Arable Market Report - 06 February 2023

Monday, 6 February 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

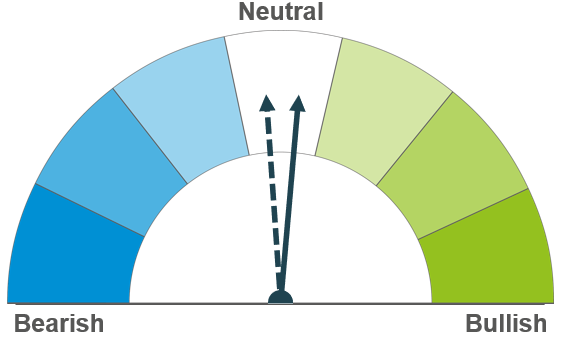

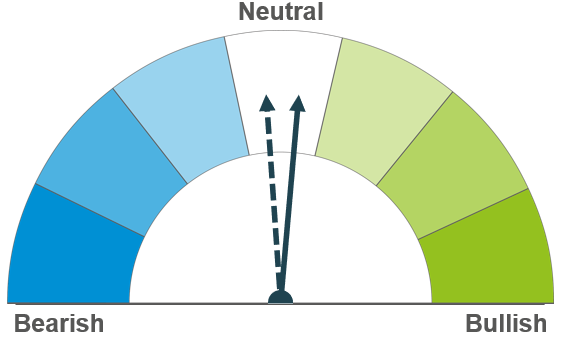

News surrounding escalations of the war in Ukraine continues to add support to prices, though competitive Russian exports look to limit any gains short to mid-term. Longer-term, the focus will be on weather and the impact on new crop conditions.

Global demand looks to be strengthening as US exports pick up, however the bumper Brazilian crop will weigh on markets moving forward too.

Barley continues to follow trends in global wheat markets.

Global grain markets

Global grain futures

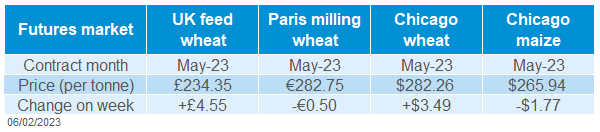

Weather concerns in the US, combined with news surrounding the escalation of the war in Ukraine, saw Chicago wheat futures (May-23) up 1.3% over the week (Friday – Friday). Chicago maize futures (May-23) however were down 0.7% over the same period, largely due to technical selling and a stronger US dollar against currencies of export origins. Some unexpected rains over parts of Argentina last week also added a bearish sentiment to maize markets.

Paris milling wheat futures (May-23) were down 0.2% over the week, as old crop prices were weighed on by competitive Black Sea supplies, although a weaker euro against the US dollar capped losses. In the same period, new crop prices (Dec-23) climbed 0.4% from a weaker euro.

Markets continue to react to news from the Black Sea region. The Ukrainian Agriculture Ministry said on Friday that its farmers had harvested 20.2Mt of wheat in 2022, compared to 32.2Mt in 2021. Total grain harvested in 2022 totalled 53.2Mt, and the Economy Ministry also said last week that this may decrease to 49.5Mt in 2023. Ukraine have also said over the weekend that they are preparing for renewed Russian offensive later this month, something to watch moving forward.

While some support in grain markets has been seen from the situation in Ukraine, competitive Russian exports continue to come onto the market capping gains. The Interfax news agency said this morning that Russia may export 30-35Mt of grain in the first half of 2023.

Looking at maize, while US prices fell last week, US export sales were larger than expected over the past few weeks. The USDA reported sales of old crop maize in the week up to January 26 totalled almost 1.6Mt, much higher than trade estimates of between 600Kt and 1.2Mt for that period. This included sales of 319.5Kt to China.

Looking to South American maize production, little rain is forecast in the key producing regions of Argentina this week, which could offer some support for prices. Analysts are also predicting that the USDA will lower Argentina’s production estimate in its monthly WASDE report due out on Wednesday, something to look out for this week.

Having said this, the bumper Brazilian crop continues to cap any major gains in maize markets. On Wednesday, StoneX pegged the 2022/23 Brazilian maize crop at 129.9Mt. If realised, this would mean production would be up 12% on the year.

Finally, while markets reacted to another cold snap across US plains last week, forecasts for this week look to be milder and improved for crop condition. Northern hemisphere weather will be a watchpoint moving forward.

UK focus

Delivered cereals

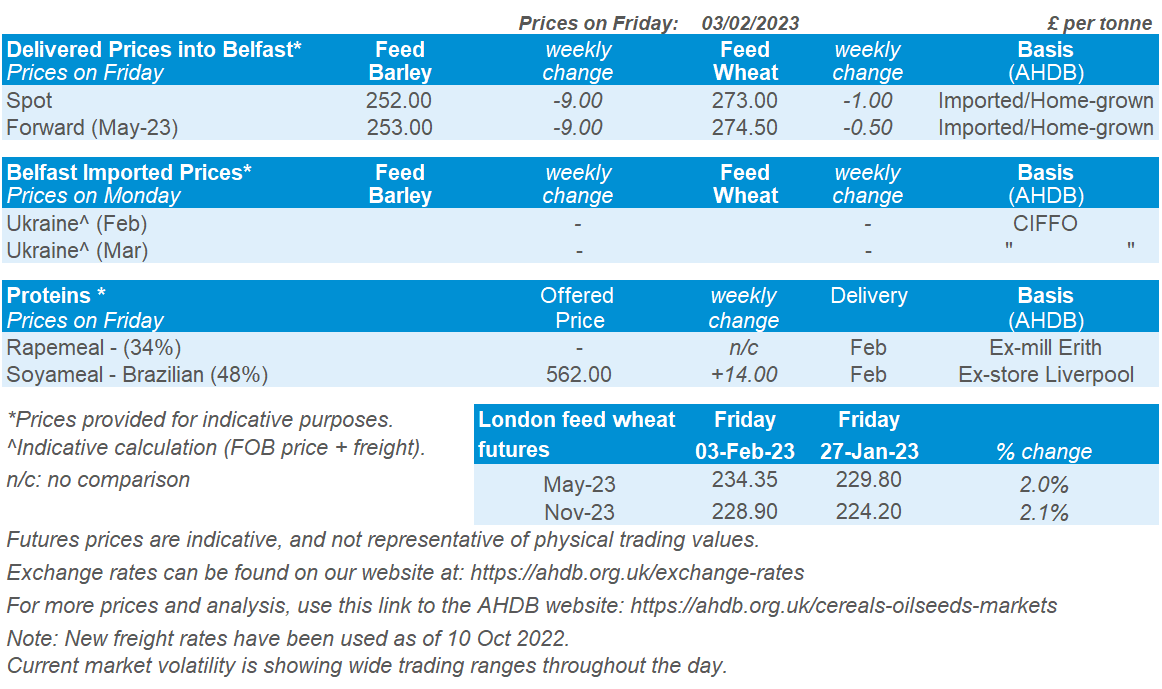

UK feed wheat futures followed the upward price movement seen in the US. Old crop prices (May-23) gained 2% Friday – Friday, and new crop futures (Nov-23) climbed 2.1% over the same period.

Feed wheat delivered into East Anglia (Feb-23 delivery) was quoted at £230.50/t on Thursday, up £2.00/t Thursday – Thursday. Bread wheat delivered into the North West (Feb-23 delivery) was quoted at £311.00/t on Thursday, up £3.50/t over the same period.

On Thursday, AHDB published the latest UK human and industrial cereal usage figures, which includes information on cereal usage by flour millers, brewers, maltsters and distillers (BMD), and oat millers, up to December. See Thursday’s GMD for a round-up of the data.

On the same day, AHDB also published the latest cereal usage data for GB animal feed production, click here to see the full set of results.

Oilseeds

Rapeseed

Soyabeans

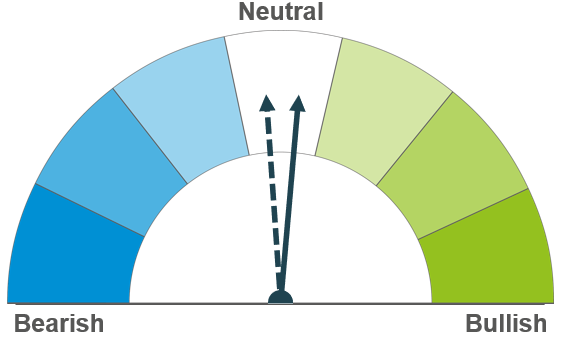

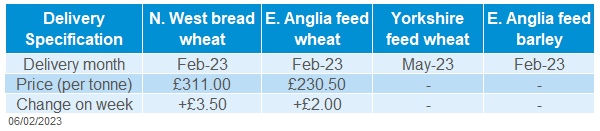

With support from soyabeans, this could support rapeseed prices short term. Though Chinese demand for global vegetable oils remains a key watchpoint. Longer term, the EU rapeseed crop is progressing well.

Short term, soyabean markets look supported by drought in Argentina, as well as rain forecast for Brazil over the next week. Though China remains a key watchpoint. Longer term, once Brazil’s record crop comes to market, we could see some global pressure.

Global oilseed markets

Global oilseed futures

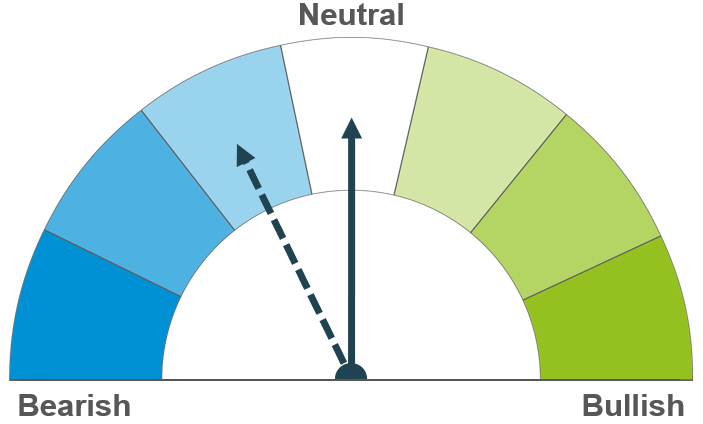

Chicago soyabean futures (May-23) felt overall support last week, gaining $7.72/t to close on Friday at $560.47/t. Despite some losses on Wednesday and Friday, strong gains at the start of last week saw overall movement upwards. The key factors driving the market currently is the drought in Argentina, and the Brazilian soyabean harvest progress.

Drought in Argentina has been driving prices in soyabean markets for several weeks. The outlook for the next 7 days looks very dry according to Refinitiv, adding to stress for crops. Though over the weekend rainfall is expected to be plentiful in many areas, but not all.

Brazilian soyabean harvest pace continues to be slowed by rain across key producing regions. On Friday, the consultancy Patria Agronegocios pegged progress at 9.9% complete, behind this time last year at 20.4% complete. Whereas consultancy Safras & Mercado believes 7.8% has so far been harvested, behind last season’s progress of 17.1%. Conab are due to release their updated official harvest figures this evening. Rain is forecast to continue over many key producing soyabean regions in Brazil over the next few weeks. Though the Brazilian soyabean crop, when it arrives, is forecast to be a record crop. According to Safras & Mercado, forward sales of this 2022/23 crop have reached 30.5% of the 153.3Mt crop due. This is behind the same piont last season and the previous five year average, due to a slow harvest pace and farmers holding out for higher prices.

In the next WASDE report, due on Wednesday, the South American production forecasts for Brazilian and Argentinian soyabean crops will be awaited by the market for price direction.

There was some divergence in movement across the soyabean oil and meal markets last week. Chicago soyoil futures (May-23) fell 2% last week, whereas Chicago soyameal futures (May-23) gained 5% over the same period. Meal markets strengthened on Argentinian drought concerns and speculative buying. Whereas soy oil felt pressure from weakness in crude oil and possible rising tensions between China and the US.

Nearby brent crude oil futures fell 8% last week, to close on Friday at $79.71/barrel. This was driven by expectations of slower growth in the world’s major economies.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-23) gained €4.75/t last week, to close on Friday at €545.25/t feeling strength from soyabean markets. Friday saw gains across the Winnipeg canola futures, which added to the support seen in rapeseed last week and sheltered rapeseed from losses seen in crude oil.

Delivered prices followed futures movement last week, a weakening pound sterling against the euro added to gains. On Friday, delivered rapeseed into Erith (Feb-23 delivery) was quoted at £481.00/t, up £8.00/t Friday to Friday.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.