Arable Market Report - 07 November 2022

Monday, 7 November 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

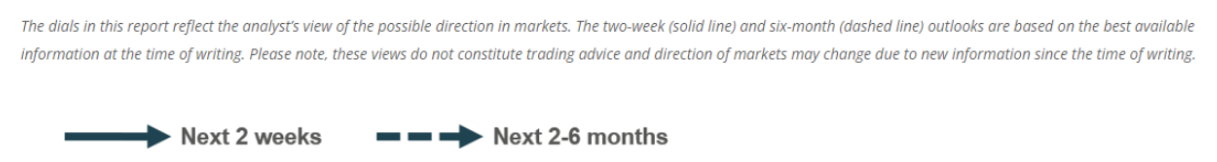

Markets remain volatile as they await news on the future of the Ukrainian export corridor. Prices stay supported but market optimism keeps gains limited. Adverse weather in the Southern Hemisphere is causing concerns over production.

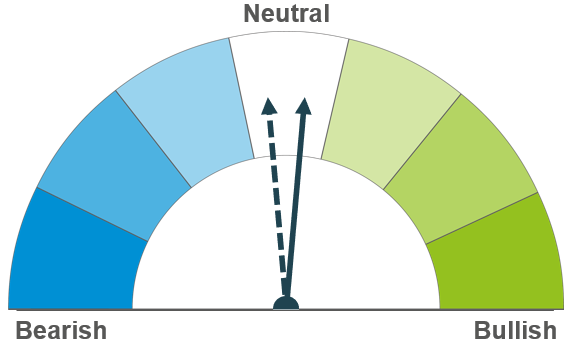

The global maize outlook remains tight, and markets are reactive to the situation in Ukraine. Forecasts of improved weather over South America could see further planting progress over the next week.

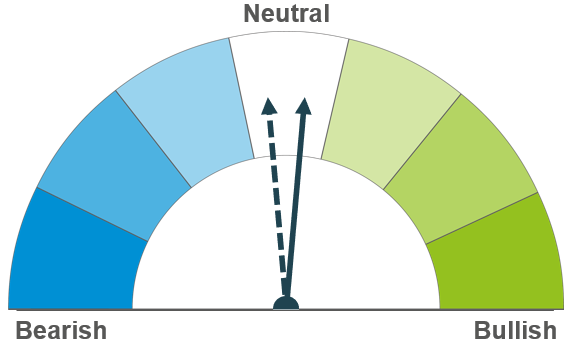

Barley markets continue to follow the wider grain complex, supported by tight outlooks.

Global grain markets

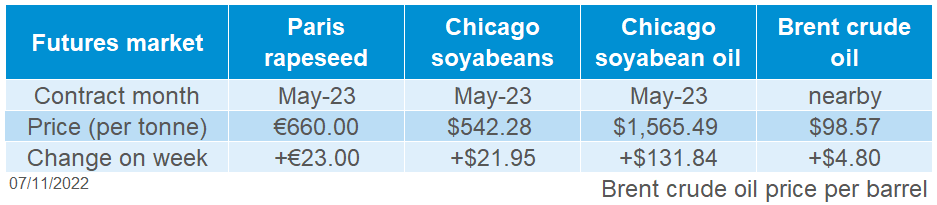

Global grain futures

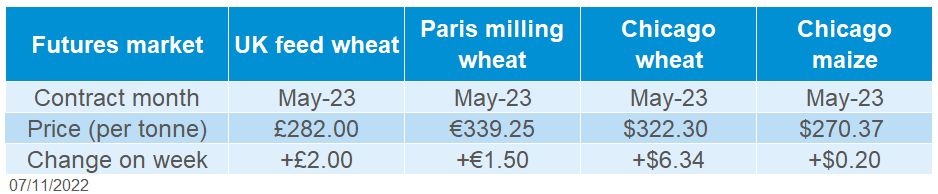

While remaining volatile, global grain markets were supported across last week. Chicago wheat (May-23) and Paris milling wheat (May-23) were up 2.0% and 0.4% respectively Friday to Friday. Chicago maize (May-23) climbed 0.1% over the same period.

Prices saw a steep rise at the beginning of the week due to Russia announcing they would no longer participate in the Ukrainian grain corridor agreement. However, prices fell mid-week as Moscow said they would re-join the export deal. Losses were capped though, as support came from Southern Hemisphere production concerns (more on Argentina and Australia below).

On Wednesday, Putin announced that Russia would not hinder grain supplies from Ukraine to Turkey “at any point in the future”, providing that guarantees from Ukraine that export routes would not be used for military means, were not violated. Turkey’s foreign minister has also said that Russia is eager to export more of its own agricultural products including fertiliser and grains, but that ships of many countries are hesitant about transporting Russian cargo. With the export deal initially agreed for 120 days ending this month, markets will remain reactive to news of the potential extension of the deal over the next couple of weeks.

The Buenos Aires Grain Exchange cut Argentina’s 2022/23 wheat harvest to 14Mt on Thursday, down from its previous estimate of 15.2Mt. Prolonged drought, combined with extended frosts over the beginning of last week in the country’s main wheat growing regions, are the reasons for these further production trims. The Exchange also said on Thursday that 2022/23 maize plantings had advanced by 1.1% across the week, with 22.9% of the estimated 7.3Mha planted area complete as at 02 November. Forecasted rains over the next week could mean conditions for maize plantings improve, but this is arguably too late for the wheat crop. The USDA’s most recent World Agricultural Supply and Demand Estimates (WASDE) will be released on Wednesday (09 Nov), and changes to the Argentinian wheat production figure will be something to look out for.

While still on track for a third bumper harvest, excessive rains and subsequent flooding in Australia is impacting quality expectations. According to Refinitiv, around half of the wheat crop grown on the eastern grain belt is expected to be reduced to animal feed. However, it’s thought that the full extent of the damage to crops will not be known until the waters recede. With more rain forecast over the next 7 days in certain eastern regions, the quality of the Australian wheat crop will be something to monitor going forward.

UK focus

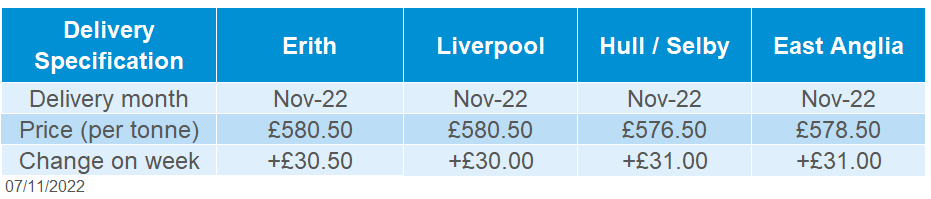

Delivered cereals

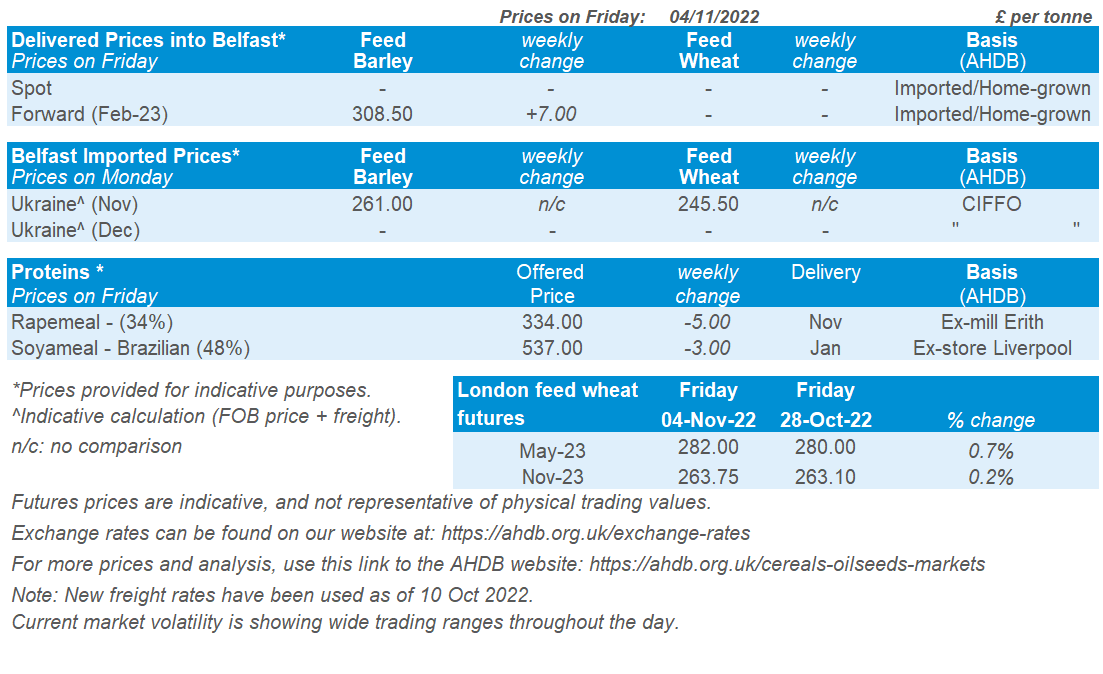

UK feed wheat futures tracked global markets up last week. The May-23 contract gained 0.7% over the week (Friday to Friday). New crop prices (Nov-23) gained slightly less, up 0.2% over the same period.

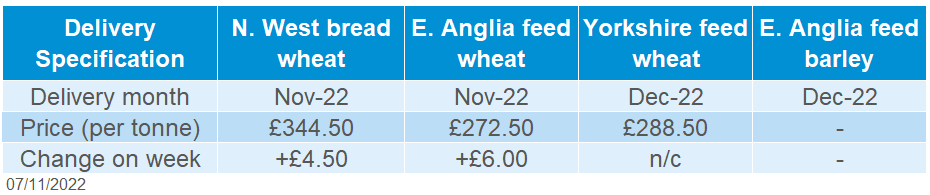

Domestic delivered prices followed futures price direction up. Feed wheat into East Anglia for November delivery was quoted at £272.50/t on Thursday, up £6.00/t on the week. Bread wheat prices for November delivery into the North West were quoted at £344.50/t, up £4.50/t on the week.

On Thursday, the Bank of England announced that its benchmark interest rate would increase from 2.25% to 3%, the highest level in 14 years. Following the news, the sterling lost value against the US dollar, down 2% over Thursday’s session. However, since then, the sterling has been trading up as the US dollar weakens. On Friday the sterling closed against the dollar at £1=$1.1375, up 1.9% from Thursday.

Last week, the latest cereal usage data for GB animal feed production and UK human and industrial cereal usage was released. Read more about the animal feed production data in Friday’s grain market daily.

In October, AHDB hosted a series of webinars to introduce the Digital Grain Passport (DGP) to stakeholders across the arable supply chain. If you missed the webinars or would like to see the prototype again, click here. Your feedback on the DGP matters. As such, please contact your relevant trade association with your feedback on the proposal. Alternatively, if you are not a member of a trade association listed here, please contact Derek Carless (Derek.Carless@ahdb.org.uk) with your views.

Oilseeds

Rapeseed

Soyabeans

In the short-term, price direction will depend on the continuation of the export corridor, though continued volatility is expected. Longer term, large soyabean supplies could weigh on the wider oilseed complex and pressure prices.

Short term, markets are expected to move on news on the Black Sea corridor, Brazilian politics and rains in Argentina. Long term sentiment there is large South American crops expected. But on-going dry weather in Argentina, and Chinese lockdowns, remain watchpoints.

Global oilseed markets

Global oilseed futures

Last week saw support for Chicago soyabeans futures (May-23), as the contract gained 4.2% across the week to close Friday at $542.28/t.

Support in oilseeds came from strong energy prices, due to uncertainty around future US interest rate hikes by the Federal Reserve, combined with the EU reducing reliance on Russian oil. This support resulted in nearby brent crude oil futures gaining 2.9% across the week.

Further to that, supporting soyabean markets were blockades in Brazil as protests escalated as Bolsonaro lost the presidential election to Lula, this put concerns over food exports out of the country.

Also, there was support from Chinese demand optimism, as there were rumours last week that China would ease their strict Covid-19 restrictions. However, this optimism hasn’t come into fruition today, as China denied all indications that they would be easing their zero-covid policy leading to marginal pressure for Chicago soyabeans today.

Chinese demand is a key parameter to oilseed market direction. Last week, the latest USDA Attaché report on oilseeds kept China’s soyabean import forecast at 96.5Mt for 2022/23. Lower than USDA official estimates and lower on 2020/21 imports, but higher than last season (2021/22) due to higher demand in animal feed and vegetable oil for the food sector.

For oilseed supply, plantings in Argentina are not off to the best start due to drought from the third successive La Niña weather event. Latest reports from Rosario Grains Exchange suggest that due to the lack of moisture, farmers are looking to reduce their fertiliser use. This is a critical watchpoint, as widespread production implication in Argentina could change the sentiment of the soyabean market. Over the next seven days, widespread rains are forecast, which will likely ease some concerns.

A watchpoint this week is the latest USDA WASDE report out this Wednesday (09 Nov). Global soyabean ending stocks are expected to marginally increase (average of analysts’ estimates - Refinitiv survey).

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices were supported last week with the oilseed complex, as Paris rapeseed futures (May-23) closed Friday at €660.00/t, up €23.00/t across the week.

Delivered rapeseed (into Erith, May-23) was quoted on Friday at £587.00/t, gaining £30.50/t over the week. Greater gains were seen on the domestic market, as the sterling weakened (-2%) against the euro across the week, to close Friday at £1 = €1.1416.

In other news, the latest Stratégie Grains oilseed report estimates the 2023/24 EU harvestable rapeseed area at 6.0Mha. This would be up 2.4% on the year if realised. High prices have incentivised the increase, whilst timely rainfall before and after plantings has aided crop establishment and development.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.