Palm oil reducing the price floor for vegetable oils: Grain market daily

Tuesday, 2 August 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £265.55/t, down £4.50/t on Friday’s close. The May-22 contract closed down the same amount at £270.30/t.

- Nov-23 contract closed at £240.75/t, down £4.00/t. While the Nov-24 contract closed down the same amount, at £238.15/t.

- The domestic market followed the global market down, mainly driven by the departure of the first ship of grain from Ukraine through the Black Sea. More information on this below.

- In the latest USDA crop progress report, 60% of US soyabeans were rated good-to-excellent in the week ending 31 July. This is up 1 percentage point (pp) from the week before. This was surprising after a week of hotter weather in the key soyabean growing regions over the past week.

Palm oil reducing the price floor for vegetable oils

Yesterday, there were multiple stories pressuring grain and oilseed markets. The main one being that the first ship carrying Ukrainian grain left the port of Odessa. The first since 24 February 2022.

Another factor adding pressure to prices is the fear of recession still looming. This can be seen in the general fall in crude oil markets. Brent crude oil (nearby) closed yesterday at $100.03/barrel, down $9.98/barrel on Friday’s close.

All this news is creating large price volatility, driving domestic rapeseed price volatility too. Yesterday, Paris rapeseed futures (Nov-22) dropped £34.22/t, to close at £545.10/t.

There are other developments in the vegetable oil complex that could potentially influence rapeseed prices further, and that’s palm oil.

Palm oil prices pressured

Since Indonesia lifted their palm oil export ban (on 23 May), prices have dropped. However, the government have still maintained a domestic market obligation to keep local cooking oil prices affordable. On Monday it was announced exporters will be allowed to ship nine times their domestic sales (from 01 Aug), up from seven times prior.

Since 01 June, Malaysian palm oil futures (delivered 3-months from spot) have reduced over 36.1%, based on yesterday’s close. Over this same period, Paris rapeseed futures (Nov-22) and Chicago soyabean futures (Nov-22) have dropped to a lesser degree at 19.2% & 6.9%, respectively.

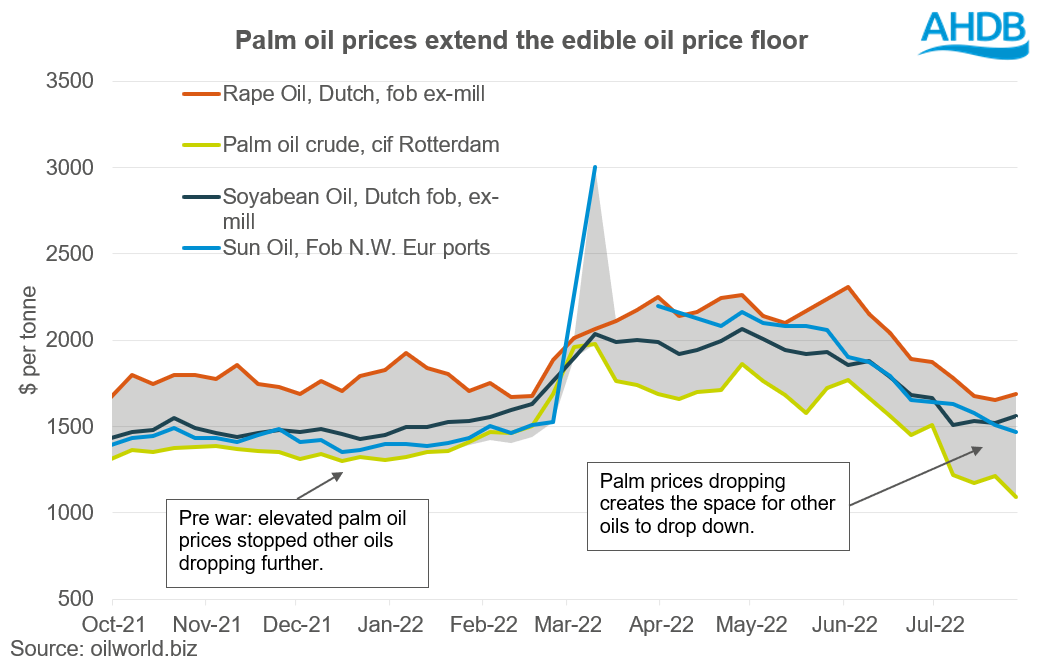

The greater pressure for palm has meant that in recent weeks, the “floor” of the vegetable oil complex has been pressured.

As shown in the graph above, palm oil has extended its discount to other vegetable oils in recent weeks. Is there room for a fall in other vegetable oil prices too?

Prior to the war between Russia and Ukraine, we can see that elevated palm oil prices prevented any other vegetable oils dropping further.

Conclusion

The price of palm oil will continue to play its part in underpinning the vegetable oil market. If that floor reduces, it will open the opportunity for other oils to drop too.

This in turn will influence rape oil, which will impact the price you receive for your rapeseed at the farm gate.

However, there are some supportive factors that are providing some support to the vegetable oil complex current. This includes US soyabean crop development (considering hot and dry conditions) and the recent dry weather in Europe that has reduced output for EU sunseed (EU commission, Stratégie grains). These factors look to keep some support for rapeseed prices currently, though areas to watch going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.