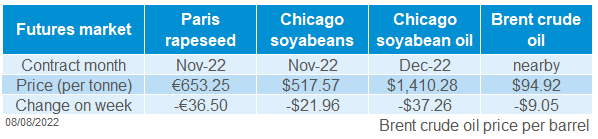

A week of pressure for the oilseed complex, as Chicago soyabean futures (Nov-22) ended down 4.1% across the week (Friday to Friday).

Driving this was the scattered rains that arrived across much of the US Midwest over the past week. This dampened concerns over US soyabeans as they enter the critical stage of pod filling. Rains are expected to continue over the coming week. There are no major cause for concerns with heat stress, but potentially in parts of western US Mid-West remain watchpoints as warmer than average temperatures are forecast in the coming week.

Energy was another driver pressuring the market last week. Brent crude oil (nearby) fell 13.7% across the week, closing at $94.92/barrel on Friday. On Thursday the price closed at $94.12/barrel, the lowest close since the war began between Russia and Ukraine in February 2022.

Limiting weekly losses for Chicago soyabean last week, were two 132Kt US soyabean sales (2022/23 marketing year) purchased by China and unknown destinations.

Despite this purchase, general administrations custom data showed that China’s soyabean imports fell 9.1% in July 22 from a year earlier. Poor crush margins combined with weaker consumption has seen China’s appetite for soyabeans reducing. This is a key watch point, as China’s consumption (and imports) of soyabeans is expected to increase for the 2022/23 marketing year.

Malaysian palm oil futures (Oct-22) were down 9.6% across the week. A recent poll from Refinitiv cited that Malaysian inventories were likely to rise (+8.3%) from last month to be the highest in 8 months at 1.79Mt, based on median estimates. This, combined with higher output from Indonesia, pressured palm oil which reduced the floor of the vegetable oil market.

Rapeseed focus

UK delivered oilseed prices

Driving rapeseed prices last week was a drop in brent crude oil (nearby) and fair weather for US soyabeans, as mentioned above.

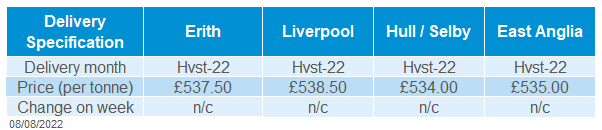

On Friday, Paris rapeseed futures (Nov-22) closed at €653.25/t, down €36.50/t on the week. Domestically, rapeseed delivered into Erith was quoted on Friday at £537.50/t, with no comparison on the week.

The Ukraine rapeseed harvest forecast, and yield estimate, remains unchanged from last month. Harvest is forecasted at 3.14Mt according to UkrAgroConsult.

Our domestic GB winter oilseed rape harvest is 84% complete, in data up to 02 August. Many areas have reached completion, though Scotland and North East have areas to finish.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.